- within Finance and Banking topic(s)

- within Consumer Protection, Privacy, Litigation and Mediation & Arbitration topic(s)

On January 22, 2025, the "Working Group on Payment Services System, etc." of the Financial System Council published its report on payment services systems (the "WG" and the report published by the WG, the "WG Report"). This was followed by the publication of a bill for amendment of the Payment Services Act (the "PSA", and the bill for amending the PSA, the "Amendment Bill") on March 7, 20251. The WG Report mainly addresses and considers issues of (i) remittance/payment services and (ii) cryptoassets/electronic payment instruments (stablecoins). This newsletter provides an outline of the issues regarding intermediary services (as defined in the PSA) for exchange of electronic payment instruments and cryptoassets.

Intermediary Services for Exchange of Electronic Payment Instruments and Cryptoassets

(A)Current Status and Issues

When entities such as gaming or telecommunications companies, which possess extensive customer bases, provide intermediary services that facilitate exchanges of cryptoassets or electronic payment instruments (collectively referred to hereinafter as "Cryptoassets, etc.") between cryptoasset exchange service providers or electronic payment instrument service providers and users, these services may qualify as "intermediary" services under the PSA (Article 2, Paragraph 10, Item 2, and Article 2, Paragraph 15, Item 2 of the PSA). This qualification depends on the specific method of service provision. Consequently, even though these entities are not direct parties to the exchange of Cryptoassets, etc., under the current regulations, they may still be required to obtain individual licensing to operate as cryptoasset exchange service providers or electronic payment instrument service providers.

However, under the PSA, licensed cryptoasset exchange service providers are required not only to segregate user property from their own but also to comply with Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) obligations, including conducting Know-Your-Customer (KYC) checks at the time of transactions and reporting suspicious transactions pursuant to the Act on Prevention of Transfer of Criminal Proceeds ("APTCP"). If an entity provides only intermediary services and does not itself engage directly in transactions involving Cryptoassets, etc., or accept deposits of users' property (including money and cryptoassets), imposing requirements such as segregation of user assets and AML/CFT obligations on such intermediary operator would constitute an excessive regulatory burden.

(B)Proposals in the WG Report

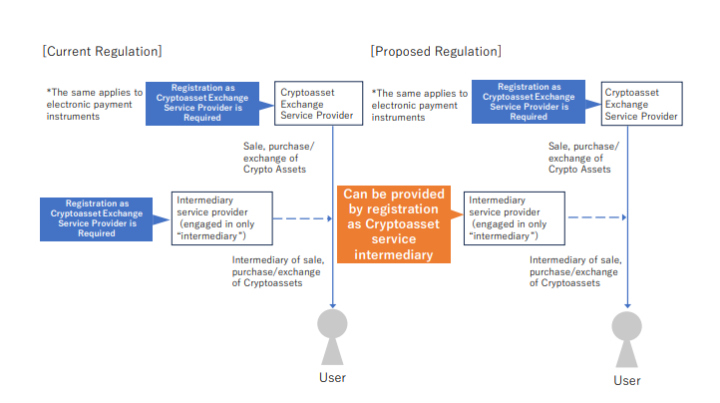

To achieve a balance between fostering innovation and safeguarding user interests, and to ensure that regulations applied to operators are appropriately tailored and flexible, the WG Report proposes the establishment of a new category of intermediary services. The proposed regulatory framework for such new category of intermediary services is outlined in items (i) through (iii) below. Under current regulations (see "Current Regulation" in the chart below), intermediary service providers that engage only in the exchange of cryptoassets are required to undergo registration as cryptoasset exchange service providers and are subject to strict regulatory requirements. By contrast, under the proposed regulation (see "Proposed Regulation" in the chart below), such intermediary service providers may engage in the same activities by undergoing registration as cryptoasset service intermediaries, a newlyestablished registration category, without the need to register as cryptoasset exchange service providers.

Source: Excerpt from p.8 of Material 1 of the "Bureau Explanation Material" of the WG for the 5th Financial System Council (Financial Services Agency, November 21, 2024)2

(i) Principal System

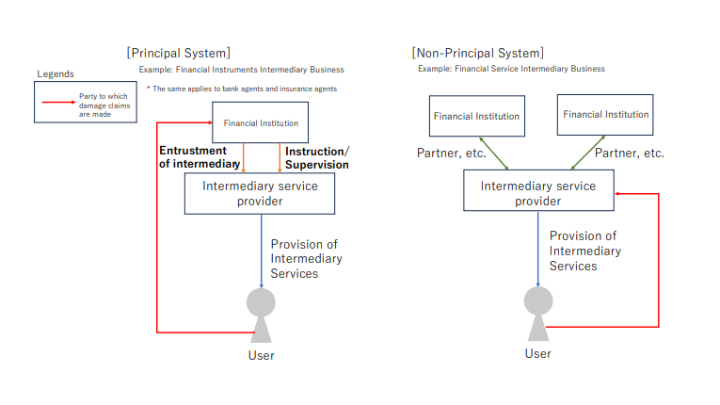

Major financial service intermediaries within the current financial sector employ the principal system for provision of intermediary services. Under this system, an intermediary service provider operates under the auspices of a specific financial institution and delivers intermediary services on behalf of that institution. Although financial service intermediaries dealing with multiple product types do not adopt the principal system, such a case is not contemplated by the newly proposed category of intermediary services. Therefore, the WG Report suggests that it is appropriate to mandate the use of the principal system for intermediary services of exchanging Cryptoassets, etc. Under the principal system (see the "Principal System" in the chart below), financial institutions entrust intermediary services relating to sale and purchase of financial instruments to intermediary service providers and provide them with instructions and supervision. If the intermediary service providers cause damage to users in connection with their intermediary activities, the entrusting financial institutions would be liable for such damages. By contrast, under the non-principal system, intermediary service providers operate in partnership with other financial institutions. Under this system, if the intermediary service providers cause damage to users in connection with their intermediary activities, the partner financial institutions would not be liable. Instead, the intermediary service providers themselves would bear the liability.

Source: Excerpt from p.10 of Material 1 of the "Bureau Explanation Material" of the WG for the 5th Financial System Council (Financial Services Agency, November 21, 2024)

(ii) Financial Barriers to Entry

The principal system described in item (i) above does not involve any deposit of property from users to intermediary service providers. This limits intermediary service providers' liability for mismanagement of users' property (although cryptoasset exchange service providers in the principal system are subject to general liability for wrongdoing). Against this backdrop, imposition of financial barriers of entry on potential entrants into the new category of intermediary services sector was considered unnecessary.

(iii) AML/CFT Obligations

When new intermediary service providers offer intermediary services for exchanges of Cryptoassets, etc., the relevant AML/CFT obligations are already carried out by the cryptoasset exchange service providers involved. Hence, it is considered unnecessary to duplicate AML/CFT-related obligations under the APTCP for the new category of intermediary service providers.

(C) The Amendment Bill

Based on the Amendment Bill, the main regulations to which intermediary service providers are subject are as follows:

| Items | Regulations on intermediary service providers |

| Principal System |

Intermediary activity in respect of sale and purchase of electronic payment instruments and cryptoassets are entrusted to intermediary service providers by an electronic payment instruments service provider and/or a cryptoasset exchange service provider (Article 63-22-3, Paragraph 1, Item 7). The entrusting electronic payment instruments service provider and/or entrusting cryptoasset exchange service provider for an intermediary service provider is liable for damages caused by the entrusted intermediary service provider to users in connection with intermediary services. However, this does not apply if the entrusting electronic payment instruments service provider and/or entrusting cryptoasset exchange service provider exercises due care in entrusting the intermediary service provider, and endeavors to prevent damage being caused to users in connection with the intermediation (Article 63-22-14). |

| Financial Requirements |

Not applicable. |

| AML/CFT requirements |

Not applicable. |

| Management of Information Security |

Intermediary service providers must take necessary measures for preventing leakage, losses, or damage of information pertaining to the intermediary services, and other measures for ensuring security management of the relevant information (Article 63-22- 10). |

| User Protection |

In relation to intermediary services for exchange of electronic payment instruments, intermediary service providers must provide explanations to prevent users from mistaking its intermediary services for a business carried out by a bank, etc., by a funds transfer service provider, or by a specified trust company. Intermediary service providers must provide information about the details of electronic payment instruments, fees and other terms, and the conditions of the contracts related to the intermediary services, and must take other measures necessary for protecting users of the intermediary services and ensuring the provision of the intermediary services in a proper and stable manner (Article 63-22-12, Paragraph 1). Regarding intermediary services for exchanging cryptoassets, intermediary service providers must provide explanations concerning the characteristics of the cryptoassets, and information about fees and other terms and the conditions of the contracts pertaining to the intermediary services, and must take other measures necessary for protecting the users of the intermediary services, and for ensuring the provision of the intermediary services in a proper and stable manner. (Article 63- 22-12, Paragraph 2). |

| Management of User's Property |

Intermediary service providers must not, for any reason, receive a deposit of money or other property from a user, or have a person specified by cabinet order as being closely related to that intermediary service provider deposit a user's money or other property, in connection with the intermediary services it provides (Article 63-22-13). |

Footnotes

1 https://www.fsa.go.jp/common/diet/index.html (Japanese only)

2 https://www.fsa.go.jp/singi/kessaiseido_wg/siryou/20241121/1.pdf (Japanese only)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.