- within Insurance topic(s)

- in United States

- with readers working within the Banking & Credit and Insurance industries

- in United States

- with readers working within the Banking & Credit and Securities & Investment industries

- within Litigation, Mediation & Arbitration and Law Department Performance topic(s)

Opportunity and Drivers

While traditional investments struggle with single-digit returns, reinsurance sidecars are delivering up to 30%+1 returns to institutional investors. This market surged by 40%2 in 2024 to reach $10 billion, as investors discovered they can collect insurance premiums with limited downside and 1-5 year exit windows.

Four Forces Created This Perfect Storm

Historically high insurance rates, regulatory pressure on insurers to find external capital, desperate institutional demand for yield3 , and AI-powered4 risk modeling that makes investment decisions more precise than ever.

Participants and Structures

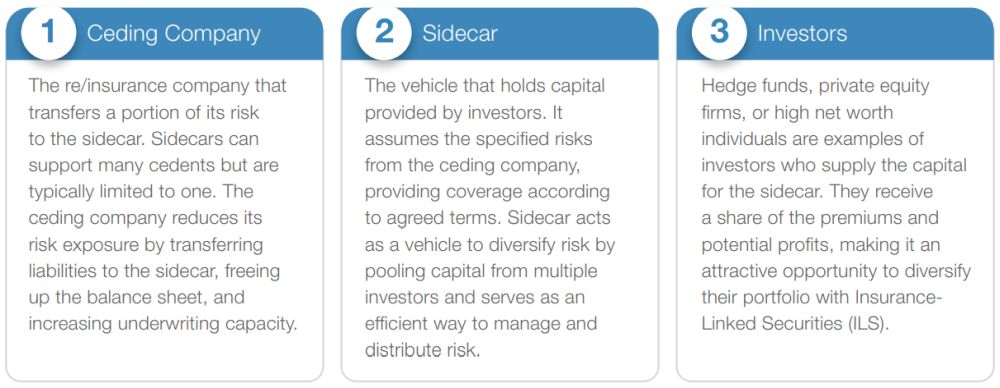

There are three main groups that participate in a reinsurance sidecar, each seeking to achieve distinct benefits:

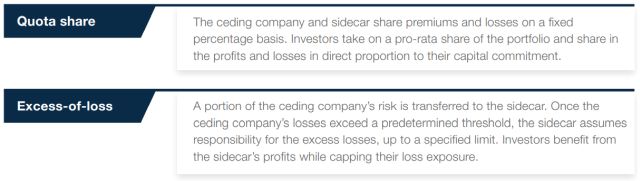

Agreement structures between these groups are dependent upon the risk profile of the ceding company, investor preferences, and regulatory environment. That said, quota share, and excess-of-loss are the two most common in the market.

Revenue Streams

Reinsurance sidecars present an opportunity for high-yield investments with varying levels of risk appetite, thanks to the sidecars typically shorter durations and adaptable structures. Investors are also attracted to their focused risk portfolio. By underwriting a smaller, more specific book of business, sidecars limit investors' exposure compared to the broader range or risks, insurance types, and geographic areas typically covered by a re/insurance company's entire portfolio.

The primary source of revenue for investors is the share of premiums paid by the ceding company for reinsurance coverage provided by the sidecar. Capital provided by investors is used to generate additional investment income. Investors also receive a portion of the profits from the underwritten policies, which can be substantial if claims are low. Since sidecars often limit investors' exposure to their invested capital, the risk of loss typically equals no more than the amount invested.

A reinsurance sidecar's term is typically one to five years, at which point the SPV is dissolved, and the remaining capital is returned to investors. If successful, however, re/insurers and investors often renew the sidecar to further their partnership.

Design Considerations

When establishing a reinsurance sidecar, several considerations must be addressed to ensure its effectiveness and alignment with strategic goals.

- Risk coverage

Determine what risks the sidecar will cover, such as in-force business, new business, or both, and at what levels of quota shares.

- Investment strategy

Define the types of assets the sidecar will invest in to ensure organizational alignment with the overall risk and return objectives.

- Risk transfer pricing

Establish how the risk transfer will be priced, such as setting the terms of reinsurance premiums and profitsharing arrangements.

- Domicile

Consider regulatory requirements, tax efficiency, and capital structures to inform jurisdiction selection. Bermuda and the Cayman Islands are the most common.

- Control

Identify the level of control the primary re/insurer has over the sidecar. Equity stakes can vary, so it is important to define organizational roles in governance and decision-making up front.

Conclusion

The reinsurance sidecar market has evolved into a $10 billion2 asset class delivering 30%+1 returns with built-in loss protection. With hard market3 conditions likely extending through 2027, early movers are positioning themselves in a rapidly expanding alternative investment category.

The Opportunity Won't Last

Elevated rates, uncorrelated returns, and clear exit timelines make this a compelling alternative to volatile traditional investments. Will you capitalize before the market becomes crowded?

Footnotes

1. Artemis.bm, "Sidecar investors 'handsomely rewarded' for commitment in 2023: Aon," January 5, 2024; https://www.artemis.bm/news/ reinsurance-sidecar-market-estimated-at-record-10bn-in-2024-aon-securities/

2. Artemis.bm, "Reinsurance sidecar market estimated at record $10bn in 2024: Aon Securities," September 9, 2024; https://www.artemis.bm/ news/sidecar-investors-handsomely-rewarded-for-commitment-in-2023-aon/

3. Insurance Journal, "Hard reinsurance pricing conditions are likely to last longer than in previous market cycles." August 15, 2024; https://www. insurancejournal.com/news/international/2024/08/15/788486.html

4. Apex Group, "Key trends in Insurance Linked Securities market in 2024," March 11, 2024; https://www.apexgroup.com/insights/what-toexpect-key-trends-in-insurance-linked-securities-market-in-2024/

Originally published 30 June 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.