- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Insurance industries

- in Africa

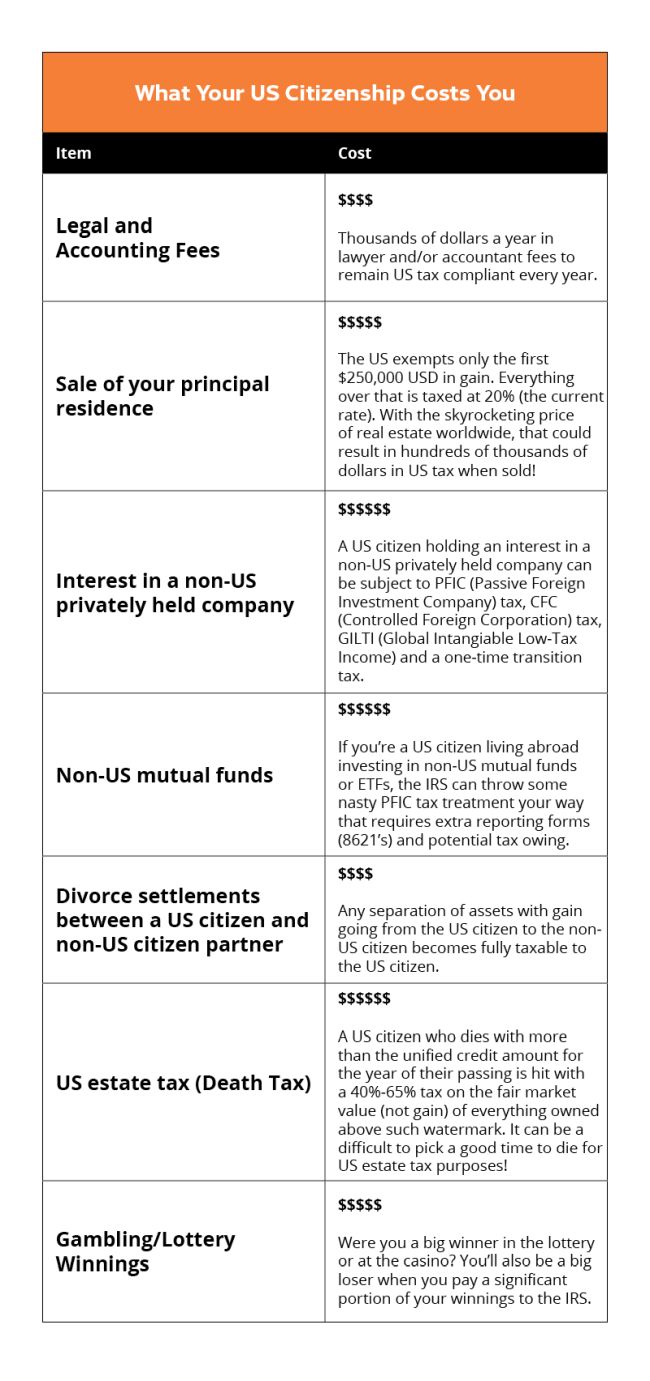

The weeks and months leading up to June 15 are typically referred to as tax season for the more than eight million US citizens living abroad. This time of year can also feel a lot like Groundhog Day. That's because US expats are reminded yearly of the cost of maintaining their US citizenship, even though they don't call the US home.

As US expats prepare for another expensive and stressful tax filing season, we've compiled a list of items that illustrate a few of the standard costs of their US citizenship while living abroad – in addition to the headaches, stress and sleepless nights that come with it.

The above list only scratches the surface regarding unexpected US tax implications. There are other hurdles awaiting US expats when it comes to taxes and regulations (think gift tax, generation-skipping tax, income splitting, medical costs, Obamacare tax on investments, and scores of other headaches coming down the legislative pipeline).

But here's the silver lining: If you are considering renouncing your US citizenship (the right way), you can bid farewell to all these double-taxation nightmares. No more worrying about Uncle Sam dipping into your pockets while alive or dead. But remember: you need to renounce the right way!

In our webinars, we cannot help but stress that renouncing your US citizenship must be done properly. The US has a whole host of tricks and traps you'll need to avoid (including the exit tax, inheritance tax, travel issues, loss of benefits, and the threat of being barred from the US for life) during the process.

Our team of experienced US lawyers represents between 600 and 900 US citizens and green card holders who decide to renounce their US status correctly every year on six continents – more than any other firm in the world. We can also help expedite your renunciation process by identifying US embassies and consulates with shorter wait times.

Moodys Tax Law is only about tax. It is not an add-on service, it is our singular focus. Our Canadian and US lawyers and Chartered Accountants work together to develop effective tax strategies that get results, for individuals and corporate clients with interests in Canada, the US or both. Our strengths lie in Canadian and US cross-border tax advisory services, estateplanning, and tax litigation/dispute resolution. We identify areas of risk and opportunity, and create plans that yield the right balance of protection, optimization and compliance for each of our clients' special circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.