- with readers working within the Retail & Leisure industries

The mining industry stands at a historic crossroads as several global trends converge. Ongoing urbanization, infrastructure booms in both mature and emerging markets, and transformative technologies—notably electrification and AI—are fueling demand growth, triggering expectations of over $1.5 trillion in cumulative mining investment by 2050. Governments are increasingly recognizing mining's role in national security and societal advancement, leading both policymakers and miners to initial streamlining efforts targeting the exorbitantly long approval and permitting processes and, in some cases, price derisking and guarantees. We are early in a period of intense new development, as demand for raw materials far exceeds the capacity of existing and even planned assets.

Despite these tailwinds, not all miners are benefiting, with investors keenly focused on the persistent inability and challenges some players have had in delivering projects safely, on time, and on budget. Successful capital projects are the result of millions of singular actions. These setbacks are not inevitable, and there is a subset of miners that excel at project delivery capabilities—and who are rewarded for it with rising profits and comparatively higher share prices and valuations. Transferring the lessons of the most effective operators requires a combination of rigorous oversight and clear processes.

AlixPartners knows how to help upfront during the design, engineering, and scoping of megaprojects. And we know how to help when things go wrong – acting in the execution and construction phases to get the budget back on track and recover schedule slippage, and in the operational readiness and commissioning phases to ensure a smooth transition to production. We also bring a track record of rapid protection and recovery work in urgent project situations. In broad strokes, overruns can be traced back to three fundamental points in the lifecycle of a capital project: initial allocation, project design, and project execution and delivery.

Allocation: We often see companies falling into the trap of using the same capital allocation process and decision-making criteria for smaller-scale projects and on mega-scale projects. This capital allocation approach typically results in overburdened small projects, and in some cases, commitments made to megaprojects with underestimated total capital costs that end up crowding out other attractive capital investments in the portfolio when the inevitable overruns occur. Sustained success comes when capital allocation is treated as a core competency, with clear identification and treatment of needs across the spectrum of project sizes, ensuring bottoms-up project-level and top-down portfolio-level alignment on every capital investment decision.

Design: Projects are frequently mis-scoped, especially when companies tackle projects in new geographies or new domains. Poor application of engineering standards, inadequate scenario planning, parameter ranging, and risk modeling, and limited use of design value optimization all contribute to bloated cost envelopes. Avoiding this outcome requires rigorous upfront planning, and ongoing attention to the challenges large capital projects inevitably face. Schedules should be pressure-tested, while independent "red teams" can help ensure projects are set up for success, and stay on track through inevitable setbacks.

Execution: Even well-conceived projects can go off the rails. Without robust controls, proactive management, and clear accountability, risks multiply—and outcomes become volatile. Empowering and increasing transparency at the planning war-room is a key enabler for tracking progress and driving alignment on key priorities and risks. Projects stay on track when stubborn issues are quickly escalated and delivery goals cascade down to the front lines.

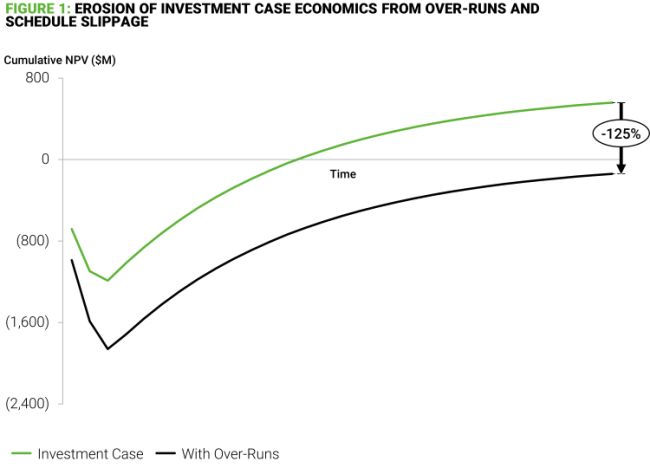

According to AlixPartners analysis, nearly all major mining projects over the past two decades experienced some degree of cost overrun and project delay, with the average major project coming in over budget by >50%, and commissioning delays exceeding eight months. At these levels, projects are pushed well below their original investment thresholds and become value destructive as shown in the figure below. An industry defined by its ability to develop projects finds itself hamstrung by its inability to do so efficiently.

The consequences of poor project delivery extend beyond financial loss to broad-based social and environmental impacts. Repeated missteps and project failures erode trust, threatening the industry's social license across jurisdictions. Worst of all, when budgets spiral, safety standards often slip—with tragic, even fatal, consequences. What should be a golden era of mine development is instead at risk of being defined by missed opportunities and preventable setbacks.

Hanging over successful project delivery strategies is the reality that mining projects are more complicated than they used to be. Just as oil and gas extraction has become more technically demanding, mining now often involves more complex metallurgy, higher altitudes, demanding risk profiles (especially around tailings and water management), and even more remote locations. Megaprojects stand at the knife's edge of being dragged down by their scale and complexity.

Compensating for the elevated project complexity requires miners and their partners to step up in new and unprecedented ways, to fix the long-running underperformance in capital project delivery. AlixPartners stands ready to help the sector turn this moment of challenge into an era of lasting achievement, with our team of seasoned professionals and a long track record of keeping things on the rails for safe, on-time, and on-budget project deliveries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]