- within Tax topic(s)

- with readers working within the Accounting & Consultancy industries

- with readers working within the Accounting & Consultancy industries

- within Law Department Performance topic(s)

There are many reasons why individuals may decide to move to, or leave the UK tax year. Whilst complex, the SRT is designed to provide taxpayers with objective clarity on how they will be assessed by HMRC.

The SRT takes into account:

- The amount of time you spend and, where relevant, work in the UK

- The connections you have with the UK

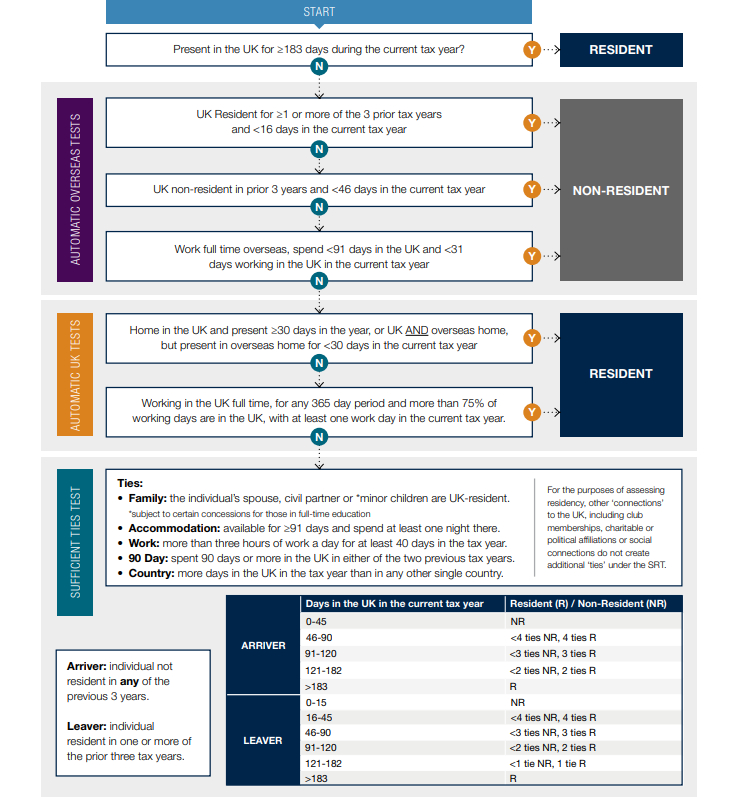

Under the SRT there are three tests to consider:

- Automatic Overseas Test

- Automatic UK Test

- Sufficient Ties Test

The tests are examined in order; if you meet the criteria for test 1 you don't need to continue, if you do not meet test 1 then you proceed to test 2 and so on.

Each test is based on factors tying the taxpayer to the UK. Whilst for tests 1 and 2 this mainly involves counting 'days' of presence in the UK during a tax year, test 3 is based upon a number of factors. Where a taxpayer is present in the UK 183 days or more in a tax year, they are automatically deemed resident and these is no need to apply the rest of the residency tests.

What is a 'day' in the UK?

A 'day' for the SRT is considered a day in which the taxpayer is present in the UK at midnight. If you have left before the end of the day it does not count as a day of UK presence (unless you are caught under the deeming rule).

Split year

In certain circumstances, the tax year can be split, with the individual being UK resident for part of the year and non-UK resident for the remainder. Split year treatment is available to individuals arriving in, or leaving from, the UK in a particular tax year. We would always recommend that further advice is sought on when the year is split as part of pre-entry and exit tax planning.

It is possible for an individual to be resident in more than one jurisdiction during the year. Where this is applicable the taxpayer may be able to look to claim under a tax treaty to determine their residency position. Tax treaties are a complex area of tax, so again it is always recommended that advice is obtained.

Work

For the purposes of the SRT, the physical location of where activities are undertaken is key in assessing where an individual is working. HMRC adopt a broad interpretation of what constitutes work, and advice should always be sought where this is relevant to assessing residence.

Statutory Residence Test flowchart

An individual's residence status for UK tax is determined using the statutory residence test (SRT).

The SRT flowchart is designed to assist individuals in determining their residence status. In particular, the flowchart gives only an indication of residence and should not under any circumstances be relied upon to determine UK residence status.

Originally published 25 July, 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.