- within Corporate/Commercial Law topic(s)

- in United Kingdom

- within Wealth Management, Antitrust/Competition Law and Transport topic(s)

The management board in brief

1. Duties of the management board

Dutch law only briefly defines the duties conferred on the management board as: a management board manages the company1 . Based on legislation and case law, the following duties are conferred specifically on the management board:

- day-to-day management;

- determining long-term and short-term policy and strategy;

- monitoring the general affairs of the business of the company;

- monitoring the liquidity position of the company;

- risk management;

- implementing financial policy;

- preparing and reporting to the (annual) general meeting;

- following up and implementing resolutions validly adopted by other corporate bodies;

- providing information to the supervisory board, if applicable;

- ensuring that employees carry out their duties;

- fulfilling tax obligations (and tax planning);

- fulfilling other administrative obligations, such as:

- keeping the books;

- financial reporting;

- keeping information in the Dutch trade register up to date; " keeping information in the shareholders' register up to date;

- preparing, publishing and, if applicable, filing the annual accounts;

- representation.

duties in line with the objects of the company as provided for in the company's articles of association. However, the management board's responsibilities are actually broader: when carrying out their duties, management board members must be guided by the interests of the company and the enterprise connected with it. This responsibility is not limited to the objects of the company as provided for in the articles of association; the interests of stakeholders such as shareholders, employees, creditors and suppliers, and under certain circumstances the public interest such as semi-public organisations, must also be taken into account. In addition, any applicable good governance rules, codes or regulations must be considered, such as the Dutch Corporate Governance Code (Corporate Governance Code) for Dutch listed companies and, if applicable, other governance codes, such as the Healthcare Governance Code (Governancecode Zorg 2024).

The objects clause included in a company's articles of association is often described very broadly, thus creating the opportunity to perform legal acts without these acts likely being in conflict with the company's objects. Nevertheless, situations may still arise in which the legal acts performed are contrary to the objects stated in the articles of association (i.e. ultra virus). The company may declare a legal act of this nature void.

A legal act will only be voidable when (i) an ultra vires act has been performed, and (ii) that ultra vires act is not in the company's best interests, and (iii) the other party knew or should have known - without carrying out any investigation - that the relevant act constituted ultra vires (acting in bad faith).

The right of nullification expires after three years. The other party may, in order to put an end to its uncertain position, set a 'reasonable' term for the company within which it must invoke the nullification.

2. Management board members and financial reporting

One of the management board's core responsibilities is the financial policy and, by extension, ensuring transparent financial reporting.

The financial reporting takes place in the form of the annual accounts and the management report, to be prepared in accordance with the requirements of Title 9, Book 2, of the Dutch Civil Code (Burgerlijk Wetboek). The management board is required to prepare these documents within five months after the end of the financial year. However, the articles of association may provide for a shorter period of time. This period may be extended for a maximum of five months by a resolution of the general meeting on grounds of special circumstances. Examples of relevant special circumstances are:

- the figures required are not available yet;

- the management board and the supervisory board are unable to agree on the contents of the annual accounts;

- some uncertainty exists concerning the valuation of items on the balance sheet; and/or

- an emergency situation has arisen (e.g. a fire or flood), as a result of which all or part of the company's books and records have been lost.

The annual accounts are to be adopted by the general meeting of the company. The management board has to publish the annual accounts within eight days after adoption with the Dutch trade register. The annual accounts (whether adopted or not) should at all times be published within twelve months after the end of the relevant financial year. A period of four months (without the possibility of extension) applies to Dutch listed companies.

All management board members are required to sign the annual accounts. By signing, they consent to the contents of the annual accounts. If a management board member does not agree with the contents of the annual accounts, he may refuse to sign the annual accounts and should have the reason for this stated in the annual accounts.

If all shareholders of a BV are also management board members of that company, their signatures also constitute the adoption of the annual accounts, unless the articles of association provide otherwise.

If a management board member is unable to agree with the contents of the annual accounts and his objections are not resolved, the management board member could consider resigning from the management board.

Dutch listed companies are required to apply the International Financial Reporting Standards (IFRS) in their consolidated accounts. Pursuant to Dutch law, non-listed companies are also able to apply IFRS as accounting standard in their (consolidated) accounts. In case IFRS is voluntary applied, certain provisions of Dutch law continue to apply. Increasingly more companies are opting to do this.

If the Netherlands Authority for the Financial Markets (AFM) has any doubts about whether a listed company is applying reporting standards properly, it may ask that listed company to provide a more detailed explanation. If a company does so, but the AFM still has its doubts, the AFM can:

- notify the company of this fact;

- advise the company to publish a notice in which it explains which sections of the financial report do not comply with the regulations and how these regulations will be applied in the future; and/or

- ask the Enterprise Chamber of the Amsterdam Court of Appeal (Ondernemingskamer) to order the company to prepare the annual accounts in accordance with the applicable reporting standards.

2.1 Sustainability reporting

The Corporate Sustainability Reporting Directive (CSRD) came into effect on 5 January 2023. The CSRD requires in-scope companies to report sustainability information by preparing a (consolidated) sustainability statement in a dedicated section of its management report in accordance with mandatory European Sustainability Reporting Standards. It should report the information necessary to understand the company's impacts on sustainability matters as well as how sustainability matters affect the company's own development, performance and position (the so-called 'double materiality' principle). Currently most Dutch listed companies and non-listed large entities2 (among others) are in scope of the CSRD. Even though the deadline for implementation by the member states already passed, the Netherlands is still in the process of implementing the CSRD. In the meantime, on 26 February 2025, the European Commission published two Omnibus simplification packages, including legislative proposals on the postponement of reporting deadlines and reduction of scope of reporting companies under the CSRD. On 3 April 2025, the European Parliament endorsed, via a fast-track procedure, the legislative 'stop the clock' proposal to postpone by two years the entry into application of the CSRD requirements for some in scope companies. This means that - at the moment of writing this booklet - only large public-interest organisations will be required to report on the basis of CSRD for the 2025 and 2026 financial years. However, as the CSRD has not yet been implemented in Dutch law, there is no formal reporting obligation at this stage.

3. Internal decision-making and adoption of resolutions

A distinction must be made between board resolutions (i.e. internal) and acts of representation on the company's behalf (i.e. external; see chapter 8: Representation). The management board implements the duties conferred on it by adopting resolutions.

If the management board is representing the company, it will be deemed to be doing so on the basis of a valid board resolution.

If a management board consists of more than one member, each management board member has one vote. The company's articles of association may provide that a management board member has more than one vote, provided that one management board member may not cast more votes than all other management board members jointly.

Where there is a tie in voting, the board resolution shall be deemed not to have been adopted. The articles of association may include that in the event of a tie in voting the resolution shall be adopted by a corporate body designated to do so. This could, for example, be the supervisory board or the general meeting. The articles of association may also include for a specific management board member (e.g. the chairman of the management board) to have a casting vote.

All members of the management board must in principle be given the opportunity to participate in discussions about all topics on which resolutions are to be adopted. This requires that each management board member is given sufficient time to prepare and is granted the opportunity to attend management board meetings. This does not mean that all management board members must attend each meeting, or that they all need to agree on a particular resolution. The articles of association or board regulations may provide otherwise. If a resolution is adopted outside a meeting, all management board members must agree that no meeting will be held. When resolutions are adopted outside meetings, the agreement of all management board members on how resolutions are adopted should be set out in writing. If a resolution is to be adopted on a topic in relation to which one or more management board members has or have a (direct or indirect) personal interest that conflicts with the company's interests, the relevant management board member(s) must refrain from participating in deliberations and the decision-making process about that particular topic (see chapter 4: Conflict of interest).

In the event a management board member is absent, he3 may not simply send a replacement to attend meetings or vote on resolutions. The concept of an alternate director as such does not exist under Dutch law. However, a management board member may grant a fellow management board member a proxy to act on his behalf in specific situations. A management board member may not grant a general proxy to a fellow management board member.

If there is a vacancy on the management board ('absence'), or a management board member is (temporarily) unable to perform his duties due to illness or for other reasons ('inability to act'), the other management board members will retain full board authority in most cases and will have the power to adopt valid resolutions (see chapter 17: Absence and inability to act). Whether or not this is the case will depend on the relevant provisions included in the articles of association.

The management board should meet frequently, at least as often as circumstances require. It is important to prepare minutes for each management board meeting, setting out the deliberations and decision-making at such meeting. A list of resolutions alone is not enough. If the management board or one or more of its members disagree with the (intended) actions of the management board or the supervisory board, if applicable, this - as well as the specific reasons for abstention - must be explicitly stated in the minutes. This is particularly relevant in connection with the possibility of exculpation in the event of the management board being held liable.

The minutes of management board meetings are not publicly available and shareholders are not entitled to inspect these. The supervisory board, however, may demand that it will be allowed to inspect the minutes of management board meetings.

4. Conflict of interest

When carrying out their duties, management board members must be guided by the company's interests and the enterprise connected with it. If a resolution is to be adopted on a topic in relation to which a management board member has a direct or indirect personal interest that is contrary to the company's interests and the enterprise connected with it, that management board member - as prescribed by law - must refrain from participating in deliberations and the decision-making process. This means that such management board member must temporarily leave the management board meeting, if and when the item concerned is on the agenda. If a management board member fails to leave and proceeds to take part in deliberations and/or the decision-making process concerning the item concerned, this will cause the resolution to become voidable. However, any acts of representation carried out on the basis of the resolution will not be affected. As such, a conflict of interest will in principle not be enforceable externally in relation to third parties. The annulment of the resolution may be requested by a fellow management board member or by a supervisory board member and any third party who has a reasonable interest in the matter.

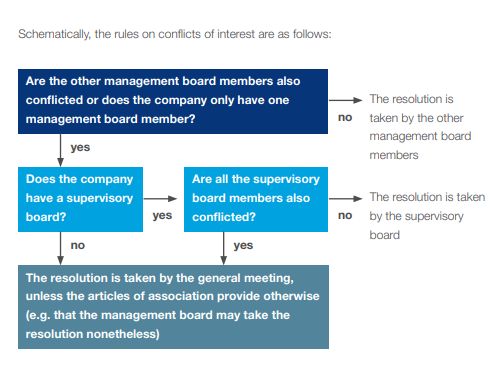

If all management board members have a conflict of interest where a particular resolution is concerned and the resolution cannot be adopted as a result, the supervisory board will be authorised to adopt such resolution. If no supervisory board has been established, or if all supervisory board members also have a conflict of interest, the general meeting may adopt the resolution. The articles of association may provide for a different approach to the situation outlined above, provided that if a supervisory board has been established the resolution of the management board will mandatorily be adopted by the supervisory board. Should the conflicted management board members nevertheless adopt the resolution, the resolution is void: it was adopted by an unauthorised corporate body. The prevailing doctrine in literature is that such resolutions cannot be repaired.

In addition to the legal provision under which a management board member with a direct or indirect conflict of interest must refrain from participating in related deliberations and decision-making, there may be other customary internal procedural rules on decision-making in the event of a conflict of interest. These are often set out in board regulations. Board regulations frequently stipulate that, in the event of a conflict of interest, advice should be obtained from an external expert or other steps must be taken to ensure that due consideration is given to the company's interests in relation to an envisaged transaction. Board regulations are also frequently geared towards avoiding any appearance of a conflict of interest. Governance codes, if applicable, also generally contain provisions to prevent this. The appearance of a conflict of interest is in fact more likely than an actual personal direct or indirect conflict of interest.

5. Division of duties

A management board consisting of more than one member may divide duties among its management board members. This does not mean that the responsibility for the actions of each of the management board members is limited to the duties conferred on an individual management board member. The management board remains collectively responsible for the policy pursued. This also follows from the implementation of the rules on liability. In principle, the management board members must decide jointly on the main outlines of the general and financial policy; this cannot be assigned to one or more specific members. It is advisable to set out a division of duties in writing (e.g. in board regulations).

In case of a one-tier board (see chapter 6: One-tier board), Dutch law offers the possibility of granting one or more management board members the authority to take certain board resolutions under or pursuant to the articles of association, in addition to making a division of duties. Resolutions adopted on the basis of this authority are then attributed to the management board as a whole. The principle of joint responsibility equally applies to such situation.

6. One-tier board

A one-tier board, also known as a monistic board structure, is a special approach to the statutory division of duties within the management board.

Establishing a one-tier board requires a provision in the company's articles of association stipulating that the duties of the management board are conferred on one or more executive directors and one or more non-executive directors. Where there is a one-tier board, both executive directors and non-executive directors are management board members.

Executive directors are primarily responsible for managing the company's day-to-day affairs. To a certain extent, the role of non-executive directors can be compared with the role of supervisory board members as they are charged with supervising the performance of the executive directors. The board as a whole is responsible for determining the strategy of the company and outlining its policy. This is exhibited in an increased risk of liability for non-executive directors compared to supervisory board members. By law, the chairman of a one-tier board may not be an executive director and executive directors may not participate in decision-making about their remuneration or nominations for the appointment of board members. So-called 'large companies'4 under the 'large company regime' are also permitted to have a one-tier board.

7. Management board autonomy

A management board is largely autonomous when performing its duties. Management board members must be guided by the company's interests and the enterprise connected with it. If shareholders' interests differ from the company's interests, management board members must be guided by the company's interests, even if they risk being dismissed by the general meeting for doing so. Management board members risk directors' liability for any incorrect decisions they make. Within the framework of the company's interest, a management board's autonomy can be restricted somewhat by the general meeting's and/or the supervisory board's right of approval or right to issue instructions, if included in the articles of association.

Fooynotes

1. In this booklet 'company' refers to both a Dutch public company (NV) and a Dutch private limited liability company (BV), unless the contrary is apparent.

2. A large entity is understood to mean a company that for two consecutive years (on a consolidated basis, if relevant) fulfills two or more of the following criteria: (i) the value of the assets is more than EUR 25 million, (ii) the net turnover is more than EUR 50 million and/or (iii) on average more than 250 employees during the financial year.

3. References to a specific gender in this booklet are meant to include all genders.

4. In short, a company will qualify as 'large company' under the 'large company regime' if it has had, for at least three consecutive years, (i) an equity capital of at least EUR 16 million, (ii) more than 100 employees in the Netherlands and (iii) a works council.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.