- within Antitrust/Competition Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

The UK Hospitality Industry has suffered from innumerable cost pressures over the last decade. From post-Brexit labour shortages to resurgent cost inflation to hikes in employers' National Insurance Contributions ('NICs') and the National Minimum Wage ('NMW'). Each of these headwinds have squeezed profitability and driven up costs for the industry.

Most recently, employment regulations, namely increases to employers' NICs and the National Minimum Wage, as well as the looming Employment Rights Bill, have threatened to vastly increase employment costs for hospitality businesses.

As a labour-intensive industry, the recent changes to employment regulations will disproportionately affect hospitality. As such, businesses in the industry will need to look to optimise their labour force and find efficiencies to mitigate these cost pressures and improve profitability. As a group with deep industry knowledge and advisory experience, Ankura's Performance Improvement team is well positioned to support clients with solutions to these problems.

Ankura's Performance Improvement team leverages industry expertise to provide solutions to clients including private equity, lenders, and management teams. Using a data-driven approach, Ankura supports clients to deliver transformative solutions and to maximise profitability and cash flows.

What Are the Employment Regulatory Changes in the UK?

The key employment regulatory changes in the UK affecting the hospitality industry are the increases in employers' NICs and increases in National Minimum and Living wages announced by Chancellor of the Exchequer Rachel Reeves in the 2024 Autumn Budget. An additional impending regulation is the Employment Rights Bill introduced by the incoming Labour government in October 2024.

In April 2025, employers' NICs increased from 13.8% to 15%with the contribution threshold reducing from £9,100 to £5,000.

Employers' NICs are employment taxes that employers must pay on top of their employees' wages/salaries. Starting April 2025, the contribution that employers must make increased from 13.8% to 15%, and the threshold at which employers pay NICs has been reduced from £9,100 to £5,000.

To put this into practice, previously an employee earning £30,000 per annum would require no contribution to the first £9,100 earned, and therefore pay 13.8% on the remaining £20,900 equalling a contribution of c.£2,900.

Starting April 2025, the same employee earning £30,000 per annum would now require no contribution up to only £5,000, and the employer would now pay 15% on the remaining £25,000 equalling £3,750 or an increase of nearly £1,000 per employee (earning £30,000 per annum).

Also starting April 2025, the National Living and Minimum wages increased for all age groupsand by more than 16% for 16– to 20-year-olds.

The National Minimum Wage was introduced on April 1, 1999 — via the National Minimum Wage Act 1998 — as a flagship policy of the incoming Labour government. On April 1, 2016, the National Minimum Wage was supplemented by a National Living Wage — first for workers over 25, now extended to workers over 21.

From April 2025, the National Living Wage for workers over 21 went up from £11.44 to £12.21 — or 6.7%. This amounts to £1,400 per annum for a full-time worker according to the government.

The National Minimum Wage went up from £8.60 to £10 per hour (or 16%) for 18– to 20-year-olds and £6.40 to £7.55 an hour (or 18%) for 16- to 17-year-olds. According to the government, this amounts to a £2,500 increase for a full-time worker.

The impending Employment Rights Bill will potentially mark the end of zero-hour contracts in their current form.

The Employment Rights Bill was introduced to parliament by the Labour government in October 2024. Dubbed by Deputy Prime Minister Angela Rayner as a "landmark bill" that is a "once-in-a-generation chance to reshape the world of work", the Employment Rights Bill introduces various individual employment law reforms, including implementation of day one rights and the reform of zero-hour contracts.

As of June 2025, the bill is still currently progressing through Parliament with expected implementation starting in August 2026.

One of the key provisions under the bill is an obligation for employers to offer zero and low-hours workers a contract that reflects their actual working hours. Employers will be required to make a contract offer to eligible workers that reflects hours worked over a reference period — currently indicated as 12-weeks. However, this is unconfirmed and is subject to consultation.

What Are the Specific Impacts on the Hospitality Industry?

Labour costs are one of the largest cost lines on most hospitality businesses' profit and loss statements. As an example, hospitality businesses in the UK spend nearly a third of turnover on payroll costs, whilst, according to RSM the average UK hotel spends over 30% of revenues on payroll.

As such, the regulatory changes are likely to add substantial costs to hospitality businesses, who will also struggle to pass on these additional costs to consumers who are in the midst of a prolonged cost of living crisis from higher energy bills, mortgage rates, rental prices, and general consumer inflation.

The reduction in the NICs threshold will drag some part-time and casual employees into the employers' NICs threshold for the first time.

In terms of the increase to NICs for employers, one of the largest impacts is that some employees will now be dragged into the threshold for the first time after the threshold was reduced from £9,100 to £5,000.

UKHospitality, a trade body for the hospitality industry in the UK, estimated that a fifth of the hospitality industry's workforce will be dragged into the new employers' NICs threshold for the first time. As the hospitality industry employs a higher proportion of casual and part-time staff, this change in the threshold will hugely affect the industry, with UKHospitality estimating an additional c.800,000 workers will be dragged into the threshold.

However, the effects of the NICs increases are slightly mitigated by the fact that workers under 21 are generally not subject to employers' NICs, facing a much higher earnings threshold of £50,270 per year.

The increase in NLW/NMW will disproportionately affect the hospitality industryas a large employer of under 21s.

National Minimum Wage and National Living Wage increases are also likely to hugely affect the hospitality industry. As a disproportionately greater employer of 16 to 20-year-olds — especially in part-time positions — the 16-17% rise in hourly pay for these age groups will add significant labour cost pressures.

For example, the Institute for Fiscal Studies, a UK-based economics and policy research institute, estimates that workers aged 20 and under make up a quarter of all workers in the hospitality industry and that the combined effect on the NICs and NMW increases will add c.7.7% to employment costs in the industry, vs 6.4% across the economy.

Office for National Statistics (ONS) data appears to be beginning to show the effects of the NICs and NMW increases.

The combined effect of the NICs and NMW increases can already be seen in recent labour market statistics released by the ONS.

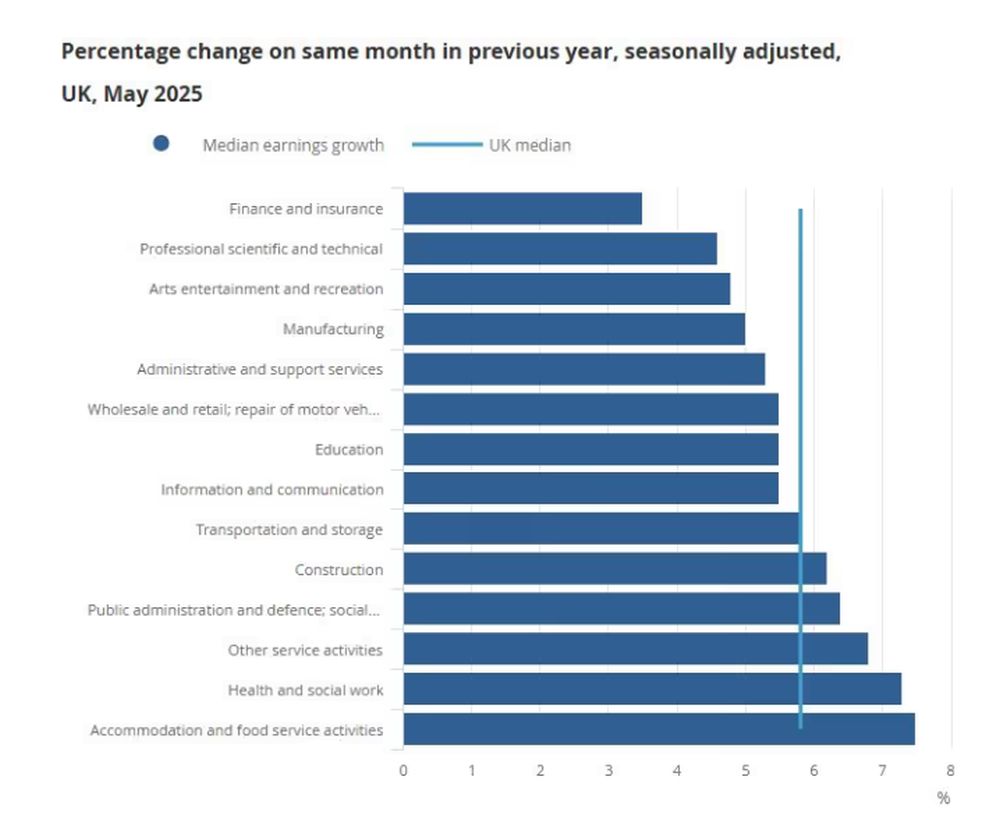

Figure 9. Office for National Statistics.

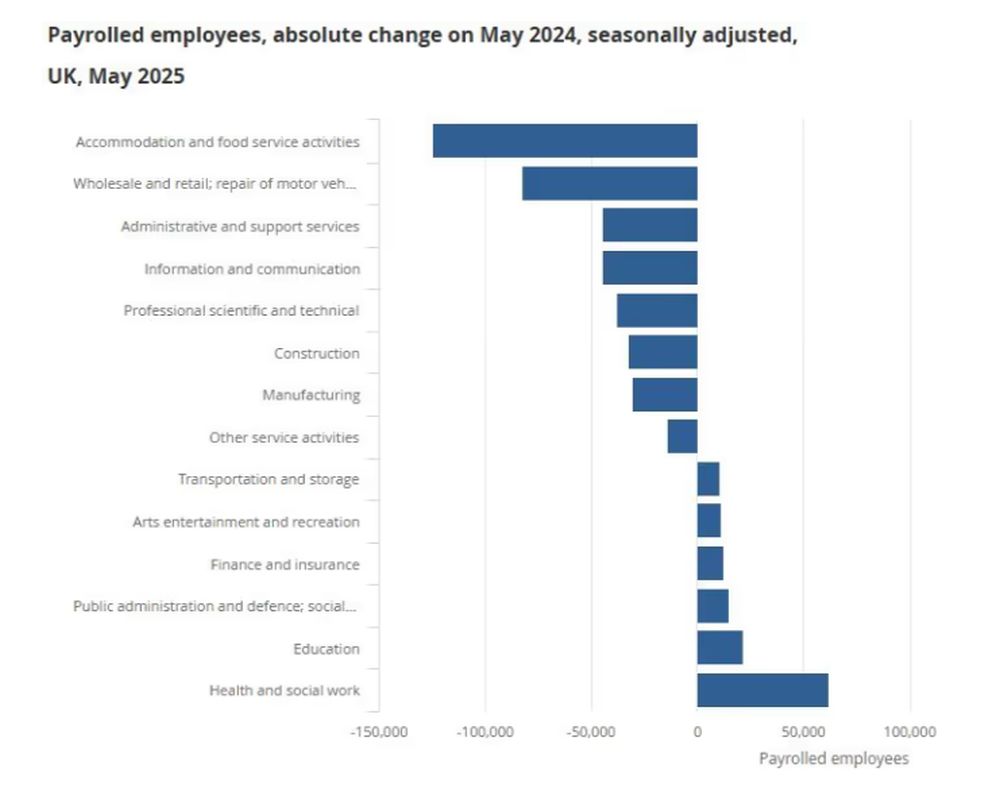

Figure 11. Office for National Statistics.

In May 2025, the accommodation and food services sector showed the largest year-on-year increase in median earnings and annual pay growth at 7.5% (partly showing the effects of the NLW/NMW increases). Concurrently, the accommodation and food services sector also showed the largest year-on-year fall in payrolled employees — with a reduction of 124,000 employees — suggesting that hospitality businesses appear to be shedding workers in light of increased costs.

What Can Hospitality Businesses Do to Mitigate Rising Costs and Improve Profitability?

Whilst the most obvious course of action for hospitality businesses in the light of increased labour costs is to — and has been to — simply cut payrolled staff and cut employee hours, this could be seen as only a temporary fix, given that global inflationary pressures and increased wage demands are likely to persist, which are compounded by annual government mandated increases to minimum and living wages.

Hospitality businesses must not solely aim to reduce payrolled staff and cut employee hours, but more importantly to improve the productivity — revenue per employee hour worked or drink/food items sold per employee hour worked as an example — of their labour force.

This could include increased use of data and technology to optimise scheduling, increased cross-training of staff and the streamlining/automating of tasks and processes.

For example, Greene King recently announced a £10 million investment in Workday, the human resources and payroll platform, for their 40,000 team members. According to the business, Workday will "help to streamline processes for line managers in its pubs and office" and provide "easy to understand reports and analytics to aid decision making." The business hopes the system will allow managers to spend less time on admin and more time improving customer experience. The business also directly comments on the Employment Rights Bill, claiming the system will allow them to "to adapt quickly to upcoming changes in employment law."

Conclusion

Hospitality businesses are hurting, and for good reason. After a tough half-decade with COVID-19, soaring inflation and depressed consumer confidence, the recent changes to employment regulations could not have come at a worse time for the industry.

The latest ONS data shows that hospitality businesses are already reacting to the regulations by cutting jobs, and, unfortunately, this trend is expected to continue.

Given these pressures, now is an opportune time for hospitality businesses to look at improving the productivity of their labour force to boost earnings and mitigate the squeeze on margins. Data and technology will be a key enabler in this respect, freeing up time for workers to focus on revenue-generating activities and reducing the size of workforce required to service customers. With our data-driven approach, Ankura's Performance Improvement team is well positioned to support clients in the hospitality industry to mitigate the pressures from rising costs and help to drive productivity within the labour force.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.