- in European Union

- within Real Estate and Construction, Law Practice Management and Law Department Performance topic(s)

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Insurance industries

Key Takeaways:

- Misclassifying workers as independent contractors instead of employees can lead to serious tax liabilities, penalties, and legal issues for your rental company.

- Understanding how behavioral control, financial control, and the nature of the relationship factor into classification decisions is key to staying compliant.

- Taking proactive steps — like consulting a tax advisor or using IRS programs — can help you correct misclassifications and protect your business going forward.

If you own or operate a rental company — whether you specialize in party supplies, heavy equipment, or anything in between — you likely rely on a mix of full-time workers, part-time help, and seasonal labor. It's easy to lump some of these workers into the "contractor" category and move on. But doing so without a solid understanding of classification rules can lead to financial and legal consequences.

Misclassifying an employee as an independent contractor is a common and costly mistake many small- and mid-size businesses make. Here's what you need to know — and why it matters to your rental business.

Why This Question Matters for You

At first glance, the difference between a contractor and an employee might not seem like a big deal. You may think: "They only work weekends" or "I don't tell them how to do the job." But the IRS and state labor agencies see things differently.

Getting the classification wrong can lead to unpaid payroll taxes, penalties, interest, and even legal disputes. That's because employees and contractors are treated differently under tax and labor laws.

What's the Difference?

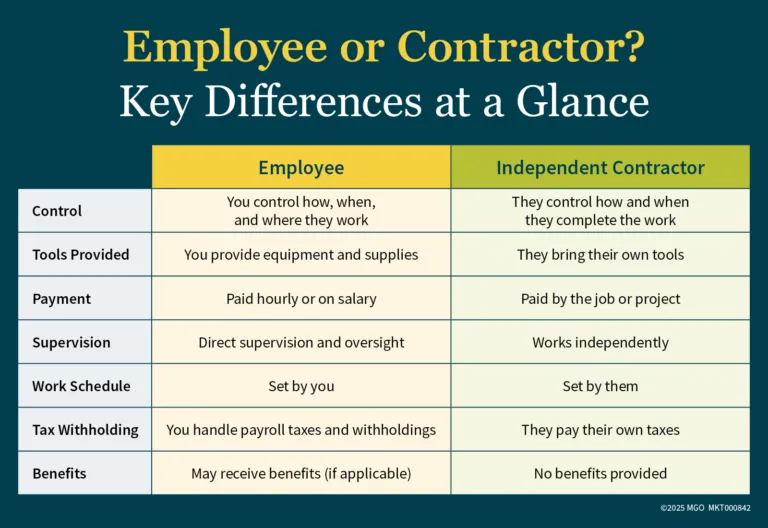

Let's break it down simply. An employee is someone whose work you control — how, when, and where it's done. You likely provide tools, set schedules, and expect ongoing availability. An independent contractor, on the other hand, typically:

- Works with little or no supervision

- Provides their own tools and equipment

- Is paid per job rather than by the hour

- Can work for multiple clients at once

- Controls how and when the work is done

Rental companies sometimes rely on contractors for specialized services — like repairing equipment or hauling inventory. But if you're bringing someone in regularly, assigning shifts, and overseeing their work like you would an employee, that person might not qualify as a contractor — even if that's how you're paying them.

Why Rental Companies Get Caught Off Guard

The rental industry's fast-paced, seasonal nature can make worker classification tricky. You might:

- Hire workers just for peak seasons

- Bring on a friend or family member casually

- Pay someone under the table

- Assume "1099" is a safe shortcut for part-time help

But informal arrangements won't protect you if the IRS or your state agency audits your business.

Many rental business owners simply aren't aware of the rules. Others might think they're saving money by avoiding payroll taxes and benefit costs. Unfortunately, those short-term savings can become long-term liabilities.

The Financial Risks of Misclassification

If the IRS or your state determines you've misclassified an employee, here's what you could be on the hook for:

- Back pay for unpaid wages, overtime, and breaks

- Employment taxes you should have paid (Social Security, Medicare, unemployment)

- Interest and penalties on those taxes

- Potential liability for workers' compensation, disability, or unemployment claims

You may also face legal action if a worker files a claim or complaint.

How to Determine the Right Classification

There's no one-size-fits-all test, but the IRS uses three key categories to evaluate worker status:

- Behavioral control: Do you direct how the work gets done?

- Financial control: Do you set the pay rate, reimburse expenses, or provide supplies?

- Relationship type: Is there a written contract? Are you offering benefits? Is the relationship ongoing?

These aren't checkboxes — they're part of a broader analysis. You'll need to consider the entire relationship. And when in doubt, document everything.

For example, if you hire a technician who sets their own hours, uses their own tools, and invoices you per job, they may qualify as a contractor. But if you expect that technician to show up at 8 a.m., wear your branded shirt, and follow your procedures, they may very well be an employee.

What If You're Still Unsure?

If you're uncertain about a worker's status, you have options:

- File IRS Form SS-8 to request an official determination (note: this can take months).

- Consult a tax advisor who understands the rental industry and employment law.

- Use the IRS's Voluntary Classification Settlement Program (VCSP) to reclassify workers prospectively with reduced penalties (if you qualify).

Getting It Right Today Can Save You Tomorrow

Correct classification isn't just about avoiding penalties — it's about protecting your business. When your workers are classified correctly:

- You reduce your audit risk

- You avoid unexpected tax bills

- You support fair labor practices

- You can build a more stable, compliant workforce

Even if you've unintentionally misclassified workers in the past, it's not too late to correct course.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.