- within Tax topic(s)

- in South America

- within Law Department Performance topic(s)

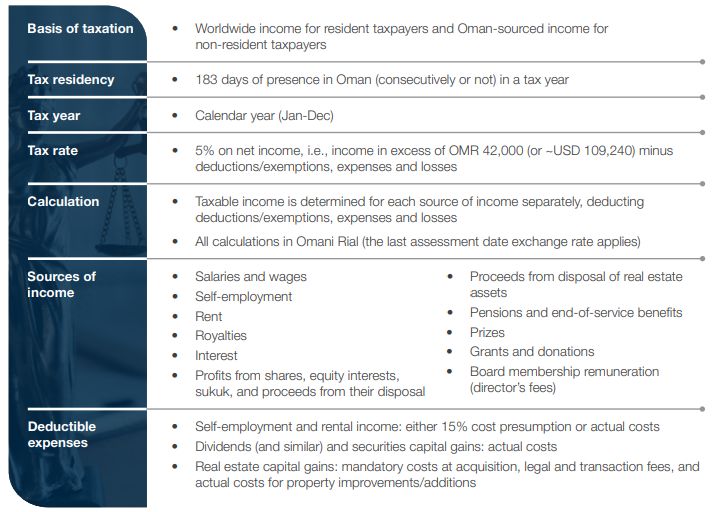

Following the recent publication of the Omani Royal Decree 56/2025, we summarize the top 5 aspects to consider and present an overview of the law:

01 Tax certainty

The Oman Personal Income Tax ("PIT") Law defines very clearly its tax residency concept, which is based on a single criterion of being present in Oman for 183 days or more, consecutively or non-consecutively, during the tax year (calendar year).

Further, the Oman PIT Law also very clearly determines the sources of income that are subject to tax in a detailed list (available below), as well as their computation. For employment income, it is relevant to state that the Oman PIT Law adopts a very broad concept, given that all benefits related to one's employment are included (such as shares in profits, in-kind benefits).

The mechanics for the self-employment and rental are also noteworthy, as they provide a lawful tax planning opportunity for taxpayers, by giving the opportunity to opt for a 15% cost presumption or the actual costs of the activity.

On the other hand, grants and donations are listed as a potentially odd taxable source of income, given that the concept is quite broad as to include all cash or in-kind benefits received from anyone other than an employer. Although there is an exemption for income from inheritance, bequests, grants, or donations received from spouses or first-degree relatives, it is still necessary to reassess this concept once the Executive Regulations are issued, as it may strike a blow to common structuring.

02 Alternative "savings" mechanisms, constant notifications and expat attraction

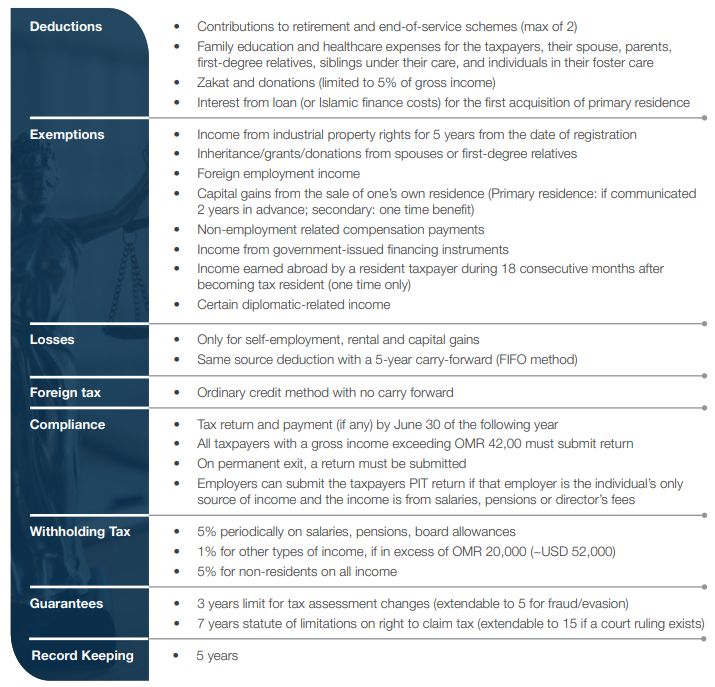

Within the Oman PIT exemptions, the deduction foreseen in Article 25(5) for an amount equal to the contributions paid to mandatory or voluntary retirement and end-of-service schemes (max of two) is set to drive a new growth for these schemes in Oman. This deduction creates an incentive for taxpayers to build up their savings, at the same time it reduces their potential PIT due.

The possibility of contributing to both mandatory and voluntary schemes broaden the potential benefit for taxpayers, considering different strategies or perspectives. At the same time, it should also result in an increase in providers with the capability to provide for this type of schemes. The executive regulations and the regulatory framework will be vital for this opportunity.

Amongst the PIT exemptions there are two that deserve the spotlight, although for different reasons. The first due to its mechanics, since it can be translated into endless notifications to the Oman Tax Authority from taxpayers looking to sell their primary residence. It is baffling to understand the reasoning behind the 2-year prior notification request, as often the real estate market moves faster than a 2-year timeframe. Meaning that, out of precaution, taxpayers may notify the Oman Tax Authority as soon as a residency is built/acquired so that if an unrefusable offer is made, they can accept without suffering a PIT leakage after 2 years.

The second exemption is worthy of praise as it shows an attempt from Oman to attract individuals to set up residency in the country while earning income from abroad. Although limited to a one-time exemption, foreign income received by an Omani tax resident during a period of 18 consecutive months, starting from the day they become a tax resident, will be exempt. 02

03 Compliance burden

Although the Omani PIT Law boasts a rather high bar for potential tax payment, considering the net income's threshold of OMR 42,000 and the significant deductions/exemptions, the compliance threshold is significantly lower.

Any person with a gross income in excess of OMR 42,000 is obliged to file an annual tax return, due by June 30 of the following year.

While not disputing the Omani Tax Authority's claim that 99% of Oman's population will not be subject to PIT, the same is not necessarily accurate in relation to the compliance burden placed on Omani taxpayers.

Nevertheless, the initiative to shift that burden from the individual to the employer (whenever an employer is the individual's only source of income and the income is from salaries, pensions or director's fees), must be saluted as a simplification procedure for employees, pensioners and directors.

04 Payroll and withholding obligations

As expected from a modern PIT system, the Omani PIT law introduces withholding obligations to be fulfilled by the paying entity, on behalf of the taxpayers. With these obligations, by 2028, Omani legal entities will need to implement more sophisticated payroll and withholding systems than the ones currently in use.

All employers and legal entities will be required to periodically withhold PIT from their employees' salaries, pensions, endof-service benefits, and board directors' fees.

Furthermore, government and legal entities will also be required to withhold 1% PIT from payments related to any other type of income whenever it exceeds OMR 20,000.

05 Tax procedures

The Omani PIT Law also establishes the tax procedures framework in relation to PIT, including the rules governing audits and inspections, litigation and penalties. These rules offer the taxpayers certainty in relation to the PIT system and its controls, as well as their guarantees when dealing with the Oman Tax Authority.

Highlighting the limitations towards audit procedures by the Oman Tax Authorities, where the taxpayer must be notified of the audit date, place, and estimated duration, and that audited returns cannot be re-audited unless new evidence emerges.

Similarly on privacy concerns, as although banks and licensed financial institutions must provide financial data about their clients to the Oman Tax Authority, such obligations must be preceded by a justified request and the Central Bank of Oman must be informed.

Taxpayers may object to assessments (with a set timeframe) and appeal decisions to the Income Tax Appeals Committee.

In addition to the penalties established for not withholding tax when due, not filling returns or filing false data, amongst others, the Oman PIT Law goes a step further by providing examples of tax evasion:

Unlawfully avoiding or reducing tax or delaying payment.

Shifting tax liability.

Falsifying tax returns.

A further step was given in the Oman PIT Law towards curbing tax crimes, as persons aiding or conspiring in a tax crime shall face the same punishment as the taxpayer.

Oman Personal Income Tax Law overview:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]