- within Corporate/Commercial Law topic(s)

- with readers working within the Retail & Leisure industries

How delivery platforms are reshaping quick service restaurants, and what leaders must do now

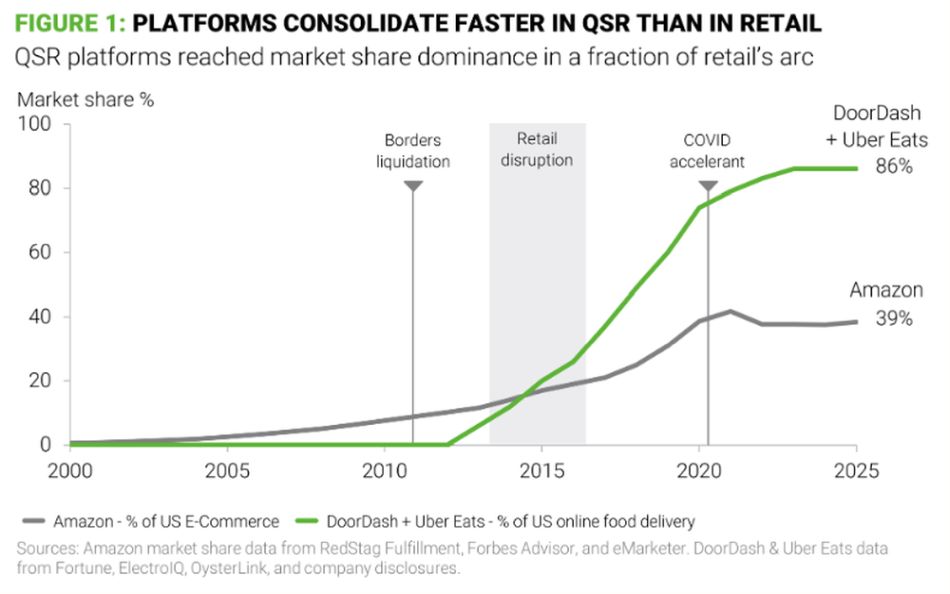

DoorDash and Uber Eats now control 85 percent of U.S. online

food delivery. At many QSR chains, third-party orders represent 20

to 30 percent of sales, a share that keeps growing even as traffic

softens and steep discounting compresses profitability. That

dependence extracts a toll: commissions squeeze margin while

customer data flows to the platform rather than the restaurant.

Aggregators have become too big to ignore, too costly to embrace

fully, and too entrenched to negotiate on equal terms.

Retail faced this moment a decade ago. When Borders outsourced

its online bookstore to Amazon in 2001, the decision seemed

logical. E-commerce was a fraction of total revenue. By 2015,

Borders was gone, and Amazon was on the agenda of every retail

board meeting. The math had become punishing: walking away from the

platform meant losing access to a growing share of demand but

staying meant funding a competitor's expansion. The risk was

not e-commerce itself, but ceding customer ownership, economics,

and execution control to a platform at the same moment it became

central to demand.

Sit in any QSR management meeting today and the parallels are

clear, but so is a crucial difference. It took Amazon 15 years to

capture 40 percent of U.S. e-commerce, while DoorDash and Uber Eats

consolidated the US online delivery market nearly twice as fast.

The window for response is narrower.

Platforms have already reshaped the industry. The question is which brands will act before the window closes.

Reclaiming control

The brands gaining ground are making choices that run counter to

conventional industry thinking. Three deliberate moves across

operations, marketing, and store portfolio are proving most

effective.

Operations: Own the peaks

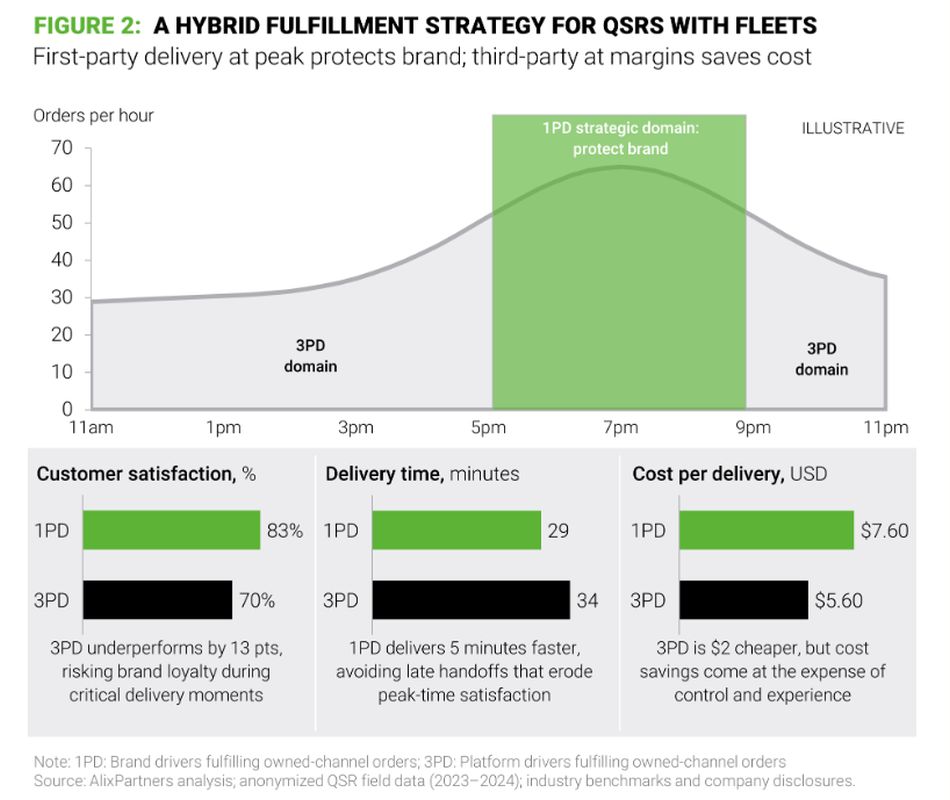

Platforms now offer white-label fulfillment. DoorDash Drive and

Uber Direct let restaurants outsource delivery even for orders

placed through their own apps, dispatching gig drivers on the

brand's behalf. The model appears sound: variable costs, no

driver management, no fleet overhead.

The reality is more complicated. Third-party drivers work

multiple apps, chasing the best payouts. When dinner rush coincides

with surge pricing elsewhere, orders sit. AlixPartners'

analysis finds aggregator-fulfilled orders arrive five minutes

slower than first-party deliveries during peak windows, with

satisfaction scores 13 points lower.

For QSRs such as large pizza chains with dedicated fleets, the

strategic question is how to balance cost and control. Third-party

delivery costs roughly $2 less per order, a meaningful margin

advantage. Yet that savings erodes quickly if applied

indiscriminately, given peak periods are when brand reputation is

built or lost. The answer for most brands is a hybrid model:

first-party delivery at peak times to protect customer experience,

third-party delivery at non-peak to protect cost.

Domino's represents one extreme: first-party fulfillment for

all orders, regardless of origin or order time. When it partnered

with Uber Eats and DoorDash, it negotiated terms ensuring

Domino's drivers fulfill every delivery. The platforms provide

incremental demand; Domino's maintain operational

control.

Of course, not every brand has or needs Domino's delivery

infrastructure. For those fully reliant on third-party delivery,

the principle is the same even if the levers differ: kitchen

throughput, order accuracy, and handoff speed determine whether the

brand experience survives the last mile during peak times. A

perfectly staged order gives even a gig driver the best chance to

deliver on the brand promise.

Own the peaks, outsource the margins, and never cede control of the brand-defining moments.

Marketing: Reclaim the relationship

QSR marketing leaders often describe aggregator promotions as

"easy money" because platform visibility and order count

tend to move in tandem. But there is a critical distinction:

platform marketing is promotional spending, not brand-building.

Every dollar spent on a platform discount or placement fee further

dilutes margin on already thin orders, while doing nothing to build

the affinity that platforms are eroding.

The trap is self-reinforcing. The more a brand spends on

platform promotions, the more customers learn to find and order

through the aggregator. Over time, the relationship transfers from

the brand to the platform, and unwinding that dependency becomes

increasingly expensive.

The window may be narrower than expected: AlixPartners'

Restaurant Consumer Outlook shows that loyalty program influence,

after a decade of steady growth, has flattened in 2025.

Points-based programs alone are no longer sufficient to overcome

platform convenience.

The brands building durable positions are shifting investment

toward first-party channels: innovative loyalty programs,

app-exclusive offers, and direct engagement. Chipotle grew its

loyalty program from 8 million in 2019 to 40 million members in

2023 by making rewards exclusive to direct ordering. The goal is

not to abandon aggregators but to treat them as

customer-acquisition channels, with a deliberate path back to owned

relationships that protect margins and brand equity.

Store portfolio: Toward a healthy fleet

The benefits of location and dense physical store coverage have

diminished in a delivery-dominated environment that has steadily

taken share from walk-ins and drive-throughs.

What matters now is a healthy fleet that can consistently

execute. In our experience, top-quartile stores in a typical QSR

system generate three to four times the contribution margin of

bottom-quartile locations, yet development teams often treat the

portfolio as undifferentiated, spreading investment across

performers and laggards alike.

The most effective franchisors we advise are rethinking

development strategies by segmenting stores into distinct cohorts

and developing tailored action plans for each: targeted investment

for high performers, operational interventions for fixable

underperformers, and proactive exit strategies for locations that

cannot be turned around. For some brands, this means shrinking

before growing, a difficult message for boards accustomed to

unit-count growth as the headline metric.

A smaller, healthier fleet creates compounding advantages: it

attracts stronger franchisees who see a system that values

profitability over vanity metrics, it appeals to capital market

investors increasingly focused on unit economics rather than store

counts, and it generates the store-level cash flow needed to invest

in digital capabilities that will define competitive advantage in

the years ahead.

The window is open

Retail's Amazon moment produced clear winners and losers,

and the difference was timing. Brands that recognized the threat

early and invested in transformation survived and in some cases

thrived. Those that waited became cautionary tales swept up as

Amazon expanded to control roughly 40 percent of U.S.

e-commerce.

QSRs can learn from that history. Brands that maintain control

of the brand experience, build direct customer relationships, and

optimize fleets for profitability will create separation that

compounds over time.

Industry shifts are decided at such inflection points, before momentum becomes irreversible. For QSR, that time is now.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]