- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Australia

- with readers working within the Metals & Mining industries

1. Individuals

1.1 Personal Income Tax

Personal income is divided in two categories and taxed accordingly:

Annual Income: income from employment, independent profession and any other income that is considered as annual.

Final income: income from property and property rights, capital and insurance and other income considered as final.

1.1.1 Residency

An individual is resident when having a permanent residence in Croatia or when having a place of abode for more than 183 days in one or two tax years. Residents pay tax on their worldwide income. Non-residents pay tax only on Croatia source income.

1.1.2 Tax Rates

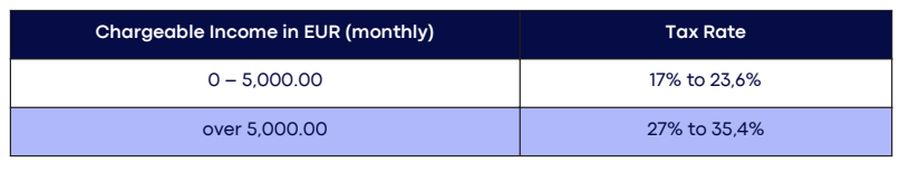

The rates of income tax depend on the source of the income and the county of residency and are taxed with lower rates ranging from 17% to 23,6% and higher rates ranging from 27% to 35,4%.

Tax rate from employment income and second income:

(Annual basic non-taxable deduction: 6,720.00 EUR)

Annual Personal Income Tax rate is 17% to 23,6% for a tax base up to 60,000.00 EUR and 27% to 35,4% for a tax base over 60,000.00 EUR if the Local Self-Government Unit does not make a decision on the amount of the tax rate.

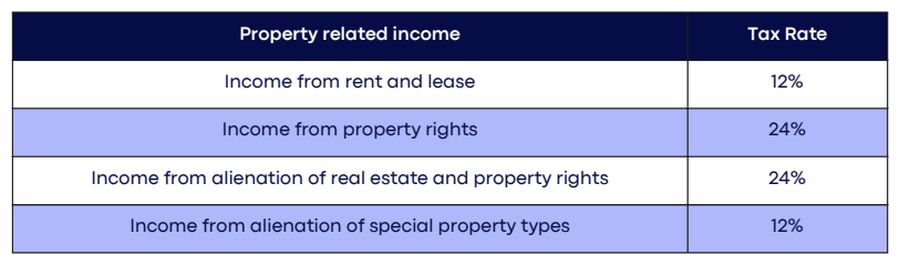

Tax rate from income derived from property rights depends on income type:

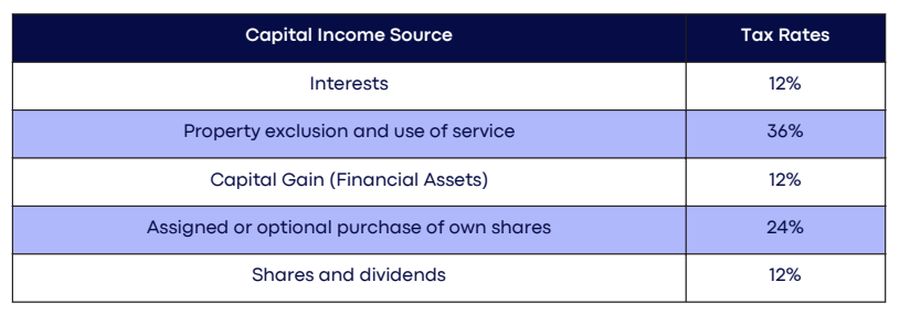

Capital Income Tax depends on the type of the income source:

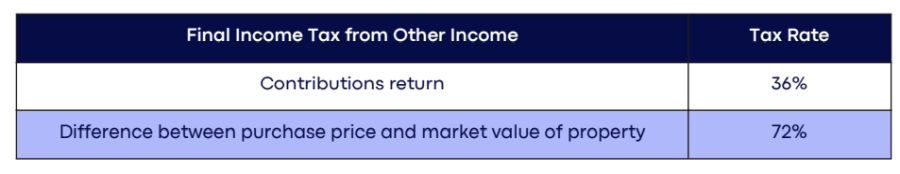

Income Tax from other income considered as final income:

Foreign pensions received by residents constitute taxable employment income for the recipient.

1.1.3 Exempt Income

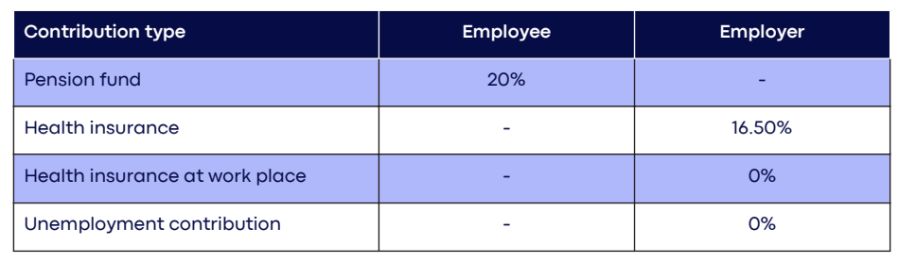

1.2 Social Security Contributions

Croatian Social Security contributions consist of pension contribution calculated and deducted from the gross salary and a health and employment contribution calculated and paid on top of the gross salary. The following rates are valid from 01.01.2019.

1.3 Inheritance & Gift Taxes

A legal entity or natural person that receives or inherits the individual movable property as a gift with value of less than EUR 6,700.00 is tax exempted. Individual movable property above theis amount, money, claims, securities and real estate regardless of its market value are taxed at 4%. Spouse and descendants are tax exempted both for received gifts and inheritance regardless of type and value of the property received.

The tax base constitutes the amount of the cash or the market value of financial and other assets on the day when the tax liability is determined, after the deduction of debts and costs related to the assets on which the tax is being paid.

1.4 Tax on Savings Income

Personal income from interests on savings is taxed at 12% regardless of the savings amount. The tax base is the amount received from interest rates on principal amount in one year.

2.Corporate Tax

2.1 Corporate Income Tax (CIT)

Taxable persons are legal entities or natural persons engaged in a business activity. Permanent establishments of non-resident enterprises are also taxable persons.

2.1.1 Residency

Resident legal entities, i.e. those which are duly registered and whose management and control is being exercised in Croatia, are generally subject to corporate tax on their worldwide income while non-residents are taxed on their incomes derived from sources in Croatia.

2.1.2 Tax Rates

CIT is assessed in the year, in which the income is earned on a current year basis. Tax rates are as follows:

- 10% for realized income up to 1,000,000.00 EUR;

- 18% for realized income equal or higher than 1,000,000.00 EUR. The taxable base is determined by increasing the accounting profits or losses for non-deductible expenses and reducing the accounting profits or losses for allowable items.

The taxable base is determined by increasing the accounting profits or losses for non-deductible expenses and reducing the accounting profits or losses for allowable items.

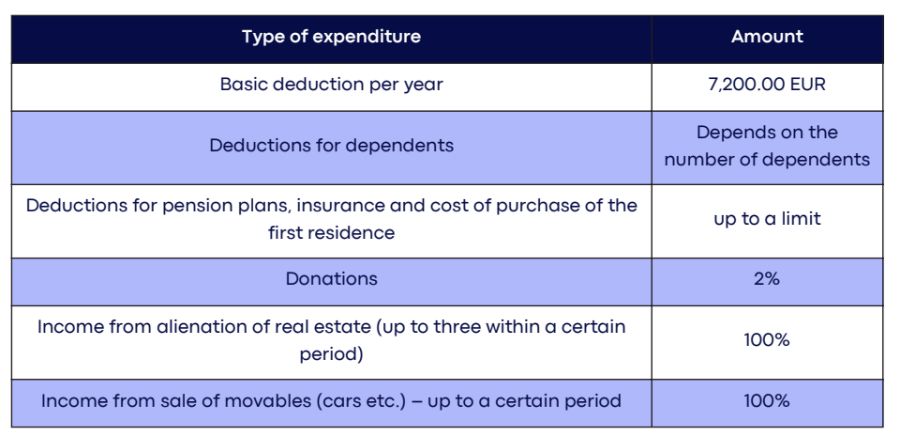

2.1.3 Tax Deductions

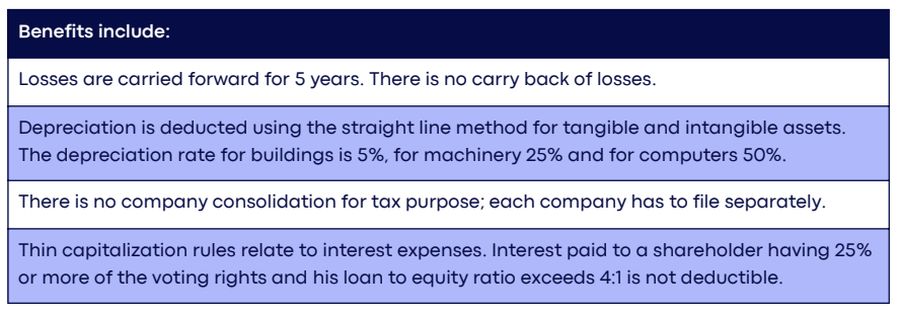

2.1.4 Deductible Expenses

Expenses incurred in the course of ordinary business are generally deductible.

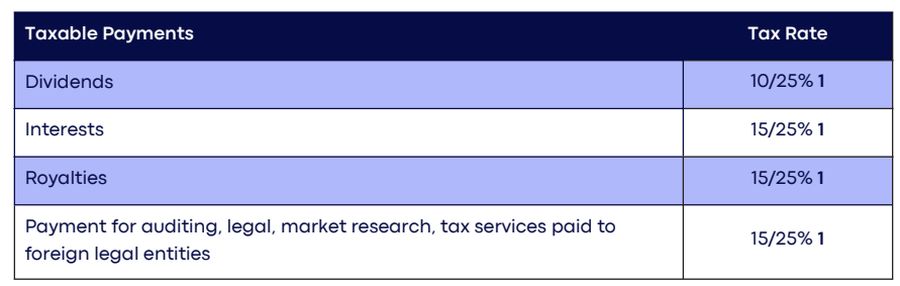

2.2 Withholding Taxes

(in the absence of a more favorable DTT)

Notes:

1 25% when paid to non-resident legal entities in countries that are listed as non-cooperative jurisdictions for tax purposes (i.e. on the EU blacklist) and have not included a tax treaty with Croatia.

2.3 Capital Gains Tax

Capital gains in Croatia are included in the aggregate taxable income of legal entities and are taxed at the 12% standard rate. If the company has sold its own shares, the gains are not taxed.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.