- within Transport, Media, Telecoms, IT, Entertainment and Tax topic(s)

- with Inhouse Counsel

- in Africa

- with readers working within the Law Firm industries

HSF Kramer view: a positive deregulation – expected to be leveraged by small and mid-cap companies initially as market practice develops; US securities law requirements continue to need to be addressed for larger offerings – we hope the markets adapt to take full advantage of the reforms over time to facilitate more 'undocumented' offerings.

When will a prospectus be required?

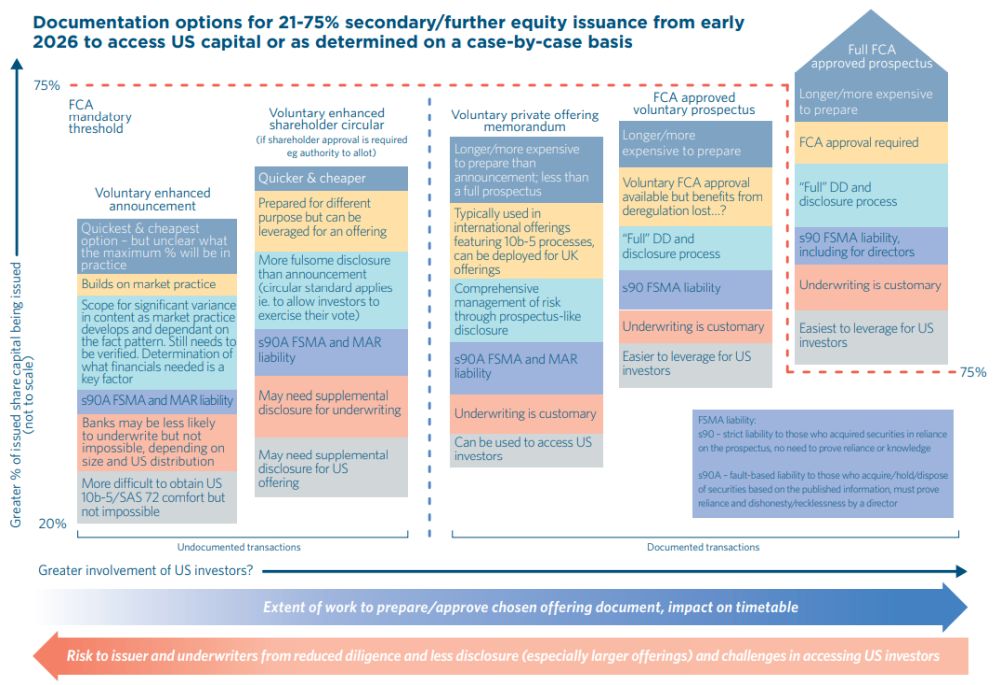

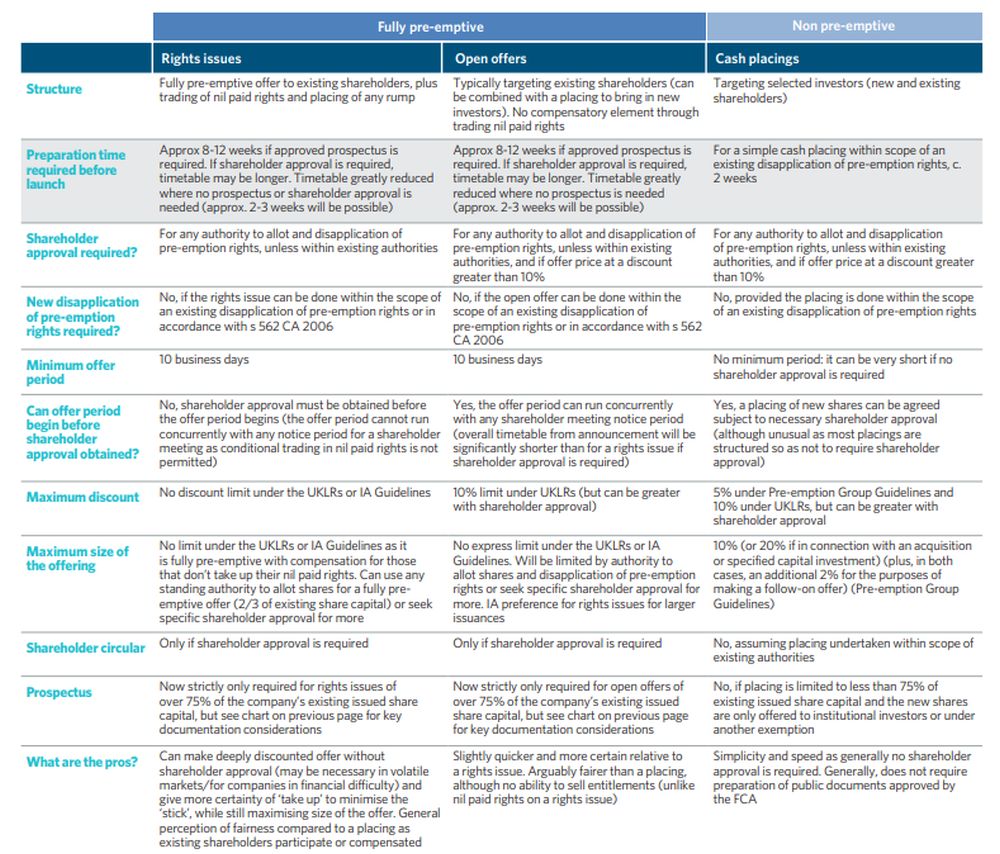

Prospectuses continue to be required for IPOs. The threshold for triggering the requirement for a prospectus on further share issuance to be increased from 20% to 75% of shares already admitted (and will no longer be a public offer requiring a prospectus). As the majority of offerings need to access a material number of US investors, it is essential to consider how to continue to access US capital and comply with US securities rules – see below for the options available to issuers – but the key takeaways are that the "documented vs. undocumented" decision, and which document to use below 75%, are very likely to be determined on a case-by-case basis going forwards.

Prospectus contents broadly the same

Overarching requirement for a prospectus to contain all "necessary information" retained for now. Prescribed content requirements largely unchanged and continue to be set out in detailed rule annexes as today.

Forward-looking statements easier to make

Distinct liability regime for "protected forward-looking statements" (PFLS) – now brought in line with ongoing listed company disclosures (ie a "recklessness" rather than "negligence" standard). PFLS can be financial or operational information that satisfies certain criteria (including profit forecasts), must be clearly demarcated, have certain disclaimers, and will need to be supported by the appropriate due diligence and accounting work on a case-by-case basis. This is a positive relaxation aimed at encouraging boards to put more forward-looking information out to market.

Rights issue timetable

It will be possible to execute a fully pre-emptive rights offer on an expedited timetable, where no shareholder approval or prospectus is required (ie. below 75%) – rights issues could be executed in 2-3 weeks, similar to a cash placing.

By comparison, under the new EU Listing Act, if an issuer has been listed for 18 months or more, a prospectus is not required on any further share issuances (irrespective of offer size), but an 11-page document must be published and filed with (but not approved by) the national competent authority. Many of the above issues will arise under this new EU regime.

Key considerations for UK listed companies and investment banks in choosing a documentation option

- No one-size-fits-all, will be highly fact specific

- Need to revise equity story and investor narrative

- Undocumented placings will require significant thought on the presentation of the equity story

- Size of offering

- Speed and cost of execution

- Risk appetite

- Managing liability for company and directors

- Involvement of US investors/shareholders

- Managing US liability for investment banks

- Need for updated financials or guidance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]