Transfer prices – increasingly contentious – new valution guidelines

The Danish tax authorities have increased their focus on transfer pricing and the area is becoming ever more contentious, giving rise to some of the largest ever Danish tax cases. Meanwhile, the tax authorities have issued new valuation guidelines.

Increasing transfer pricing adjustments

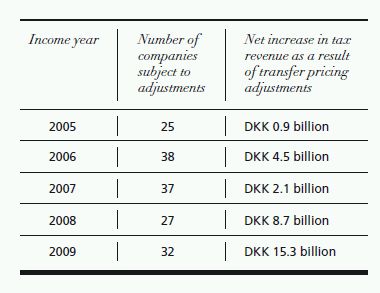

According to recently published figures, the Danish tax authorities are increasing revenues from transfer pricing audits.

In 2009, 32 adjustments were made with adjustments totalling DKK 15.3 billion.

The figures for the period 2005 - 2009 are as follows:

Denmark's newly appointed Minister of Taxation, Mr. Troels Lund Poulsen, has announced even more transfer pricing audits of multinational groups. According to a top civil servant in the Danish Ministry of Taxation, this approach may very well lead to more transfer pricing litigation, as the Danish Tax Authorities will test the boundaries of the transfer pricing rules and may also lead to fewer successful mutual agreements, Denmark opting to maintain its adjustment and refer the Danish tax payer to seek resolution in the Danish Courts.

New transfer pricing valuation guidelines

A significant chunk of the above revenue increase is attributable to tax authorities' attack on cross-border restructurings, valuations being set aside and increased and/or the tax authorities requalifying for instance contract research structures into disposals of IP rights.

Meanwhile and with effect from 21 August 2009, the Danish tax authorities have issued new guidelines for the valuation of companies and business units, goodwill and other intangible rights in connection with transactions between related parties.

The guidelines contain a description of valuation models, recommendations for the use of valuation models and recommendations for the content of the valuation documentation in order for the tax authorities to be able to assess whether a valuation reflects arm's length terms and conditions.

The guidelines represent the Danish tax authorities' view on how, in practice, the valuation of companies and business units should be carried out, and a description of the recommended documentation that must be available in order for the tax authorities to be able to assess whether a valuation reflects arm's length terms and conditions.

The guidelines are addressed to the Danish tax authorities and are therefore, in principle, binding for the Danish tax authorities. The guidelines are not binding for taxpayers, but will give companies and their advisers an indication of which valuation models will be accepted by the Danish tax authorities, as well as more detailed instructions on what documentation ought to be presented. Existing circulars already provide guidance on the valuation of goodwill and unlisted shares. However, these circulars are very schematic. The new valuation guidelines are a supplement to the existing circulars and must be expected to be of broader application.

It would seem that Denmark is the first country in the world to issue such detailed and comprehensive guidelines regarding transfer pricing valuation.

Valuation models

The valuation models applied in the new guidelines are as follows:

- income-based models in which the value is determined on the basis of the expected future income on the subject of valuation:

-

- the discounted cash flow (DCF) model;

- the economic value added (EVA) model, which is recommended for e.g. the control calculation of the DCF model; and

- the 'relief from royalty' method, used e.g. for the valuation of intangible assets where the value cannot be calculated as a residual item in an overall enterprise valuation;

- market-based models in which the value is determined on the basis of comparable independent transactions:

-

- valuation using multiples, used e.g. to support DCF model valuation;

- P / E (price/earnings);

- EV / EBIT (enterprise value/earnings before interest and taxes);

- EV / EBITDA (enterprise value/earnings before interest, taxes, depreciation and amortisation);

- EV / sales (enterprise value/sales (revenue)); and

- EV / NOPAT (enterprise value / net operating profit less adjusted taxes); and

- cost-based models in which the value is determined on the basis of costs incurred in building the asset or the costs that would have to be incurred in building a corresponding asset (substitution costs).

The different valuation models are described in detail in the guidelines followed by the Danish tax authorities' recommendations for dealing with specific issues.

The guidelines indicate that the Danish tax authorities seem to prefer the income-based models, and preferably the DCF method, but no specific recommendation is presented. The guidelines are rather a summary of valuation approaches.

The tax authorities have not considered it appropriate to set out rigid recommendations for the documentation of valuations based on the new valuation guidelines. The documentation guidelines are, however, very broad and may increase the existing documentation requirements significantly.

The new valuation guidelines significantly change the traditional approach of Danish transfer pricing valuations of entire businesses and intangible assets. The guidelines recommend forward-looking valuation approaches, which are more up-to-date than the traditional approaches.

The documentation requirements included in the guidelines are very general and may prove an additional administrative burden on taxpayers. However, the guidelines will be the starting point when Danish groups or entities consider a transfer of intangibles or business reorganisation.

Beneficial owner' – defeat to danish tax authorities

The concept of 'beneficial owner' has in recent years been hotly debated in Denmark. The Danish Minister of Taxation has issued a number of statements as to the meaning of the term in a Danish tax context, but until a recent decision from the Tax Tribunal the concept had not been tested in practice.

'Beneficial owner' in Danish tax law

The term 'beneficial owner' does not have an equivalent in Danish law and there are no published precedents from the Danish courts offering explicit guidance as to the meaning of the term. Moreover, until quite recently, the Danish tax authorities seem not to have looked into whether a recipient of dividends etc. from sources in Denmark was also the 'beneficial owner'.

Indeed, in 2007 during the hearing of a bill aimed, among other things, at reducing Danish tax base erosion resulting from debtleveraged buyouts, the Danish Minister of Taxation considered several questions concerning 'flow-through entities' and stated that:

"I have [ ... ] no knowledge of cases where the Danish tax authorities have refused to recognise a foreign holding company and thus considered it a nullity in relation to dividends."

First Danish decision on beneficial ownership

But the Danish tax authorities no longer shy away from attacking foreign holding companies. Several matters are now pending regarding dividend and interest withholding taxes, and the Danish Tax Tribunal ('Landsskatteretten') in March 2010 published its decision in the first-ever Danish case laying down a Danish tax meaning of 'beneficial ownership'.

The Tribunal decided that a Luxembourg holding company that received dividends from its Danish subsidiary was the beneficial owner of the dividends and therefore entitled to the zero rate of withholding tax provided for under the Danish participation exemption regime.

Facts

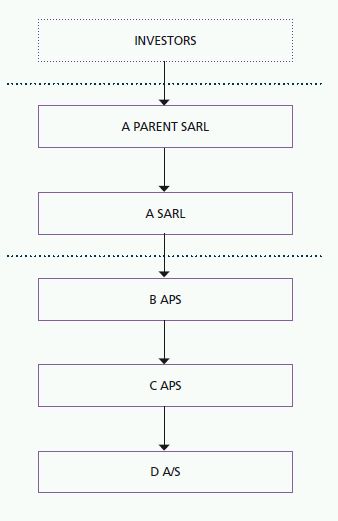

In May 2005, the Danish subsidiary B distributed several billion DKK of dividends to its Luxembourg parent company A. On the same day, a similar – but not identical – amount was lent back from A to B, which on the same day carried out a share capital increase in its Danish subsidiary C, in an amount significantly exceeding the dividends from B to A. C used the amount to buy the Danish operating company D.

The Danish tax authorities had argued that A was not the beneficial owner of the dividends paid from B to A, since A did not have any activities other than the holding of the shares in B and since the shareholders of A had in reality in advance to A receiving the dividends decided how A should apply the dividends.

The Tribunal decision

In its decision, the Danish Tax Tribunal first referred to the OECD Commentary to the OECD Model treaty which states that a conduit company cannot normally be regarded as the beneficial owner if, though the formal owner, it has actually very narrow powers which render it, in relation to the income concerned, a mere fiduciary or administrator acting on account of other parties.

However, since

- A did not pass on the dividend to its parent company, or to the shareholders of the parent company,

- but instead lent it to its subsidiary B,

- which used it to increase the capital of C,

- which ultimately used the amount to buy D,

the Tribunal found that, in these circumstances, A should not in relation to the dividend from B be regarded as a conduit company, but as the beneficial owner of the dividend.

Even though the Tax Tribunal's decision on beneficial ownership was sufficient to settle the matter in favour of the taxpayer, the Tax Tribunal also referred to the Parent/Subsidiary Directive (90/435).

Article 1(2) of the directive provides that the directive does not preclude the application of domestic or agreement-based provisions required for the prevention of fraud or abuse.

The Danish tax authorities had argued that the insertion of A constituted such abuse and had therefore denied A the benefits of the directive.

However, the Tax Tribunal did not find that there was sufficient legal basis in domestic Danish tax law to set aside the distribution of dividend from B to A and therefore found that A was entitled to the benefits of the directive.

Outlook

At the time of this publication going into print, it is not known whether the tax authorities will appeal the Tribunal decision to the Courts. However, several other matters on very significant amounts of withholding tax are pending and seem destined to reach, ultimately, the Danish Supreme Court on appeal from either the Danish tax authorities or the tax payer. Until then it remains open if and how 'beneficial ownership' should be applied in Danish tax law and this uncertainty must be taken into account in cross-border structures involving Denmark, of course.

New danish participation regime

As part of a major Danish tax reform passed by the Danish parliament in the spring of 2009, the Danish participation regime has been significantly amended.

The former Danish participation regime

Under the former Danish participation regime, which was generally applicable up to 31 December 2009, gains on shares were generally tax-exempt for corporate shareholders provided that the shares had been held for three years or more, while gains on shares held for less than three years were taxable.

Dividends received by a corporate shareholder were generally tax exempt if the corporate shareholder had held at least 10 % of the shares in the dividend-paying company for a continuous period of at least 12 months. In respect of dividends paid to corporate shareholders not resident in Denmark, exemption was furthermore conditional upon the corporate shareholder being resident within the EC or in a jurisdiction that had entered into a tax treaty with Denmark.

New participation regime

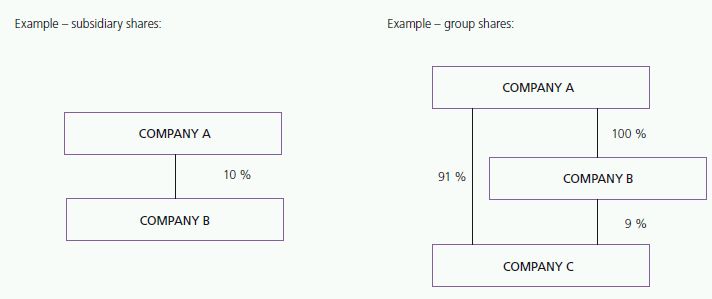

The tax reform introduces a distinction between subsidiary shares, group shares and portfolio shares.

Dividends and capital gains on subsidiary shares and group shares will generally be exempt from taxation, while dividends and capital gains on portfolio shares will generally be taxable (at the full corporate tax rate of 25 %). Furthermore, capital gains on portfolio shares will – as a starting point – be taxed annually on a mark-tomarket basis. However, corporate tax-payers may opt for taxation on a realisation basis in relation to portfolio shares that are not traded on a regulated market.

Subsidiary shares are shares where (i) the corporate shareholder owns at least 10 % of the shares in another company, and (ii) the other company is a Danish company subject to corporate tax or a foreign company where the taxation of dividends paid by such foreign company must be waived or reduced according to the Parent/Subsidiary Directive (90/435) or a tax treaty between Denmark and the jurisdiction where the foreign company is a tax resident. In respect of dividends paid to corporate shareholders that are not tax residents of Denmark, exemption is furthermore conditional upon the corporate shareholder being resident within the EC or in a jurisdiction that had entered into a tax treaty with Denmark.

Group shares are shares where the corporate shareholder and the company are subject to Danish national joint taxation or could elect to be subject to Danish international joint taxation (generally, this requires that the corporate shareholder and the company are part of the same group).

Portfolio shares are shares that do not qualify as subsidiary shares or group shares.

The concepts of subsidiary shares and group shares are illustrated in the below examples:

Company A holds 10 % of the shares in company B. Company B is a tax resident of Denmark. Therefore, the shares in company B held by company A are subsidiary shares.

If company A is a tax resident of Denmark, capital gains and dividends on the shares will generally be exempt from taxation under the participation regime.

If company A is not a tax resident of Denmark, capital gains on the shares will not be subject to taxation in Denmark as Denmark generally does not tax gains on shares in Danish companies realised by shareholders that are not tax residents of Denmark.

If company A is not a tax resident of Denmark, dividends on the shares will only be exempt from taxation under the participation regime if company A is a tax resident within the EC or in a jurisdiction that has entered into a tax treaty with Denmark. Company A holds 100 % of the shares in company B and 91 % of the shares in company C. Company B holds 9 % of the shares in company C. Company C is a tax resident of Denmark. As company B and C are both controlled by company A, they are for Danish tax purposes part of the same group and company B's shares in company C are therefore group shares.

If company B is a tax resident of Denmark, capital gains and dividends on the shares in company C held by company B will generally be exempt from taxation under the participation regime.

If company B is not a tax resident of Denmark, capital gains on the shares in company C held by company B will not be subject to taxation in Denmark as Denmark generally does not tax gains on shares in Danish companies realised by shareholders that are not tax residents of Denmark.

If company B is not a tax resident of Denmark, dividends on the shares in company C held by company B will only be exempt from taxation under the participation regime if company B is a tax resident within the EC or in a jurisdiction that has entered into a tax treaty with Denmark.

New anti-avoidance 'look-through' provision

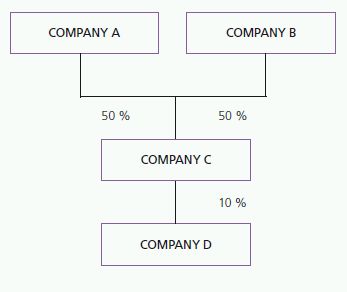

In order to counter structures where two or more corporate shareholders with shareholdings below the 10 % threshold pool their shares in a joint holding company to reach the 10 % threshold, a highly complicated anti-avoidance provision has been introduced. According to this rule, subsidiary shares or group shares held by a holding company are for tax purposes deemed to be held by the shareholders of the holding company (look-through approach) if the following cumulative conditions are met:

- the primary function of the holding company is to own subsidiary shares or group shares;

- the holding company does not carry out genuine economic business activities in relation to the shareholding;

- more than 50 % of the shares in the holding company are – directly or indirectly – owned by Danish resident companies (or a Danish permanent establishment of a foreign company) that would not be able to receive taxfree dividends in case of direct ownership of the shares owned by the holding; and

- the shares in the holding company are not listed on a regulated market or a multilateral trading facility.

The scope of the anti-avoidance rule can be illustrated by the following example:

This is a typical example of a structure that will be affected by the new anti-avoidance rule. Company A and B would only hold 5 % each of company D, had company A and B owned the shares in company D directly. Provided that the other conditions for the application of the anti-avoidance rule are met, the rule will have the effect that the shares in company D for tax purposes are deemed owned by company A and B, and the participation regime will therefore not apply.

Carried interest – new danish tax rules

As part of a major Danish tax reform passed by the Danish parliament in the spring of 2009, special rules for the taxation of carried interest have been introduced in Denmark for the first time. The new rules became effective from the income year 2010.

In a private equity fund, the partners often only contribute a minor part of the fund capital, while outside investors contribute the rest. The partners typically receive a percentage of the profits which is higher than the percentage they hold of the fund capital. This is known as 'carried interest'.

Profits are often distributed by first returning the contributed capital to the investors plus an agreed interest. The remaining amount is typically distributed with up to 20 % to the partners and 80 % to the investors.

The carried interest provides the partners with high upside potential without having to put up a similar amount of cash, and it creates a significant economic incentive for the partners to achieve high capital gains.

Taxation of carried interest

Historically, the Danish tax authorities have accepted that carried interest paid on shares held by partners in private equity funds should be taxed as capital gains on shares or as dividends, with the result that carried interest paid directly to private equity partners that are tax residents of Denmark has been taxed as share income (at rates of up to 42 %).

However, under the new rules carried interest paid directly to private equity partners that are tax residents of Denmark is taxed as personal income at significant higher rates.

The new rules apply to individuals, who are tax residents of Denmark, and who hold shares in a private equity or venture fund that carry the right to a 'preferred return'. Shares are deemed to carry the right to a preferred return when the shares entitle the holder to a part of the profits of the fund that exceeds the proportion of the full capital of the fund (in the form of equity and shareholders' loans) contributed to the fund by the holder of the shares.

The new rules also apply when a partner invests in a private equity or venture fund through a personal holding company. In such case, carried interest received by the holding company is treated as CFC income for the partner, which means that the partner is taxed on the carried interest received by the holding company at a rate of 25 %. In addition, when the carried interest received by the holding company is paid on to the partner as dividends, the partner is taxed on the distribution as share income (at rates of up to 42 %).

Danish investment companies

The Danish investment company regime offers tax planning opportunities for multinationals and cross-border investors.

The Danish investment company regime

The Danish investment company regime provides for a special tax treatment of companies that qualify as investment companies for Danish tax purposes.

Companies that qualify as investment companies are taxed only on income in the form of dividends received from companies that are tax residents of Denmark. All other forms of income and gains (e.g. interest, capital gains on shares, bonds and financial contracts and dividends from companies that are not tax residents of Denmark) are exempt from taxation at the level of an investment company and this applies irrespective of whether or not such income and gains are taxed in any other jurisdiction.

Danish tax-resident investors are taxed on all dividends received from an investment company. Furthermore, Danish tax-resident investors are taxed annually on capital gains on shares in an investment company under a mark-to-market principle, and an investment company is therefore not from a tax point of view a particular attractive investment vehicle for Danish tax-resident investors.

An investor that is not a tax resident of Denmark is not subject to Danish tax on capital gains on shares in a Danish investment company. Therefore, depending on the tax rules applicable to an investment in a Danish investment company in the jurisdiction where the investor is resident for tax purposes, a Danish investment company may offer significant tax planning opportunities.

Which companies qualify as investment companies?

Broadly speaking, a company will qualify as an investment company for Danish tax purposes if:

- the company qualifies as an undertaking for collective investment in transferable securities within the meaning of the UCITS Directive (85/611/EEC); or

- the company's sole business is investment in securities etc. and, at the request of the shareholders, shares in the company shall be redeemed by means of company funds at a price not materially below book value; or

- the company's sole business is investment in securities and the company has eight or more shareholders.

The Danish investment company regime does not contain any requirements as to the legal form of the company. Thus, an investment company may take the legal form of a Danish public limited liability company (A/S), a Danish private limited liability company (ApS) or a Danish association. However, the legal form of the company must not be transparent for Danish tax purposes (e.g. a Danish partnership).

It is not a requirement that the shares in an investment company are offered to the public. Thus, it is possible for a closed group of investors to form and invest through a Danish investment company.

Finally, it is not a requirement that the company invests in a diversified portfolio of assets and an investment company may choose to invest only in one single asset or in one single type of assets.

Tax planning opportunities

As mentioned, the only income taxable at the level of a Danish investment company is dividends received from companies that are tax residents of Denmark.

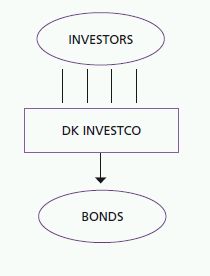

The Danish investment company is therefore a very interesting vehicle for use in international structures as illustrated below:

A group of investors that are not tax residents of Denmark invest in a portfolio of bonds through a Danish company (DK InvestCo). Assuming that DK InvestCo qualifies as an investment company, income derived from the bonds will be tax-exempt at the level of DK InvestCo.

Amendments to danish tax rules on distributing investment funds

In January 2010, the Danish Minister of Taxation presented a bill significantly amending the Danish tax rules applicable to distributing investment funds.

Existing Danish tax rules on distributing investment funds Danish tax law differentiates between distributing investment funds and investment companies.

A distributing investment fund is for Danish tax purposes defined as an investment fund that on an annual basis calculates a so-called 'minimum dividend' and files the components of this minimum dividend with the Danish tax authorities (it is not a requirement that any dividend is actually paid). An investment fund that does not fulfil the minimum dividend requirement is considered an investment company for Danish tax purposes.

Distributing investment funds are currently divided into four different categories for Danish tax purposes:

- distributing investment funds investing in shares;

- distributing investment funds investing in Danish bonds;

- distributing investment funds investing in non-Danish bonds; and

- distributing investment funds investing in mixed securities.

Different tax rules apply to the tax treatment of investors in the four types of distributing investment funds.

The proposed amendments

In the bill presented by the Danish Minister of Taxation, it is proposed to simplify the Danish tax rules applicable to distributing investment funds. Thus, it is proposed that the current four categories of distributing investment funds for tax purposes be reduced to the following two categories:

- distributing investment funds investing in shares, and

- distributing investment funds investing in bonds.

Broadly speaking, it is proposed that a distributing investment fund is considered to be investing in shares if on average during the income year 50 % or more of the assets of the fund are invested in shares (other than shares in investment companies and distributing investment funds investing in bonds), while a distributing investment fund is to be considered to be investing in bonds if on average during the income year less than 50 % of the assets of the fund are invested in shares (other than shares in investment companies and distributing investment funds investing in bonds).

If adopted, the proposal is likely to make it easier for non-Danish investment funds to qualify as distributing investment funds investing in shares.

However, in order to qualify as a distributing investment fund it will still be a condition that the minimum dividend requirement is fulfilled and so far only very few non-Danish investment funds have in practice been able to fulfil this requirement.

Exit taxation – demand for changes to danish exit charge provisions

The European Commission recently requested Denmark to change its exit-tax provisions for companies. The request was given in the form of a reasoned opinion.

Exit-tax provisions

In September 2009, the European Commission sent Sweden a reasoned opinion requesting Sweden to change its provisions on exit taxation of companies that cease to be tax residents of Sweden, and in October 2009 the Commission referred Spain and Portugal to the European Court of Justice for tax provisions that impose exit tax on companies which cease to be tax residents of these countries. Sweden has since then complied with the Commission's request.

In March 2010, the Commission in a reasoned opinion requested Denmark to change its provisions on exit taxation of companies as well.

According to the Danish provisions on exit tax, a transfer of assets from a non-resident company's permanent establishment in Denmark to the company's head office outside Denmark or a transfer of assets from the head office of a Danish company to a permanent establishment outside Denmark is for tax purposes considered a taxable event.

Contrary to a purely domestic internal transfer of assets, the Danish exit taxation triggers immediate Danish taxation on unrealised capital gains on assets in a cross-border internal transfer of assets. Therefore, a cross-border internal transfer of assets is penalised with an immediate taxation of unrealised capital gains and is therefore subject to less favourable treatment as compared to those companies which transfer assets domestically.

On the basis of the case law of the European Court of Justice and on the Court's Communication on exit taxation, the Commission finds that immediate taxation of accrued but unrealised capital gains at the moment of exit is not allowed if there would be no similar taxation in comparable domestic situations. Instead member states must defer the collection of taxes until the moment of actual realisation of the capital gains.

The 25 % expatriate tax scheme

The so-called 25 % scheme is often relevant for Danish companies recruiting employees abroad.

With effect from 2010, salary and other forms of personal income are in Denmark taxed according to a progressive scale at a rate of up to 56 % (including labour market contributions).

Prior to 2009, salary and other forms of personal income were taxed at rates of up to almost 63 %. In order to enable Danish employers to attract and retain professional employees from abroad by making it more attractive for such employees to work in Denmark, a special favourable tax scheme applicable to researchers and key employees recruited abroad was introduced in 1992.

The scheme is still in force and is still relevant despite the recent changes in marginal taxation. The scheme has been amended on an ongoing basis. The original special 25 % (after labour market contributions) tax scheme may only be used during one or more periods which in total do not exceed 36 months. However, over the years it became apparent that the 36-month period was too short to make the 25 % scheme sufficiently attractive as many recruitments stretch over 4-5 years. In 2008, the scheme was therefore amended, allowing employees who entered the scheme in 2008 or later to choose to pay tax either at a rate of 25 % (after labour market contributions) for a period of up to 36 months or at a rate of 33 % (after labour market contributions) for a period of up to 60 months.

Employees may change their choice between the 25 % and the 33 % scheme once and this must be done before the expiry of the first 36 months taxed under the scheme.

Use of the scheme is subject to a number of conditions. In summary, they are as follows:

- The employee must become subject to in Denmark from the start of his or her employment in Denmark. If the employee moves to Denmark however, the employee may start the stay in Denmark up to one month prior to the commencement of the employment.

- The employee must not have been subject to full or limited taxation in Denmark on salaries or certain other types of income within the three years preceding the employment in Denmark.

- This condition basically prevents employees who have been employed in Denmark during a trial period from applying the 25/33 % scheme. However, researchers are allowed to benefit from the tax scheme even if they have been employed in Denmark as guest lecturer etc. at universities and other research institutions during a period of maximum 12 months, within the three years preceding their employment in Denmark.

- The employee must not have been directly or indirectly involved in the management of or have had control or significant influence over the enterprise where the employee is to be employed within five years prior to the employment. If the employing enterprise is a company, the employee must not own or have owned 25 % or more of the share capital or hold or have held more than 50 % of the voting rights in the employing company. If the employing enterprise is personally owned, the employee must not own or have owned 25 % or more of the equity capital or enjoy or have enjoyed control over the enterprise.

- The employee must not have been employed by the research institution or by the Danish company (or any group company) where the employee is to be employed within a period of three years before and one year after cessation of full or limited tax liability in Denmark. This condition of course is only relevant if the employee previously has been subject to full or limited taxation in Denmark. Pursuant to a special rule, the condition does not have to be fulfilled if the employee has not been employed by the research institution or by the Danish company (or any group company) within the last three years.

- The employee must not have been posted abroad as a PhD student with the salary being paid by Danish public funds.

- The monthly remuneration received by the employee must be at least DKK 63,800 (2010) before tax, but after deduction of labour market contribution (Danish or foreign) and contributions to Danish ATP (supplementary labour market pension). Consequently, the actual remuneration requirement exceeds DKK 63,800. If Danish labour market contribution is applicable, the minimum salary requirement is DKK 69,300 (2010) plus Danish ATP. No remuneration requirement applies to researchers.

2011 - Amendment

When using the scheme, companies and employees must take into account that the Danish regulation on labour market contribution has been changed with effect from 2011. Thus, from 2011 the employee is obliged to pay Danish labour market contribution (8 %) of the salary when the salary is taxable in Denmark, irrespective of whether the employee is socially secured in another country and pays social security contributions in that other country. The effective taxation including Danish labour market contribution is 31/38.4 % under the scheme.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.