- within Technology topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- within Technology, Law Department Performance and Immigration topic(s)

Across the EU, regulators are transitioning from observing AI adoption to actively supervising its use through a risk-based regulatory framework.

The AI Act introduces structured obligations for systems involved in decision-making, onboarding processes and automated communications, areas increasingly relevant to professional service firms.

Many organisations now deploy AI tools to:

- respond to initial client enquiries,

- extract onboarding data from communications,

- support internal compliance workflows, and

- assist monitoring and operational processes.

While these technologies deliver efficiency gains, they also raise questions around accountability, transparency and human oversight, particularly in regulated environments such as accounting, corporate services and fiduciary administration.

From a Cyprus perspective, firms must increasingly evaluate AI within their broader governance and risk frameworks rather than treating it as a standalone digital initiative.

Practical Challenges Firms Are Facing Today

Professional service providers across Europe are encountering similar uncertainties when implementing AI solutions:

- Risk Classification Uncertainty: determining whether AI systems fall within high-risk or limited-risk categories.

- Data Governance Concerns: ensuring personal and financial data processed through AI remains GDPR-compliant.

- Transparency Expectations: explaining AI-generated outputs clearly to clients and regulators.

- AML Implications: understanding how AI interacts with onboarding, monitoring and due diligence procedures.

These challenges are particularly relevant for firms managing cross-border clients or operating in high-compliance jurisdictions such as Cyprus.

Key Regulatory Considerations Under the EU AI Act

Although the AI Act introduces complex legal definitions, several practical governance principles are emerging for professional service providers:

- Human Oversight

AI systems assisting with onboarding or communication should remain subject to human supervision. Decisions that materially affect clients should not rely solely on automated outputs.

- Transparency & Documentation

Firms should maintain internal documentation describing:

- how AI tools operate,

- what data they process, and

- what safeguards exist to mitigate risks.

This aligns closely with existing AML governance expectations where audit trails and internal controls are already essential.

- Risk-Based Governance

Regulators expect structured oversight mechanisms, including policies, internal controls and management accountability, integrating AI risk alongside AML, cybersecurity and operational resilience.

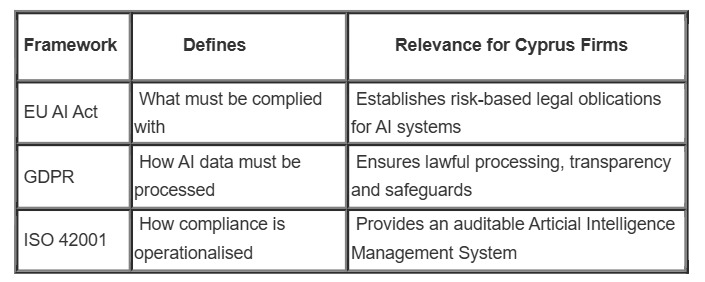

The Three Pillars of AI Compliance for Cyprus Firms

Effective AI governance in Cyprus increasingly relies on integrating multiple regulatory frameworks into a unified operating model:

Understanding the Risk Classification

The AI Act adopts a four-tiered risk-based structure, with the highest obligations applied to High-Risk AI Systems.

For professional services, particular attention should be given to systems used for:

- financial or corporate risk assessment,

- employment or HR-related decisions,

- compliance and due diligence workflows.

Firms acting as deployers (users) or providers (developers) of high-risk systems may face obligations relating to risk management, technical documentation, monitoring and transparency.

Key Compliance Obligations for Deployers in Cyprus

For firms using AI agents, including onboarding automation or internal workflow tools, governance responsibilities focus on deployment rather than development.

Key practical steps include:

- AI Literacy and Training

Staff must possess sufficient knowledge to understand AI risks and oversight responsibilities. - Internal Governance Structures

Firms should integrate AI risk into existing governance frameworks, potentially through internal policies or steering committees. - Fundamental Rights Assessments

High-risk systems may require structured assessments to identify potential bias or unintended impacts. - Vendor Oversight

Firms remain responsible for AI systems used within the EU regardless of vendor location, requiring contractual safeguards and due diligence. - Auditability and Monitoring

AI processes should maintain logging and allow human intervention where necessary.

AML & Compliance Implications

The intersection between AI and AML obligations is becoming increasingly significant.

AI-assisted onboarding tools may:

- extract client data from emails or documents,

- pre-populate onboarding forms,

- assist internal risk scoring.

While these functions enhance efficiency, firms must ensure:

- onboarding remains compliant with due diligence standards,

- AI outputs are reviewed by trained staff, and

- audit trails demonstrate accountability.

Regulators are likely to focus on whether firms maintain effective control over automated workflows rather than whether AI is used at all.

The Cyprus Structuring Perspective

Cyprus continues to position itself as a jurisdiction balancing innovation with regulatory credibility.

For international firms implementing AI within professional services, Cyprus offers:

- access to the EU regulatory framework,

- strong AML-aligned compliance culture,

- an evolving fintech and digital ecosystem.

However, firms must demonstrate substance, governance and effective internal controls. AI adoption should therefore be embedded into existing compliance structures rather than treated as a separate technology layer.

Governance & Risk Considerations for Directors

Boards and senior management increasingly carry responsibility for overseeing AI-related risks.

Key considerations include:

- establishing internal AI policies,

- coordinating oversight between compliance, IT and management,

- conducting periodic risk assessments, and

- integrating AI into internal audit and AML review cycles.

Positioning AI governance within overall corporate governance frameworks helps organisations adapt more effectively to evolving EU expectations.

Penalties and Moving from Compliance to Innovation

The AI Act introduces significant financial penalties, reaching up to €35 million or 7% of global annual turnover for certain prohibited practices.

However, the regulation should be viewed not only as a compliance obligation but also as an opportunity to build trust and strengthen operational resilience through responsible AI adoption.

Common Risks to Avoid

Organisations implementing AI-driven workflows should remain cautious of:

- automation without clear human oversight,

- reliance on unverified AI-generated outputs,

- insufficient documentation of AI systems, and

- overlooking GDPR data-processing obligations.

Addressing these risks early supports both regulatory compliance and client confidence.

Key Takeaways

The EU AI Act signals a shift towards structured governance rather than restriction of innovation.

For professional service firms operating from Cyprus or expanding into the EU, the priority should be aligning AI adoption with existing AML, data protection and corporate governance frameworks.

AI agents and automation tools can significantly enhance efficiency and client experience when implemented within a transparent and accountable operational structure. Firms that integrate technology with strong governance practices will be best positioned to operate confidently within the European regulatory landscape.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.