- within Tax topic(s)

- within Tax, Food, Drugs, Healthcare, Life Sciences and Employment and HR topic(s)

- with readers working within the Law Firm industries

Summary

The HKSAR Government has recently put forward its proposals on (1) enhancing the existing tax concessions for maritime services industry and (2) introducing a half-rate tax concessionary regime for physical commodity trading business in the Hong Kong SAR (Hong Kong) to the Legislative Council.

In this tax alert, we summarise the key features of the government's proposals and share our observations.

As mentioned in the 2024 Policy Address1 and the 2025/26 Budget Speech2, the HKSAR Government is planning to (1) enhance the tax concessionary measures for the maritime services industry and (2) introduce a half-rate tax concessionary regime for commodity trading business in Hong Kong. On 8 July 2025, the government presented a briefing paper3 to the Legislative Council outlining its major recommendations on the above two tax concessions.

Enhancements of the existing tax concessions for the maritime services industry

The existing tax concessionary regime for maritime services industry provides (1) a 0% concessionary tax rate for qualifying ship lessors, (2) a 0% or 8.25% concessionary tax rate for qualifying ship leasing managers and (3) a tax exemption or a concessionary tax rate of 0% or 8.25% for shipping commercial principals (i.e. ship agents, ship managers and ship brokers).

To further strengthen Hong Kong's position as a leading international maritime centre and maintain the competitiveness of the existing tax concessions after the implementation of the global minimum tax (GMT) and Hong Kong domestic minimum top-up tax (HKMTT) under BEPS Pillar 2 in Hong Kong, the government has proposed the below refinements to the existing tax concessions.

1. Expanded scope of "lease" and "lessees"

The government recommends (i) removing the requirement that the lease term of a qualifying ship operating lease or finance lease must be over one year and (ii) expanding the scope of "lessees" to cover "any other persons" rather than limited to ship lessors, ship operators and ship leasing managers.

2. An optional 15% concessionary tax rate

The government recommends introducing a 15% concessionary tax rate as an additional option for qualifying ship lessors, ship leasing managers and shipping commercial principals of an in-scope MNE group under BEPS Pillar 2. Such entities can elect their preferred tax rate on an annual basis. There would be measures to deal with offsetting assessable profits with tax losses carried forward in situations where a taxpayer elects for different concessionary tax rates (e.g. 8.25% vs 15%) for its maritime services income across different years of assessment.

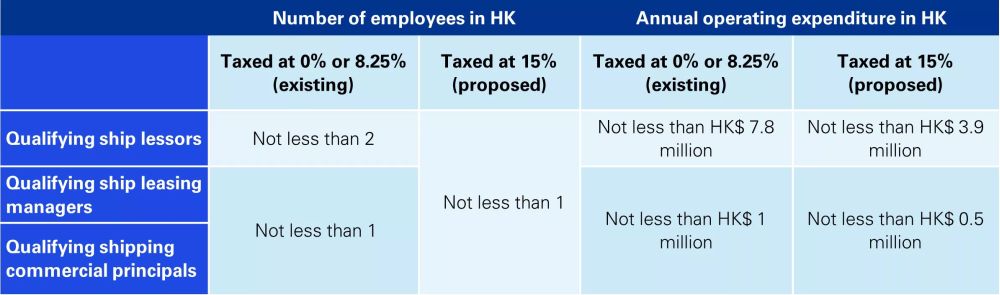

Entities electing for the 15% rate would be subject to a reduced substantial activity requirement as set out in the table below.

3. Tax deduction on ship acquisition costs for ship lessors under operating lease

Under the current regime, qualifying ship lessors under operating lease are not entitled to any tax deduction for the ship acquisition costs. Instead, a "20% tax base concession" applies whereby the assessable profits are calculated based on 20% of the lease income. For Hong Kong profits tax (under Part 4 of the Inland Revenue Ordinance) purposes, this does not have any actual impact given the applicable tax rate is 0%. However, with the implementation of BEPS Pillar 2, such computation basis will drag down the effective date rate for Hong Kong for GMT and HKMTT purposes and may result in top-up tax being imposed for in-scope MNE groups.

The government therefore recommends introducing a tax deduction of ship acquisition costs in lieu of applying the 20% tax base concession for qualifying ship lessors under operating lease. The proposed tax deduction applies to ships acquired before or after the effective date of the legislative amendments. For ships which have been acquired and used prior to the effective date of the legislative amendments, the tax deduction amount will be adjusted.

Upon disposal of a ship of which a tax deduction has been granted, the sale proceeds of the ship (capped at the total amount of deduction allowed) will be deemed as taxable trading receipts for calculating the assessable profits in the disposal year.

4. Relaxing the tax deduction on interest expenses for ship lessors

Under the existing stringent interest expense deduction rules, interest expenses incurred by qualifying ship lessors for financing ship acquisition may not be deductible at all (e.g. for borrowings from an overseas associated company that is not a financial institution). The government recommends expanding the scope of tax deduction on interest expenses incurred for acquiring a ship to interest expenses on borrowings from:

- a non-associated financier (e.g. an overseas non-financial institution); and

- an associated financier who is required to pay a similar tax (i.e. Part 4 profits tax in Hong Kong) on the interest income in a jurisdiction outside Hong Kong.

KPMG observations

We welcome the proposed enhancements of the existing tax concessions for the maritime services industry. The proposed changes in (2) and (3) above will help mitigate the top-up tax impact and reduce the compliance burden under BEPS Pillar 2 for in-scope MNE groups. This is particularly helpful when the international shipping income exclusion under the GloBE rules is not applicable.

A few proposed enhancements mentioned above mirror those made to the aircraft leasing tax concessionary regime that apply from year of assessment 2023/244. It has yet to be seen whether the optional 15% concessionary tax rate will also be made available under the aircraft leasing tax regime to provide similar flexibility to Pillar 2 in-scope aircraft leasing groups.

We recommend that the government takes the opportunity of the current review of the concessionary tax regime for the maritime services industry to consider other enhancements of the regime – e.g. (i) expanding the scope of the regime to cover container leasing, freight forwarding and logistics businesses and (ii) relaxing the requirement that actual corporate income tax must be paid by the overseas associated financier on the interest income for the Hong Kong taxpayer to claim a tax deduction on the interest expenses incurred on the borrowings from that overseas associated financier. Currently, this requirement cannot be met when the interest income is offset by a tax loss, resulting in no tax being paid by the overseas associated financier.

Proposed tax concessionary regime for physical commodity trading business

To attract more physical commodity traders to conduct their businesses in Hong Kong so as to drive the demand for high value-added maritime services in Hong Kong, the government has proposed to provide a half-rate tax concession for assessable profits derived from physical commodity trading business, subject to fulfilment of the specified conditions. We summarise below the key features of the proposed tax concession.

1. The tax concession

Assessable profits (including incidental income such as interest income, exchange gains and hedging gains) derived by a qualifying physical commodity trader (qualifying trader) from qualifying physical commodity trading activity will be taxed at an 8.25% tax rate. In addition, there is an option for a qualifying trader belonging to a Pillar 2 in-scope MNE group to make an annual election to be taxed at a 15% tax rate.

2. Qualifying physical commodity items

Three broad categories of physical commodities are covered, namely (1) energy and industrial commodities, (2) agricultural commodities and (3) metal mine commodities. The full list of qualifying physical commodity items is set out in the Appendix to Annex II of the briefing paper3.

3. Qualifying physical commodity trading activity

Qualifying physical commodity trading activity refers to an activity of buying and/or selling of a qualifying physical commodity item that results in the physical delivery of the item5 and that fulfils the following requirements:

- the activity is carried out in the ordinary course of business carried out in Hong Kong; and

- the contract for buying and/or selling of a qualifying physical commodity item is effected in Hong Kong.

4. Qualifying physical commodity trader

An entity is regarded as a qualifying physical commodity trader if it fulfils one of the following conditions:

- it has carried out one or more qualifying physical commodity trading activities in Hong Kong and has not carried out any non-qualifying activities in Hong Kong;

- it satisfies the safe harbour rule (i.e. the corporation has not less than 75% of all its profits and assets being physical commodity trading profits and physical commodity trading assets); or

- it has obtained the determination of the Commissioner of Inland Revenue that it is a qualifying trader.

5. The Hong Kong nexus requirement

The tax concession will only apply if:

- the central management and control of the qualifying trader is exercised in Hong Kong;

- the activities that derive the qualifying profits are carried out in Hong Kong by the qualifying trader or arranged by it to be carried out in Hong Kong; and

- the activities are not carried out by a permanent establishment of the qualifying trader outside Hong Kong.

6. Minimum annual business turnover requirement

The total annual income derived from qualifying physical commodity trading activity must be not less than HK$700 million.

7. Minimum requirements on the use of Hong Kong maritime services

For expenditure incurred by a qualifying trader on specified maritime services6, there is a requirement that at least:

- 30% of the expenditure on any of the specified maritime services in aggregate; or

- 50% of the expenditure on one of the specified maritime services

must be incurred on services provided by "Hong Kong-based service providers" (i.e. persons whose business is registered in accordance with the Business Registration Ordinance).

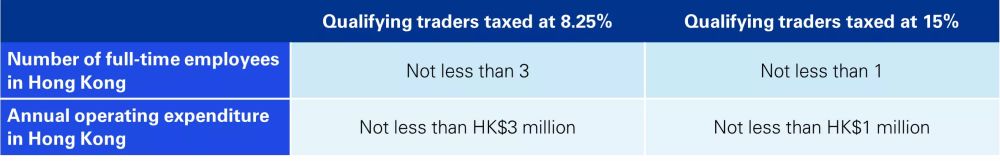

8. Economic substance requirements

KPMG observations

The proposed tax concessionary regime for physical commodity trading business in Hong Kong represents another step taken by the HKSAR Government toward extending Hong Kong's tax incentives to sectors beyond financial services.

Currently, Singapore also offers a tax incentive for commodity trading businesses in Singapore under the Global Trader Programme7 (GTP). The GTP applies to a wide range of commodity trading activities (including physical trading, derivative trading and structured commodity financing activities) and offers a preferential tax rate as low as 5%. While there are differences in the scope and tax rate offered under the Hong Kong and Singapore regimes, taxpayers should be mindful that the qualifying requirements, the degree of certainty and compliance burden may also be different under the two regimes.

To ensure the proposed tax concessionary regime in Hong Kong serves its policy objective, the government needs to continuously monitor its usage, solicit feedback from the industry and consider making any necessary enhancements. Although the major policy objective of the proposed concession is to bolster the development of the maritime services sector and therefore the current scope of the concession only covers physical commodity trading, we urge the government to consider, as the next step, expanding the scope of the concession to cover derivative trading and other financing activities related to commodity trading to nurture a more sustainable development of the commodity trading ecosystem in Hong Kong.

In addition, to strengthen the overall competitiveness of Hong Kong's tax system as a whole, we recommend that the government looks into the other aspects of the Hong Kong tax system where refinements may be warranted. An example is the existing stringent interest expense deduction rules in Hong Kong which may pose challenges for overseas business groups seeking to conduct their businesses in Hong Kong.

Implementation timeline

The government plans to introduce a bill with the necessary legislative amendments to the Legislative Council in the first half of 2026. Upon the completion of the legislative process, both of the proposals for maritime services industry and physical commodity trading will take effect from the year of assessment 2025/26.

Footnotes

1. The 2024 Policy Address can be accessed via this link: https://www.policyaddress.gov.hk/2024/en/policy.html

2. The 2025/26 Budget Speech can be accessed via this link: https://www.budget.gov.hk/2025/eng/index.html

3. The briefing paper presented at the meeting of the Legislative Council's Panel on Economic Development held on 8 July 2025 can be accessed via this link: https://www.legco.gov.hk/yr2025/english/panels/edev/papers/edev20250708cb3-1045-5-e.pdf

4. For details, please refer to our previously issued Hong Kong (SAR) Tax Alert - Issue 25, December 2023.

5. Please refer to Annex II of the briefing paper for a list of actions constituting such activity.

6. Specified maritime services mean any services in connection with the activities of ship leasing, ship leasing management, ship agency, ship management and ship broking as well as freight booking, ship repairing, ship tug-and-row, maritime legal services and marine insurance.

7. For details, please refer to the website of the Enterprise Singapore via this link: https://www.enterprisesg.gov.sg/financial-support/global-trader-programme