- within Technology topic(s)

- with Finance and Tax Executives

- with readers working within the Banking & Credit and Business & Consumer Services industries

Welcome to our EU crypto update - a roundup of key Irish and EU legislative and regulatory developments shaping the crypto-asset sector.

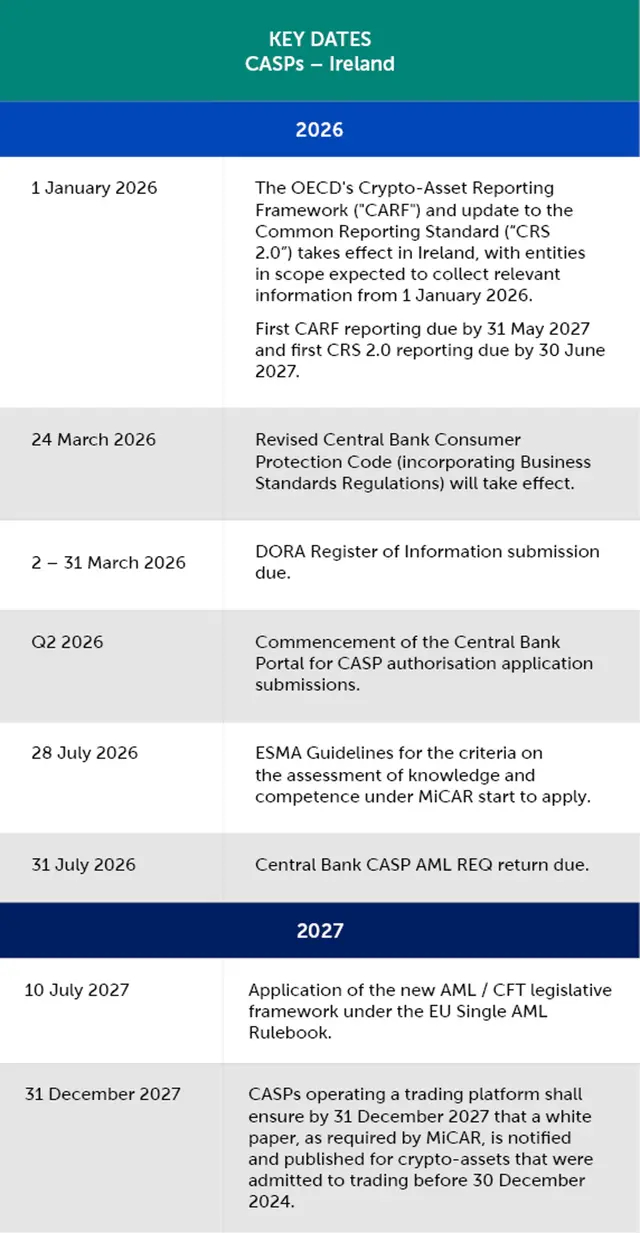

The "key dates" section highlights key legislative and reporting dates relevant to Irish CASPs.

This update is brought to you by our Regulatory & Risk Advisory practice group in Ireland. Our aim is to keep you informed of the fast-evolving legal landscape, from new legislation and guidance to significant case law and observations.

Sign up here to receive the next update in your inbox.

Key developments this month include:

- CASP applications to be submitted through the Central Bank of Ireland Portal from early Q2 2026.

- ESMA releases final guidelines for the criteria on the assessment of knowledge and competence under MiCAR.

- ECB paves way for acceptance of DLT-based assets as eligible Eurosystem collateral.

Legislation and guidance

Ireland

Central Bank of Ireland – CASP application submissions

21 January 2026 – The Central Bank of Ireland (Central Bank) announced on its MiCAR communications web page that Crypto Asset Service Provider (CASP) applications will be submitted through the Central Bank Portal from early Q2 2026.

- The Central Bank will publish a system guide at the end of Q1 2026 to allow firms to familiarise themselves with the Central Bank Portal and the new CASP application submission.

- The Central Bank Portal aims to provide improved transparency, so applicants have greater visibility of the status of an application and any follow-up requests.

Europe

ESMA Guidelines under MiCAR

28 January 2026 – The European Securities and Markets Authority (ESMA) has published the final guidelines for the criteria on the assessment of knowledge and competence under MiCAR (the Guidelines).

- The Guidelines aim to promote greater convergence in the criteria for the assessment of knowledge and competence of staff providing advice or information about crypto-assets or crypto-asset services and their application.

- The Guidelines have been translated into the official EU languages and will apply from 28 July 2026.

Other updates

Europe

ECB paves way for acceptance of DLT-based assets as eligible Eurosystem collateral

27 January 2026 – The European Central Bank (ECB) has released a press release announcing that from 30 March 2026, the Eurosystem will accept marketable assets in central securities depositories using distributed ledger technology (DLT) as eligible collateral for Eurosystem credit operations.

- Like other marketable assets, they must comply with Eurosystem collateral eligibility criteria and collateral management requirements.

- Further work is exploring ways to expand eligibility to assets issued and settled entirely on DLT networks which are not represented in eligible securities settlement systems.

ESMA adopts new Digital Strategy and updated Data Strategy

13 January 2026 – ESMA has adopted a new Digital Strategy 2026-2028 and updated its Data Strategy 2023-2028.

- The digital strategy aims to continue ESMA's digital transformation while the Data Strategy update is oriented to capitalise on opportunities to simplify, better integrate and streamline data management and technology.

- A key objective of the strategies is the implementation of the subsequent phases of the joint supervisory tool developed for monitoring of crypto-asset markets under MiCAR.

EIOPA and EBA Single Programming Documents

19 January 2026 – The European Insurance and Occupational Pensions Authority (EIOPA) published its Revised Single Programming Document 2026 – 2028 including the Annual Work Programme for 2026.

- As part of its deliverables, EIOPA will monitor the use of crypto-assets in the insurance and pension sectors and support the implementation of MiCAR and the issuing of opinions at the request of National Competent Authorities (NCAs).

29 January 2026 – The European Banking Authority (EBA) published its draft Single Programming Document 2027-2029.

- As regards MiCAR, the EBA will foster convergence of supervisory practices regarding the authorisation and supervision of issuers of asset-referenced and e-money tokens through a dedicated crypto-asset standing committee and discussions with NCAs on supervisory techniques. The EBA will also have intervention powers to prohibit or restrict activity related to asset-referenced or e-money tokens in relevant cases.

- In addition, EBA will review the MiCAR supervisory handbook on issuers of asset-referenced and e-money tokens to adjust to current supervisory practices and market developments.

- The EBA has also republished its 2026 Work Programme to align with the final Single Programming Document 2026-2028.

Speeches

28 January 2026 – Verena Ross, ESMA Chair, Speech on the Role of Capital Markets in Europe's Strategic Renewal.

- The speech notes that the most important sources of risks on ESMA's radar include the increasing interconnectedness between different parts of the financial sector including bank/non-bank and traditional/crypto-assets, as well as growing retail trading in complex products or crypto-assets, reinforced by digital and social‑media‑driven biases.

- Verena Ross notes that the Markets Integration Package (referenced in our December 2025 update) will have material consequences for CASPs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.