- within Energy and Natural Resources topic(s)

- with readers working within the Advertising & Public Relations, Oil & Gas and Utilities industries

- within Energy and Natural Resources, Transport, Media, Telecoms, IT and Entertainment topic(s)

- with Inhouse Counsel

- in Turkey

On 23 June 2025, the government published its Clean Energy Industries Sector Plan (the Plan), which aims to double clean energy investment in designated 'frontier' industries to over £30 billion per year by 2035. The Plan is one of a suite of plans to be rolled out by the government under the UK's Modern Industrial Strategy relating to eight sectors that the government refers to as the "IS-8".1

The Plan also identifies certain 'frontier' Clean Energy Industries, which government support will be focussed on.

These are:

- Wind (onshore, offshore and floating offshore);

- Nuclear Fission;

- Fusion Energy;

- Carbon Capture Usage & Storage (CCUS);

- Greenhouse Gas Removals;

- Hydrogen; and

- Heat Pumps.

Notably absent from the list of 'frontier' technologies are solar, long duration energy storage (LDES), bioenergy, heat networks, and smart grid technologies. These technologies are described as "vital", and there is an assurance that the government will "continue to support the deployment of these technologies", but they are almost entirely unmentioned for the remainder of the Plan.

The 10-year strategy set out in the Plan confirms long-term deployment plans for the frontier technologies with the aim of driving investment by providing certainty to industry. Two key levers by which the government aims to deliver its strategy are highlighted throughout the Plan – delivering 'targeted catalytic public investment' and 'breaking down barriers to investment'. While not the focus of this blog, the Plan also covers how the government plans to ensure there is a skilled workforce in the UK to deliver the strategy.

Delivering catalytic public investment

The Plan outlines how a comprehensive suite of public financial institutions will be mobilised to 'crowd in' private capital.

- Great British Energy (GBE)

GBE and Great British Energy (GBE‑N) will invest more than £8.3 billion over this Parliament (to 2029) to develop, invest in, build and operate clean energy projects and supply chains. £300 million of this amount has been committed to offshore wind.

- Clean Energy Supply Chain Fund

A new £1 billion dedicated Clean Energy Supply Chain Fund to support UK‑based manufacturing of key components (eg floating offshore platforms, cables, hydrogen infrastructure).

- National Wealth Fund (NWF)

£27.8 billion of capital has been confirmed for the NWF, to enable higher-risk investments, including equity. The NWF will invest in capital intensive projects, business and assets. At least £5.8 billion of this amount will target carbon capture, low carbon hydrogen, gigafactories, ports, and green steel over this Parliament.

- Expansion of the Clean Industry Bonus (CIB) via Contracts for Difference (CfD)

Building on the success of the CfD CIB, the government is introducing the CIB for offshore wind auction round 7 and considering expanding the scheme to onshore wind and hydrogen.

- British Business Bank

The new £4 billion scale-up and start-up financing package will fund new specialist investors in pre-commercial stage companies, increasing its yearly investments by two-thirds to bring its total financial capacity to £25.6 billion. It will also make direct investments of up to £60 million in strategically important companies.

- HALEU Fuel Programme

A £300 million investment has been announced for the High‑Assay Low Enriched Uranium (HALEU) fuel programme, to support advanced nuclear technologies.

Breaking down barriers to investment

The Industrial Strategy does not only set out specific investments in clean energy that the government intends to make or facilitate, but also addresses other energy-related challenges, such as the cost of power to industry and the linking of the UK ETS and EU ETS, in order to increase the overall competitiveness of the industry.

Planning Reform

The government is set to publish a Strategic Spatial Energy Plan (SSEP) in late 2026, mapping out land/sea potential for infrastructure from 2030 to 2050. The SSEP will be one of several sectoral spatial plans that will be overseen by the National Infrastructure & Service Transformation Authority (NISTA), under the overarching infrastructure spatial strategy (as set out in the UK Infrastructure 10 Year Strategy). More clarity on NISTA's role and the alignment between the national infrastructure spatial strategy and sectoral spatial plans will help to avoid uncertainty for industry and investors.

The Plan also makes reference to the government's landmark Planning and Infrastructure Bill. The Bill, which amends regulatory processes and enables accelerated approvals for nationally significant infrastructure projects (NSIPs), is currently in the committee stage in the House of Lords (of as 22 July 2025). For further details on the Bill's reforms to judicial review of NSIPs, please see our previous article.

Upgrades to infrastructure

The Plan sets out a range of government support for upgrading and investing in the UK's grid infrastructure. The Transmission Owner business plans for 2026 to 2031 (still subject to Ofgem final decisions) set out over £60 billion in proposed investment, and the Plan confirms that the government will shortly publish a positive response in line with the National Infrastructure Commission's recommendations on strategic investment in the distribution network.

The Strategy suggests that the government is looking to build on the 'Gate 2 to Whole Queue' process that is being conducted this summer is part of the government's programme to re-order the connections queue and prioritise projects that are strategically important and ready to connect to the grid. For more details on the reforms and what this means for projects, you can read our previous article.

The Plan also suggests the government will explore a new Market Demand Guarantee to encourage domestic equipment manufacturing for electricity networks in the UK.

Reducing electricity costs for IS‑8 manufacturing industries

The Plan announced that, from 2027, a new British Industrial Competitiveness Scheme will reduce electricity costs by c. £35‑40/MWh for electricity‑intensive frontier IS‑8 manufacturing industries and foundational manufacturing industries in their supply chains, such as chemicals. Eligible business will be exempt from paying the costs of:

- the Renewables Obligation;

- Feed-in Tariffs; and

- the Capacity Market.

The Plan does not explain how the scheme will be funded. The government has said it will launch a consultation shortly to determine eligibility for the scheme, which will be reviewed again in 2030.

The Plan announces an uplift of the Network Charging Compensation (NCC) scheme (for companies operating in industries eligible for the British Industry Supercharger package). This uplift will give certain energy-intensive industries a reduction in their electricity network charges, upfrom 60% to 90% from 2026.

The government will also continue its support for the Energy Intensive Industries Compensation Scheme. It plans to review the scheme by the end of 2025 and confirm how support will continue alongside the implementation of the UK Carbon Border Adjustment Mechanism (CBAM) in 2027.

Previously announced in the 2025 Spring Statement, the Plan reaffirms that relief from the Climate Change Levy will be granted for electricity used in hydrogen electrolysis.

While these exemptions are positive news for industry and investors. The detail is awaited and the delay of the launch of the British Industrial Competitiveness Scheme to 2027 may mean that industry requires additional support in the interim.

Linking UK ETS with EU ETS

The Plan confirms the government's intention to link the UK's Emissions Trading Scheme (ETS) with the EU ETS. You can read more of our thoughts on how this might work in our previous blog post on the topic.

The Plan also notes that the government's response to the consultation on expanding the UK ETS to Greenhouse Gas Removals (GGR) technologies will be published shortly.

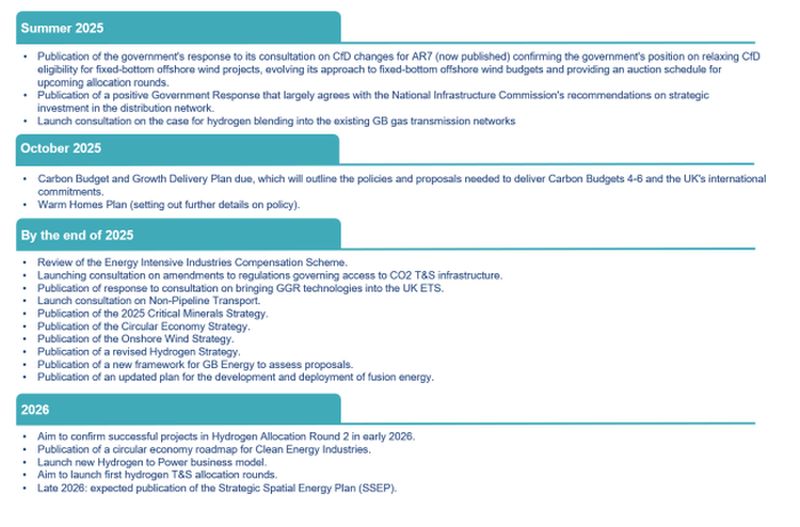

Future dates to note

Please do get in touch if you would like to discuss any of these upcoming consultations and announcements and how they will affect businesses and investors.

Conclusion

The government's clear message to industry and investors, through the Clean Energy Industries Sector Plan, is that the UK is committed to becoming a 'clean energy superpower' by 2035, bringing together comprehensive capital commitments, infrastructure reforms, and support for investment.

However, the Plan's success will hinge on translating ambition into aligned execution. Multiple upcoming consultations may influence investors' attitudes, and further detail is needed on how certain schemes and industry support will be funded.

Footnote

1. The sector plans, only the first six of which have been published so far, are (1) Clean Energies Industries, (2) Advanced Manufacturing, (3) Creative Industries, (4) Digital and Technologies, (5) Professional and Business Services, (6) Financial Services, (7) Life Sciences and (8) Defence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.