- within Employment and HR topic(s)

- in United Kingdom

- with readers working within the Retail & Leisure industries

- within Employment and HR topic(s)

- with readers working within the Securities & Investment and Utilities industries

- within Employment and HR, Corporate/Commercial Law and Tax topic(s)

We set down updates on recent changes to Employment Law in Malaysia.

Minimum Wage

Effective 1 February 2025, the minimum wage for all employment sectors in Malaysia was increased from RM1,500 to RM1,700.

Employers with less than 5 workers are granted a deferment to 1 August 2025 to comply.

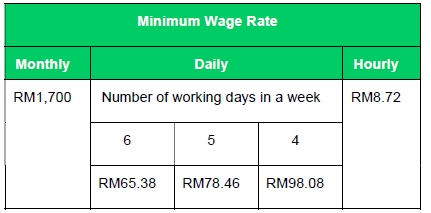

The new minimum wage rate is as follows:

Employees' Provident Fund Contributions for Foreign Workers

An amendment bill was passed by the Malaysian Parliament in March 2025, whereby contributions by both employers and employees, will become mandatory in respect of all foreign workers, at the rate of 2% of the amount of wages.

The above change will reportedly come into force in the fourth quarter of 2025.

Investor Pass

Malaysia had launched a new Investor Pass effective 1 April 2025 targeted towards foreign investors and business persons.

The Investor Pass will allow foreign investors who are frequent travelers with the purpose of seeking business opportunities and fall within the definition of New Investor, Investor in Pipeline and Existing Investor, will be entitled to apply for and on approval, stay for a duration of 6 months with an option to renew for an additional 6 months.

1:3 Internship Policy

The Progressive Policy on Expatriate Contribution to Local Talent Development (otherwise referred to as the "1:3 Internship Policy") will come into effect 1 January 2026, with its pilot implementation commencing from 15 February 2025.

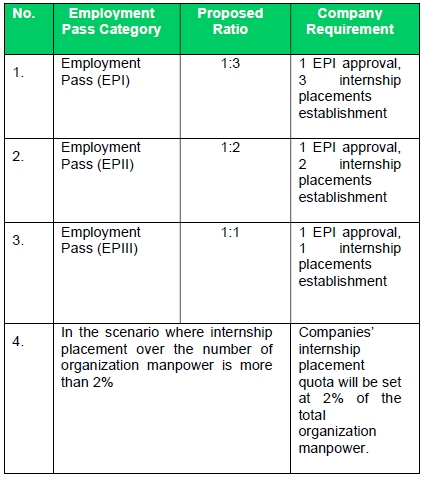

Under the 1:3 Internship Policy, companies granted approval for expatriate employment passes will be required to offer internships or work-based learning placements for local talent based on the following ratio:

We understand that the number of internships or work-based learning placements may be adjusted taking into consideration the company and size of the workforce.

As a form of incentive, companies and organisations will be granted double tax deductions on internship-related expenses.

Originally published 7 May 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.