- within Corporate/Commercial Law topic(s)

- with Inhouse Counsel

- with readers working within the Banking & Credit industries

ASIC has recently issued warnings to 18 social media influencers-commonly known as "finfluencers"-for providing unlicensed financial advice and promoting high-risk financial products without appropriate licensing. These actions were part of a coordinated Global Week of Action Against Unlawful Finfluencers, involving nine international regulators, including those from Canada, Hong Kong, Italy, the United Arab Emirates, and the United Kingdom.

ASIC is keeping a close eye on social media influencers especially where they suspect they are breaching of Corporations Act in relation to unlicensed conduct or misleading and deceptive conduct.

Section 911A of the Corporations Act provides that it is an offence to carry on a financial service without holding an Australian Financial Services Licence (AFSL) unless you are authorised as a representative or an exemption applies. This provision imposes significant civil and criminal penalties, including up to five years' imprisonment for an individual and major fines for body corporates.

ASIC can take enforcement action against such breaches by issuing stop orders, enforceable undertakings, or seeking injunctions, where it is in the public interest to do so.

A notable case:

In December 2022, the Federal Court found that "finfluencer" Tyson Robert Scholz (@ASXWOLF_TS) contravened s911A of the Corporations Act. In April 2023, the Federal Court handed down permanent injunctions against Mr Scholz.

The case against Mr Scholz shows how seriously ASIC takes its position on finfluencers. Anyone posting financial commentary on social media or online must be aware of the licensing requirements and position themselves either as financial product advice providers who are appropriately licensed or limit their information to factual information only.

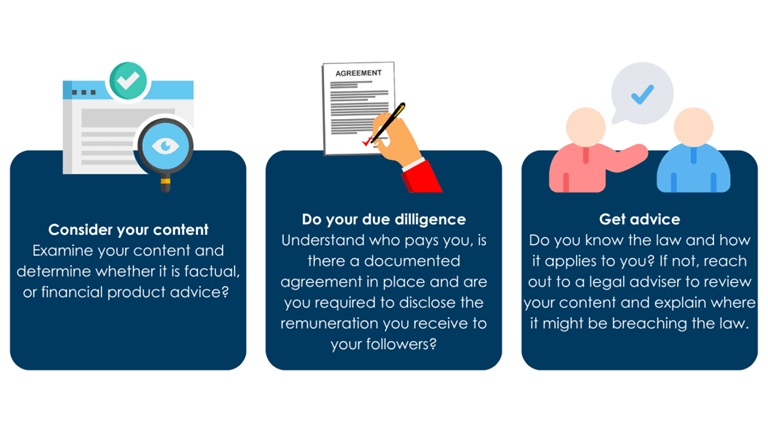

If you are a finfluencer, you should consider the following:

- Examine your content and determine whether it is factual, or financial product advice?

- Does your content breach other consumer protections, such as the prohibition on misleading and deceptive conduct and/or representations?

- If you do not want to be authorised in Australia, consider switching off all marketing activities targeting Australian consumers or putting in place disclaimers limiting your services to consumers outside the Australian jurisdiction;

- Ensure you are familiar with your local financial services laws relating to finfluencers or their equivalent;

- Get advice - do you know the law and how it applies to you? If not, reach out to a legal adviser to review your content and explain where it might be breaching the law.

- Do your due diligence - understand who pays you, is there a documented agreement in place and are you required to disclose the remuneration you receive to your followers?

If you are unsure of your obligations or require assistance to get yourself licensed, please do not hesitate to reach out to us.

More information:

- ASIC Information Sheet 269 (INFO 269)

- ASIC cracks down on unlawful finfluencers in global push against misconduct

- The Rise of the Finfluencer - What are they and do they need to be regulated?

- ASIC Actions Against Finfluencers

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.