- within Insolvency/Bankruptcy/Re-Structuring and Strategy topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Banking & Credit, Healthcare and Law Firm industries

The first two quarters of M&A activity in 2025 have not achieved the banner-year levels that many predicted; however, amid the uncertainty, there is still room for optimism for a strong dealmaking environment to finish out the year. We examine cross-border deal flows at the half-year mark to provide insight into how tariffs and other trade developments continue to shape the market sentiment—and the factors hanging in the balance that could tip in favor of a more robust deal environment for the remainder of 2025.

U.S. M&A deal environment

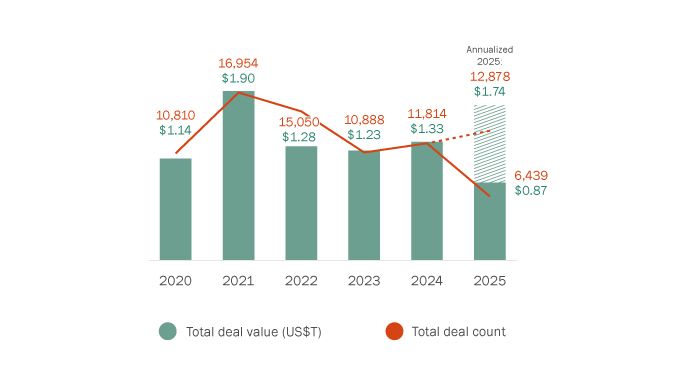

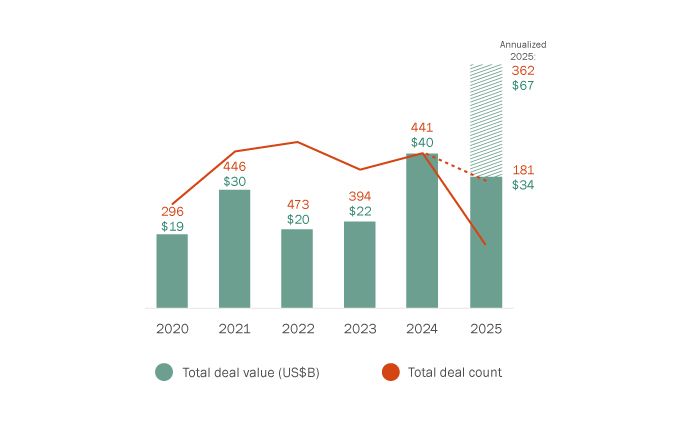

The picture of U.S. M&A deals remains mixed halfway into the year, with combined global and domestic investment into U.S. targets showing signs of a slowdown (see Figure 1), as ongoing geopolitical volatility has had a chilling effect on dealmaking in what was anticipated to be a comeback year for transactions. It comes as no surprise that many dealmakers have opted for a wait-and-see approach amid the flurry of U.S. tariff announcements and the many subsequent pauses, adjustments and retaliatory measures rolled out over the course of the last few months. Dealmakers have also been impacted by stubbornly high U.S. interest rates, as well as by uncertainty regarding the Trump administration's approach to antitrust enforcement.

That said, there are signs of life for deals involving U.S. targets. U.S. domestic annualized deal value is projected to rise moderately from $1.31 trillion in 2024 to $1.46 trillion in 2025 (see Figure 2), driven in part by high activity levels in transactions exceeding $1 billion. This year is also currently on track for a significant 29% YoY increase in deal value, though a more moderate a 5% YoY increase in deal count for transactions involving U.S. acquirers of U.S. targets (see Figure 2).

Figure 1: Deal value and count (any acquirer of U.S. target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Figure 2: Deal value and count (U.S. acquirer of U.S. target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Even as many deals remain paused, megadeals (with a value greater than $1 billion) have sustained forward momentum. Whether these megadeals represent a long tail of deals conceived in late 2024 or an optimistic indicator for 2025 remains to be seen. The aggregate value of the 10 largest announced deals accounted for around 34% of total deal value in the first half of 2025, with the largest transaction valued at $39 billion (Sycamore Partners' planned acquisition of Walgreens). Other notable announced transactions include Charter Communications' acquisition of Cox Communications for $34.5 billion and Alphabet Inc.'s acquisition of Wiz Inc. for $32 billion.

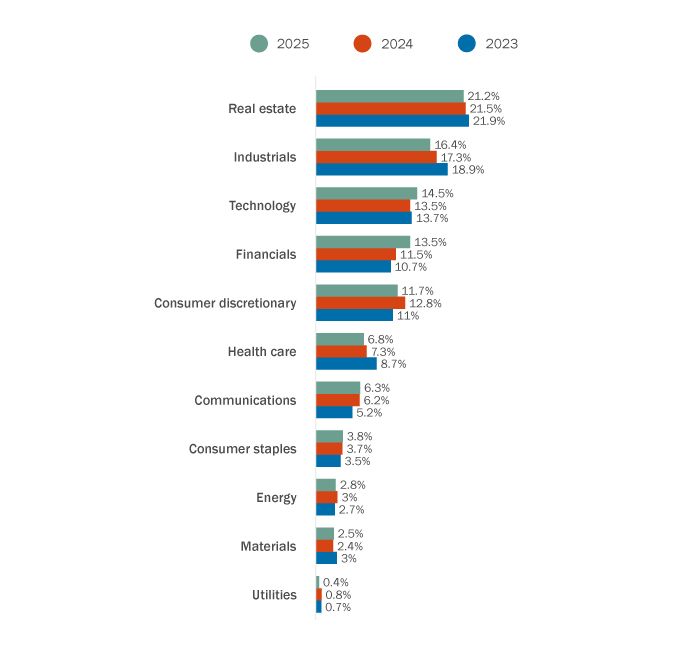

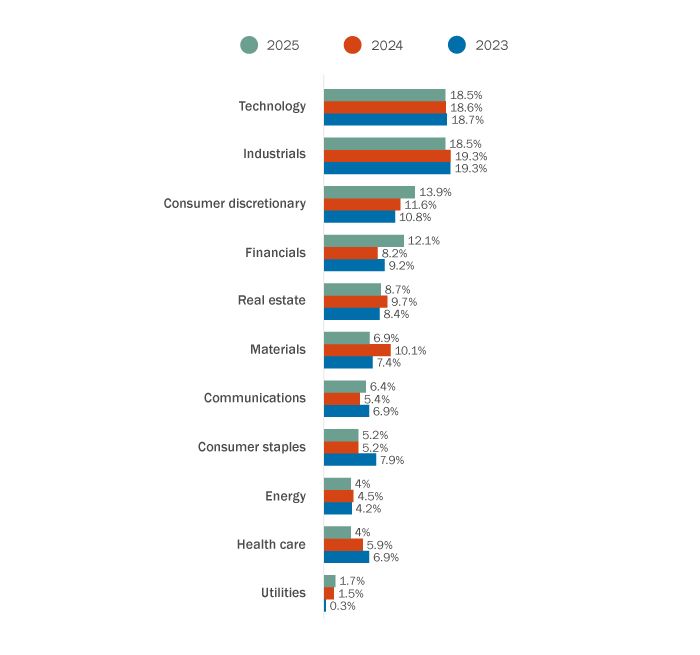

In terms of sector-focus, U.S. acquirers are finding opportunities in real estate, which is the top sector by deal count YTD (see Figure 3). New alternative real estate asset classes have increased M&A activity in recent years1, while more traditional real estate assets (e.g., housing and offices) remain tied, in part, to the outcome of interest rates and the knock-on effects from tariffs on construction costs, supply and valuations. However, real estate's intersection with digital infrastructure (e.g., data centers, cables and energy-generating facilities) has helped fuel some of 2024's megadeals, including the $16 billion acquisition of AirTrunk by Blackstone2, and show signs of sustained growth for 2025. Technology also continues to be a bright spot as investors remain engaged in cloud computing, AI-enhanced software and cybersecurity, among other assets in the tech sector tied to the AI boom. The market expectations for this sector remain high and will likely continue to be a focus of investment for the remainder of the year, as exemplified by xAI's acquisition of X Corp. for $33 billion in March.

Figure 3: Target industry breakdown (U.S. acquirer of U.S. target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Global deal flows

Investment from Canada into the U.S.

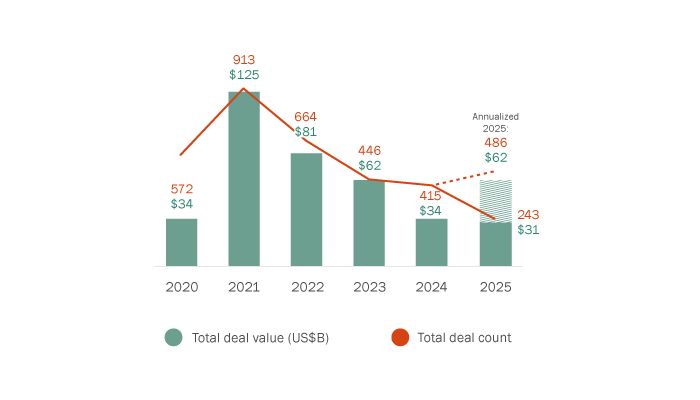

U.S. inbound investment from Canada seems unlikely to return to high-water marks of 2021 and 2022; however, based on the projected annualized deal value of $62 billion, it appears that 2025 may prove to be a modest improvement over last year's weak performance. The continued slowdown of Canadian investment to the U.S. from 2023 and 2024 is emblematic of the larger themes of uncertainty in global trade relations as well as the particular uncertainties in U.S.-Canada trade relations. On the other hand, the promise of a potential U.S.-Canada trade deal (following the rescission of Canada's planned digital services tax) could alleviate uncertainty for Canadian investors in the U.S. and encourage M&A activity.

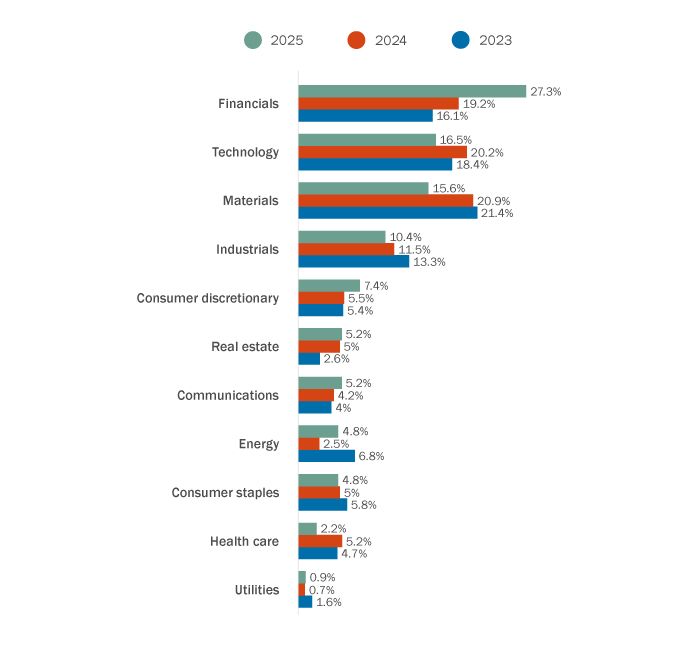

While deal volume remains low in most sectors after years of high inflation and financing challenges, we continue to see Canadian acquirers look to the U.S. for opportunities, with a moderate uptick in the proportion of deals valued over $1 billion and those valued between $100 million and $500 million compared to last year. In particular, Canadian acquirers in the financial sector have accounted for the greatest proportion of U.S.-inbound deals announced YTD, which are up 8% this year compared to the proportion of deals announced in 2024 (see Figure 5). The share of deals from energy acquirers has also seen a modest increase (3% over 2024), which may reflect a renewed focus on energy security acquisitions, such as Keyera Corp.'s deal to buy the Canadian natural gas liquids business of the U.S. firm Plains, announced in June3. Conversely, the share of deals by Canadian acquirers in the materials sector is down 5% from last year, likely due to the sector's vulnerability to the whipsawing of U.S. tariffs and retaliatory measures worldwide. Even before the most recent announcement of 35% tariffs on Canadian goods, U.S. tariff rates in 2025 have been at their highest levels since 19394, continuing to burden businesses with international supply chains.

Figure 4: Deal value and count (Canadian acquirers of U.S. target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Figure 5: Acquirer industry breakdown (Canadian acquirers of U.S. targets)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Investment from the U.S. into Canada

The current geopolitical environment is having a significant impact on deals into Canada. Deal activity from the U.S. into Canada appears to be softening following a stronger year in 2024, with annualized deal count projected to reach 362 deals, down from last year's 441 deals (see Figure 6). Adding to the chilling effect, the Canadian government updated its Guidelines on the National Security Review of Investments to consider, when reviewing foreign investment into Canada, the potential of the investment to undermine Canada's economic security through the enhanced integration of the Canadian business with the economy of a foreign state.

That said, deal value is expected to outpace last year at a projected $67 billion (compared to $40 billion in 2024). This points to a shift from last year for U.S. buyers of Canadian assets, who are focusing on larger M&A deals. For example, Sunoco's planned $9 billion acquisition of Parkland Corp is the largest announced deal involving a U.S. acquirer and a Canadian target since 2020. Transactions in the financial sector have grown significantly (see Figure 7), likely bolstered by steadying inflation rates as the Bank of Canada maintains its target interest rate at 2.75%5. Industrials are down somewhat but retain their status over the last three years as a top target industry. Notwithstanding tariff risk, industrials' strong earnings and tailwinds from infrastructure activity suggest that this sector will continue to remain of interest for U.S. acquirers.

Figure 6: Deal value and count (U.S. acquirer of Canadian target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Figure 7: Industry breakdown (U.S. acquirer of Canadian target)

Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

Spotlight on Japan

Japan has gained significant traction on the global M&A stage in the last several years. Market reforms and shareholder activism aimed at increasing shareholder value have led to increased Japanese investment into North America. Annualized deal value for Japanese acquirers of U.S. and Canadian targets is up so far in 2025 (by 43% for Canadian targets in particular)6. Canada's consumer discretionary, materials and consumer staples are the top target for Japanese investors, with a focus on smaller transactions (less than $100 million). Investment from Japan into Canada is further supported by the two countries' collaboration on the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which eliminates or reduces tariffs on most key Canadian exports to Japan, including for agriculture, seafood, forestry, and metals and mineral products7.

Conclusion

While 2025 has so far not met market expectations, there have been improvements over 2024 and dealmaking may rebound further depending on how several issues play out, including tariff policies, inflation rates and overall market sentiment. Buyers and sellers may adjust their playbooks once again as countries, including Canada, continue to negotiate trade deals with the United States8. If tariff and trade tensions settle, investors may be able to more precisely make the assessments they need to get deals over the finish line, with the possibility of increased activity towards the year's end.

Footnotes

1. See PwC, "Global M&A Trends in Real Estate", (June 24, 2025).

2. See Blackstone, "Blackstone Announces Agreement to Acquire AirTrunk in a A$24B Transaction", (September 4, 2024).

3. See BNN Bloomberg, "Keyera says $5.15 billion deal to buy Plains' Canadian business to help energy security", (June 17, 2025).

4. See EY, "US economic outlook May 2025", (June 20, 2025).

5. Bank of Canada, "Policy interest rate", (June 4, 2025).

6. Source: Bloomberg. Based on M&A deals announced during Jan 1, 2020 - June 30, 2025. Excludes terminated and withdrawn deals.

7. See Government of Canada, "Canada-Japan relations", (June 7, 2025).

8. The Financial Post, "Where does Canada stand as Trump's tariff deadlines loom", (July 8, 2025).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.