- within Energy and Natural Resources, Government, Public Sector and Corporate/Commercial Law topic(s)

- in United Kingdom

- with readers working within the Law Firm industries

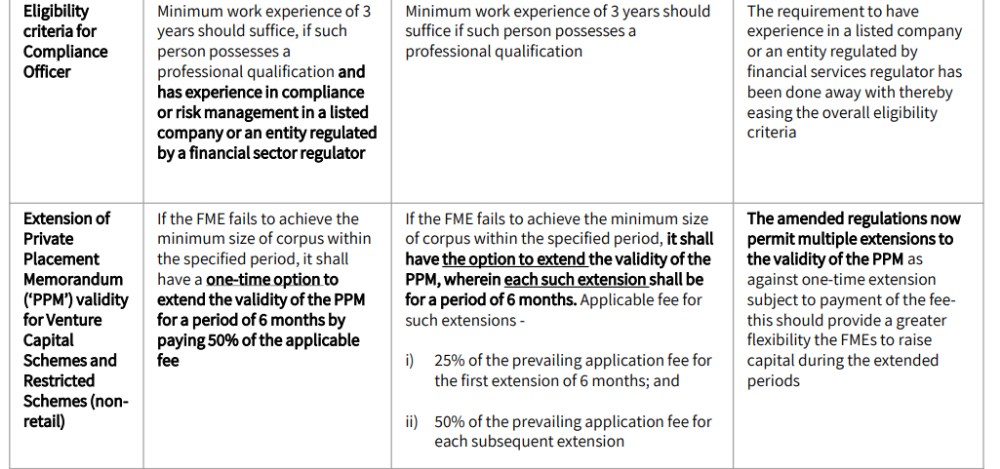

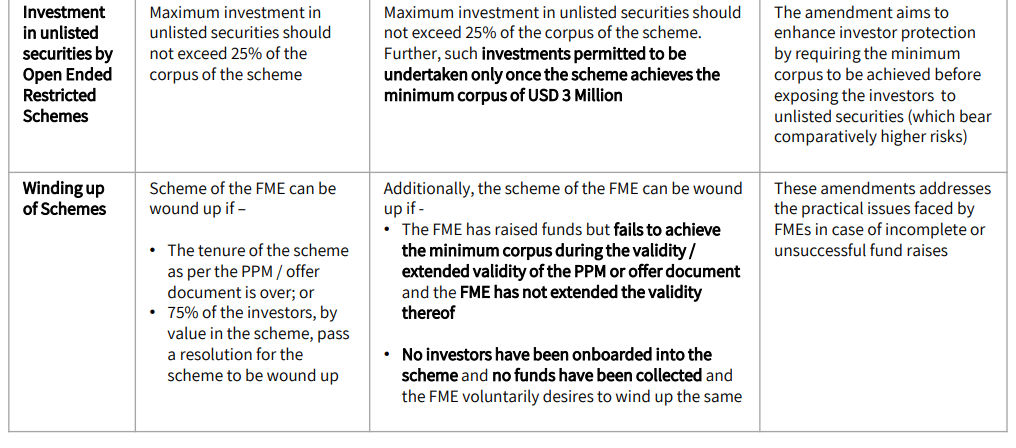

In light of the recently held 26th meeting of the International Financial Services Centres Authority ('IFSCA'), the IFSCA has vide notification dated 27 January 2026, notified the IFSCA (Fund Management) (Amendment) Regulations, 2026 ('Amended Regulations') amending the IFSCA (Fund Management) Regulations, 2025 ('Original Regulations').

These amendments aim to address operational challenges faced by Fund Management Entities ('FMEs') in IFSC, enhance ease of doing business and further strengthen investor protection framework in IFSC. A summary of the key changes introduced under the Amended Regulations is tabulated below

ANNEXURE

1. KMP work experience requirement under the Original Regulation (extract)

Relevant experience of at least 5 years in related activities in the securities market or financial products including in a portfolio manager, fund manager, investment advisor, broker dealer, investment banker, wealth manager, research analyst, credit rating agency, market infrastructure institution, financial sector regulator or consultancy experience in areas related to fund management, such as deal due diligence, transaction advisory or similar activities

Provided that the consultancy experience in areas related to fund management, such as deal due diligence, transaction advisory, etc. shall be considered for a maximum period of 2 years and experience in other areas as mentioned in sub-regulation (b) shall be required for at least 3 years

2. KMP work experience requirements under the Amended Regulations (extract)

In addition to the educational qualifications, an experience of at least five 5 years in related activities in the securities market or financial products in an eligible institution:

"eligible institution" shall include the following –

i) Market Infrastructure Institutions, Capital Market Intermediaries, financial sector regulators, FMEs, Banks, Finance Companies, Insurance Companies, and Insurance Intermediaries in IFSC, and equivalent institutions in India or any foreign jurisdiction;

ii) consulting firms / advisory firms / firms of Chartered Accountants / Company Secretaries / Cost Accountants in IFSC, India or any foreign jurisdiction, providing services to the institutions mentioned above in (i), in relation to a financial product; and

iii) a company, whether private or public, if the experience is in relation to finance/ accounts/ secretarial/ law departments of such company

Footnote

1 and 2 – Refer annexure

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.