- with readers working within the Business & Consumer Services industries

- within Privacy, Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

ASIC recently suspended an Australian Financial Service Licence (AFSL) as the entity had not been carrying on a financial services business since June 2024, when the entity was sold to new owners and the shareholders and directors were replaced. In addition to changes to the ownership of the licensee, the Responsible Managers and Key Person listed on the AFSL were not involved with the AFSL after the sale.

Change of control

Over the course of a business life cycle, change in ownership and business direction can occur. Where the entity being transferred or sold holds an AFSL or Australian Credit Licence, there are important compliance obligations related to the licence that the entity must continue to comply with, at all times.

One of the obligations is to notify ASIC of the change of control. A change of control doesn't need ASIC approval before it is implemented. However it is possible that after receiving notification, ASIC may then conduct further surveillance to determine whether the licensee is complying with its general obligations and take any regulatory action it considers appropriate, such as using its power to suspend or cancel the licence on grounds such as:

- the entity ceased to carry on a financial services business or engage in credit activities; and/or

- the entity failed to comply with (or is likely to contravene) their general obligations as a licensee.

What does this mean for new owners of AFSLs or credit licences?

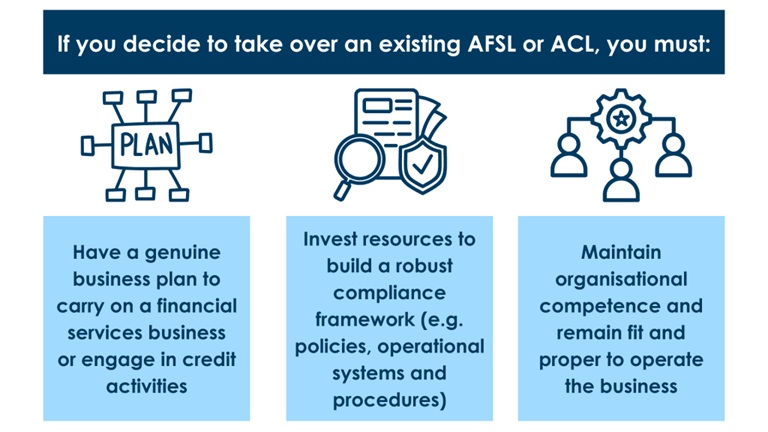

New owners who acquire an entity that holds an AFSL or credit licence need to invest resources to meet compliance obligations and ensure there is:

- a genuine business plan to carry on a financial services business or engage in credit activities in accordance with the authorisations on the licence. The business should not stay inactive or dormant for an extended period of time; and

- a robust compliance framework to ensure the licensee is complying with its obligations and licence conditions, including having fit and proper people (such as Responsible Managers) who are familiar with compliance processes and regulatory requirements.

Key aspects of a robust compliance framework include (but are not limited to):

- maintaining organisational competence - Responsible Managers should be involved in the licensee's business, unless they have ceased their role with the licensee and ASIC has been notified of their cessation;

- implementing and reviewing compliance policies and systems to ensure they remain fit for the business; and

- ensuring the licensee remains compliant with its compliance and financial requirements, audit and regulatory lodgements (including notifying ASIC of a change of control).

What does this mean for Responsible Managers?

Responsible Managers who continue with a licensee following a change of ownership must remember they are responsible for the significant day-to-day decisions about the ongoing provision of financial or credit services by the licensee. Therefore, Responsible Managers should assist the new owners to recommence business operations in compliance with regulatory requirements as soon as possible.

Inactivity can represent a significant risk to Responsible Managers. Firstly, Responsible Managers will be implicated if ASIC decides to look into the licensee for inactivity. Secondly, experience accrued under an inactive licensee could affect the Responsible Manager's suitability if they wish to support a licence application for another business in the future.

Sophie Grace has experience assisting licensees with a change of control and ongoing compliance services for newly acquired licenses. If you have any questions, please contact us.

Further Reading

- ASIC suspends AFS licence following change of ownership

- ASIC suspends retail OTC derivative licence after change of control

- Statutory inquiry into ASIC, the Takeovers Panel and the Corporations Legislation: ASIC Licence Transfers (July 2023)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.