- within Corporate/Commercial Law topic(s)

- in European Union

- with readers working within the Banking & Credit industries

- in European Union

- in European Union

- within Insurance, Consumer Protection, Government and Public Sector topic(s)

Pull the Parachute, Not the Tax Trigger: Section 47 can make a Liquidation Tax-Neutral

When a company faces liquidation, winding-up or deregistration the instinct might be to brace for tax consequences, but section 47 of the Income Tax Act 58 of 1962 (the "ITA") offers a parachute. This provision provides roll-over relief for corporate restructurings where a company is wound up and its assets are distributed to a resident company within the same group. These are known as liquidation distributions, and when the statutory requirements are met, they allow the transaction to glide past income tax, capital gains tax, and recoupment triggers.

The definition of a "liquidation distribution" in section 47(1) of the ITA contains two components:

- Paragraph (a) covers domestic liquidation distributions; and

- Paragraph (b) applies to certain cross-border transactions.

This article focuses exclusively on domestic liquidation distributions as contemplated in section 47(1)(a) of the ITA.

Understanding Liquidation Distributions

A transaction qualifies as a liquidation distribution if a resident company, referred to as the liquidating company, disposes of all its assets to its shareholders in anticipation of or during its liquidation, winding-up, or deregistration. The relief only applies to the extent that the assets are disposed of to a resident holding company that forms part of the same group of companies on the date of disposal.

In terms of the relief rules, the liquidating company is not required to dispose of assets that it elects to retain for the settlement of:

- debts incurred in the ordinary course of its business;

- any reasonably anticipated liability to any sphere of government; or

- the administrative costs of the liquidation process.

Practical Application and Reasons to Conclude aLiquidation Distributions

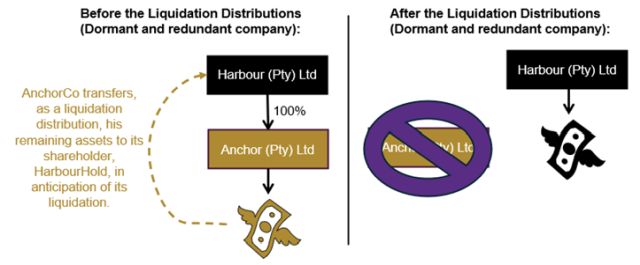

1. Dormant and redundant company

Over time, companies within a group structure may become dormant, no longer conducting business or holding strategic value. Keeping such entities active can lead to unnecessary administrative burdens and compliance costs. Section 47 of the ITA offers a way to wind down these companies efficiently by allowing for a tax-neutral transfer of assets to another group company, avoiding the tax consequences that would normally arise from liquidation.

Take, for example, a group of companies that includes a subsidiary, Anchor (Pty) Ltd ("AnchorCo"), that was once active but has since become dormant and serves no further commercial purpose. The holding company, Harbour (Pty) Ltd ("HarbourHold"), owns 100% of AnchorCo's shares. Rather than letting AnchorCo drift aimlessly and incur ongoing compliance costs, the group decides to wind it up.

By invoking Section 47 of the ITA, the group can "pull the parachute" and execute a tax-neutral liquidation. AnchorCo's remaining assets, such as cash reserves or minor receivables, are transferred to HarbourHold without triggering income tax, capital gains tax, or recoupments. The transaction qualifies as a "liquidation distribution".

Instead of triggering unnecessary tax liabilities by disposing of assets through a standard sale or distribution, the group uses section 47 to land softly, preserving asset value and avoiding tax turbulence.

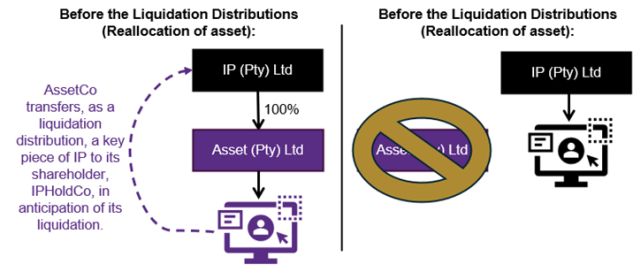

2. When a company holds a single asset that needs to be reallocated

Sometimes, a company within a group holds a valuable asset, such as intellectual property, real estate, or equipment, but has no other operational purpose. Once the asset is transferred to a more appropriate entity within the group, the original company becomes redundant. Section 47 of the ITA enables this transfer to happen without triggering immediate tax consequences, making it an ideal tool for strategic asset realignment.

For example, Asset (Pty) Ltd ("AssetCo") owns a key piece of intellectual property (IP) that the group wants to consolidate under IP (Pty) Ltd ("IPHoldCo"), which manages all IP-related matters. After the transfer, AssetCo will have no further use.

Instead of triggering tax on the IP transfer, the group "pulls the parachute" by using section 47. AssetCo is liquidated, and the IP is transferred to IPHoldCo as part of a liquidation distribution. Because the companies are part of the same group and the transfer is in anticipation of liquidation, the transaction qualifies for roll-over relief.

This approach allows the group to realign its asset ownership structure without setting off the tax trigger ensuring a smooth and strategic landing.

Section 47 Compliance Requirements

To benefit from the tax deferral under section 47, the following conditions must be satisfied:

- Both the liquidating company and the holding company must be South African tax residents;

- The two companies must be part of the same group of companies on the date of disposal;

- The liquidating company must dispose of all of its assets as part of or in anticipation of its liquidation, winding-up or deregistration;

- The assets must be transferred to its shareholders or holding company, and the holding company must either dispose of its equity shares in the liquidating company or assume qualifying debt;

Failure to comply with these requirements may result in the loss of roll-over relief and the triggering of tax consequences in the hands of either or both companies.

Tax Implications for the Liquidating Company

When these conditions are met, the liquidating company does not recognise any gain or loss on the disposal of its assets whether trading stock, capital assets, or allowance assets. The assets are transferred at their tax cost, preserving their tax attributes in the hands of the holding company.

This roll-over relief applies only if the consideration consists of equity shares in the liquidating company held by the holding company which are disposed of due to the liquidation, or the assumption of qualifying debts by the holding company. Qualifying debts include those incurred more than 18 months before the disposal, or those within 18 months if incurred in the ordinary course of business or refinanced.

Tax Implications for the Holding Company or Shareholders

The holding company receiving the assets must adopt the tax cost and character of the assets as they were in the hands of the liquidating company. The roll-over provisions in sections 47(2) and 47(3) of the ITA ensure that:

- the holding company's tax base remains neutral; and

- the tax history of the assets is preserved, including capital vs. trading character.

Importantly, the holding company must when determining its taxable income, assessed loss or aggregate capital gain or capital loss disregard any:

- capital gain or loss resulting from the disposal of its shares in the liquidating company;

- return of capital received from the liquidating company by way of distribution in anticipation of or during the winding-up.

This ensures that the tax base is not eroded through artificial losses or duplicate relief.

Conclusion

Section 47 of the ITA offers a valuable parachute for group restructurings involving the liquidation of a company and the transfer of its assets to a related resident company. When the conditions are met, this roll-over relief ensures a smooth descent, no immediate tax is triggered for either the liquidating or the holding company, and the tax base of the assets remains intact.

But as with any controlled landing, precision is key. The statutory requirements must be satisfied in full, and the transaction must be commercially sound. Legal and tax advisory input is strongly recommended to ensure the structure qualifies under section 47 and to avoid any unintended tax turbulence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]