- within Food, Drugs, Healthcare, Life Sciences, Law Department Performance and Compliance topic(s)

- in United States

- with readers working within the Banking & Credit industries

1. What are the headlines?

- In February 2025, the European Commission introduced an Omnibus Package of proposed changes to a number of the flagship EU sustainability regulations, in particular impacting sustainability-related reporting and due diligence obligations. In this Briefing, we summarize the important points for companies to be aware of: condensing a significant number of interconnected developments into key Q&As.

- For large EU undertakings, the original EU Corporate Sustainability Reporting Directive ("CSRD") reporting deadlines have formally been postponed by two years to 1 January 2027. For companies already reporting under CSRD, or non-EU parent companies, reporting deadlines have not been delayed. However, in July 2025, the Commission published a new "quick fix" delegated regulation to reduce additional phased-in reporting requirements for the first wave companies that are already reporting. This will provide some short term clarity during the transitional period, before the Omnibus Package is finalized.

- The transposition date for the original EU Corporate Sustainability Due Diligence Directive ("CSDDD") has formally been postponed by one year to July 2027, which pushes back the first reporting date under CSDDD to July 2028. It may be postponed by a further year pursuant to the latest Council Proposal (defined below).

- Whilst (most) timing changes have been approved, scoping and substantive changes to CSRD and CSDDD obligations continue to be negotiated as part of the European legislative process. All proposals indicate that scoping thresholds are likely to rise and result in significantly fewer companies in scope of the CSRD and CSDDD obligations.

- In terms of sustainability disclosures, the proposed amendments would reduce the number of specific disclosures required and increase consistency between international sustainability-related frameworks.

- Due diligence obligations are due to be scaled back in various ways, in particular to focus on reporting on direct business partners above a certain threshold.

- In June 2025, the Council of the European Union (the "Council") published its agreed position on the Omnibus Simplification Directive (defined below), as negotiated between the governments of Member States (the "Council Proposal"). The Council Proposal will be negotiated with the European Parliament, once the latter reaches its own negotiating position, with a view to reaching a final agreement.

- In total, the legislative process is expected to take 12 to 18 months.

- Overall, this fast moving landscape requires close monitoring given the real impact on companies (public and private, which could include PE portfolio companies) in terms of processes, resources, systems and preparation.

2. What is the Omnibus Sustainability Package?

On 26 February 2025, the European Commission (the "Commission" or "EC") published its "Omnibus Package": a set of legislative proposals aimed principally at scaling back and postponing sustainability reporting and sustainabilityrelated supply chain due diligence obligations under specific legislation, including (i) the CSRD; (ii) the CSDDD; (iii) the EU Taxonomy Regulation; and (iv) the EU Carbon Border Adjustment Mechanism ("CBAM").

The Omnibus Package included two separate proposals: one on timing, aiming to delay certain reporting deadlines for CSRD and transposition deadlines for CSDDD (the "Omnibus Stop the Clock Directive"); the other proposing amendments to the specific requirements of the legislation in scope (the "Omnibus Simplification Directive" or the "Commission Proposal").

The Omnibus Stop the Clock Directive moved quickly through the legislative process, with no changes to the proposed text, largely because of the interim uncertainty on timing and deadlines. It was published in the Official Journal in April 2025 and needs to be transposed by Member States by 31 December 2025.

The Omnibus Simplification Directive is more detailed and reflects changes to scoping thresholds and substantive obligations. The Council Proposal builds on and revises the Commission Proposal, introducing new thresholds further discussed in Q&A 4 and 5 below.

3. Why has the EU decided to simplify sustainability reporting?

The Omnibus Package aims to, on the one hand, reduce regulatory complexity, compliance costs and administrative burdens and, on the other hand, encourage investment and growth within the EU. In the accompanying press release, the Commission says that the Omnibus amendments are estimated to reduce administrative costs by more than EUR 6BN

The proposals (or a version of them) had been expected since November 2024, following indications from EC President Ursula von der Leyen. They also relate to the analysis provided in the "Future of European Competitiveness" report, published by Mario Draghi, former President of the European Central Bank, in September 2024. That report called out "red tape", "compliance costs" and "regulatory burden" as some of the main challenges for innovation and growth in the EU and discussed concerns arising from sustainability-related requirements, including the CSRD and CSDDD.

In addition to cutting red tape, the Omnibus Package signals increased efforts to improve European competitiveness as recommended in the Draghi Report and to boost investment in the EU, including through proposed amendments to the InvestEU Regulation and the Regulation on the European Fund for Strategic Investments ("EFSI Regulation"), as well as The Clean Industrial Deal, which were announced at the same time. Together, they are indicative of the Commission's shift toward balancing sustainability with industrial competitiveness and pragmatism. While the EU Green Deal initially emphasised strict environmental targets, the wider investment program prioritises reducing regulatory burdens, streamlining approval processes and supporting low-carbon industrial investment to keep the EU globally competitive.

The Omnibus amendments also follow a series of postponements and delays in the application of sustainabilityrelated regulation, including for the EU Deforestation Regulation ("EUDR") (implementation postponed by a year to December 2025 with various updated guidance and delegated regulations published so far this year, as well as several Member State proposals to further simplify the regulation); the proposed EU Green Claims Directive (which was expected to be approved in 2024, but is delayed); and expected reforms to the EU Sustainable Finance Disclosure Regulation ("SFDR"), on which also see Q&A 8.

4. How does the Omnibus Package affect CSRD reporting?

TIMING

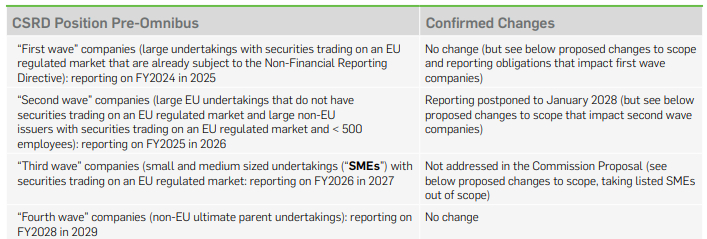

The Omnibus Stop the Clock Directive confirmed the following changes to reporting deadlines. These changes need to be transposed by Member States by 31 December 2025.

As referred to and linked in Q&A 1, in July 2025, the EC published a new "quick fix" delegated regulation to the first set of European Sustainability Reporting Standards ("ESRS"), which reduces the additional phased-in reporting requirements for first wave companies that have already reported their 2024 data and are obliged to report again for FY2025 and FY2026. See Q&A 10 below for further information. Pursuant to the main Omnibus Package, and, as shown in the tables above and below, from FY2027, many of these first wave / prior reporting companies may be descoped entirely and those that do report again are likely to do so against further reduced reporting requirements.

Second wave companies now have extra time to prepare their reports and should await further detail regarding simplified disclosure requirements. In addition, under the Council Proposal, Member States are given the power to waive reporting requirements for companies until 31 December 2026. This could mean that first wave companies are entirely exempt from reporting until 1 January 2027, when they will report with other in-scope companies.

SCOPING

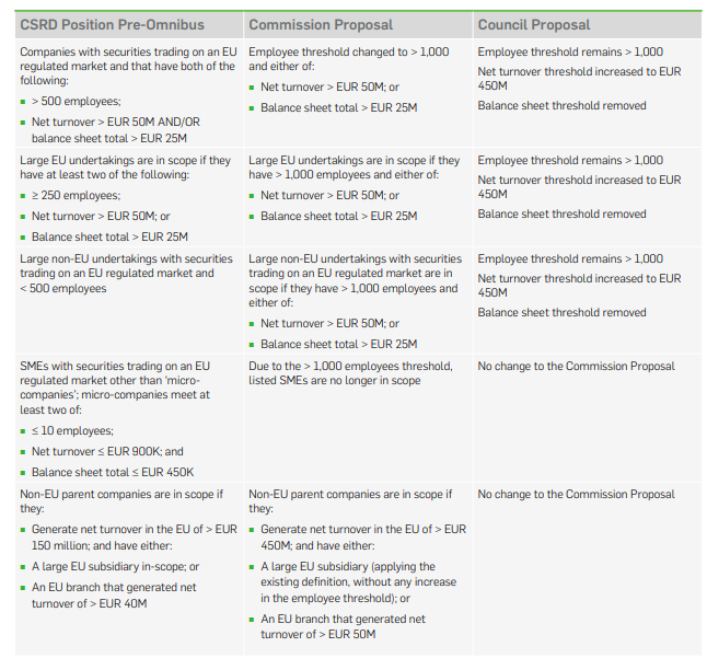

The number of companies in scope of CSRD was reduced by the Commission Proposal and further amended by the Council Proposal. The Commission Proposal and Council Proposal align on raising the employee threshold to over 1,000 employees, however the Council Proposal increases the EU net turnover threshold to EUR 450M (up from EUR 50M in the Commission Proposal). Note that the Council Proposal also removes the requirement of having a balance sheet total threshold.

SIMPLIFICATIONS

The Omnibus Simplification Directive proposes various changes to CSRD reporting requirements:

- Simplification of the EU ESRS. The Commission intends to reduce the number of data points required to be disclosed pursuant to the ESRS by removing those that are deemed to be less important and prioritising quantitative data. These changes are due to be adopted within six months of the entry into force of the Omnibus Simplification Directive. In June 2025, EFRAG (previously known as the European Financial Reporting Advisory Group) published a Progress Report on its work to simplify and streamline the ESRS, stating that it is working to reach a 50+ per cent reduction in the number of mandatory datapoints, including to simplify double materiality assessments (also see below). These changes to the ESRS are separate from the "quick fix" simplifications for first wave companies addressed elsewhere in this Briefing. The revised ESRS will be opened to public consultation in September 2025, with the final version submitted to the Commission by November 2025.

- Double Materiality Assessment ("DMA"). Sustainability reports under CSRD are required to include information about impacts, risks and opportunities across environmental, social and governance matters determined to be material from the impact materiality perspective, the financial materiality perspective, or both. The Commission and the Council did not propose amendments to the DMA framework in CSRD. However, EFRAG's Progress Report suggests that the double materiality principle will be simplified.

- Removing sector-specific standards. The Commission proposes to remove the requirement for it to adopt sector-specific ESRSs, which had in any case not yet been published. This also aligns with the Council Proposal. At an entity level, companies will still need to consider whether their material impacts, risks or opportunities are covered in sufficient detail by the ESRS (which are sector-agnostic), and if not, they may need to include additional disclosures.

- Voluntary reporting. The Commission aims to limit the information that larger entities need to request from smaller entities with fewer than 1,000 employees, based on the voluntary sustainability reporting for SMEs developed by EFRAG.

- Removing reasonable assurance requirements. The Commission Proposal and the Council Proposal both propose to remove the requirement to move from a limited to reasonable assurance requirement. Under CSRD, reasonable assurance standards were required to be adopted by October 2028. CSRD requires the Commission to adopt limited assurance standards by October 2026, but this deadline has been proposed to be deleted in the Omnibus Simplification Directive and Council Proposal. The proposals include a requirement to provide targeted assurance guidelines by 2026.

- Optional EU Taxonomy Reporting. The Commission proposes an EU Taxonomy "opt-in" regime for large undertakings with a net turnover not exceeding EUR 450M, among other revisions. See Q&A 6 below for more detail

5. How does the Omnibus Package affect CSDDD reporting?

TIMING AND SCOPE

The Omnibus Stop the Clock Directive postponed the transposition date for CSDDD by one year to July 2027. This defers the deadline for Member State implementation to July 2028. Two waves of implementation will follow from then, ending in July 2029. Despite the adoption of the Omnibus Stop the Clock Directive, the Council Proposal includes a further delay to the transposition date of the CSDDD, which would push the first reporting obligation to July 2029.

The Commission Proposal included no proposed changes to the overall CSDDD scope, such that it still applies to (i) EU companies with more than 1,000 employees and net worldwide turnover of more than EUR 450M; and (ii) non-EU companies with net turnover in the EU of more than EUR 450M. The Council Proposal increases these thresholds to 5,000 employees and EUR 1.5BN net turnover

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.