- within Corporate/Commercial Law topic(s)

- in Asia

- in Asia

- within Real Estate and Construction topic(s)

A. General

1. What is the main legal framework applicable to companies in your jurisdiction?

The legal framework applicable to companies in the Kyrgyz Republic is based on the Constitution of the Kyrgyz Republic that enables and consists of the following normative legal acts:

- Civil Code of the Kyrgyz Republic (Part 1) dated 8 May 1996, No. 15;

- Civil Code of the Kyrgyz Republic (Part 2) dated 5 January 1998, No. 1;

- Tax Code of the Kyrgyz Republic dated 18 January 2022, No. 3;

- The Law of the Kyrgyz Republic "On business partnerships and companies" dated 15 November 1996, No. 60;

- The Law of the Kyrgyz Republic "On Joint Stock Companies" dated 27 March 2003, No. 64;

- Regulation on the procedure for state registration of legal entities, branches (representative offices) (approved by the Resolution of the Cabinet of Ministers of the Kyrgyz Republic dated 31 March 2023 No. 178);

- The Law of the Kyrgyz Republic "On Licensing and Permit System in the Kyrgyz Republic" dated 19 October 2013, No. 195.

Aside from the above, there are many other legal acts that differ in scope and their application depending on the specific types of activity a company carries out in the Kyrgyz Republic.

2. What are the most common types of corporate entities (e.g., joint stock companies, limited liability companies, etc.) used in your jurisdiction? What are the main differences between them (including but not limited to with regard to the shareholders' liability)?

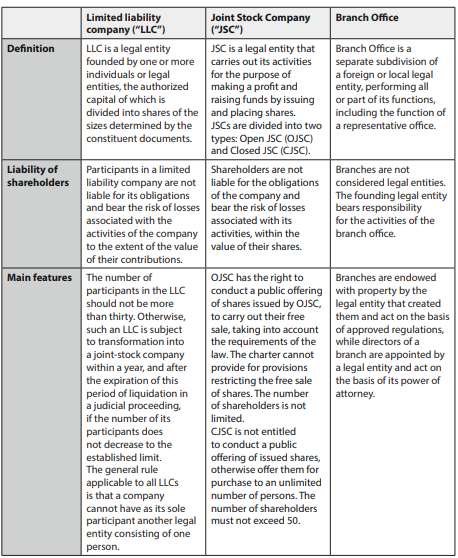

The current legislation of the Kyrgyz Republic provides for different legal forms of legal entities. The most common types of legal entities in the Kyrgyz Republic include a limited liability company and a joint stock company (open or closed types). While not considered a legal entity, some foreign companies tend to carry out their business activities via branch or representative offices.

B. Foreign Investment

3. Are there any restrictions on foreign investors incorporating or acquiring the shares of a company in your jurisdiction?

As a general rule, foreign investors enjoy the same national treatment applied to individuals and legal entities of the Kyrgyz Republic. That said, there might be certain restrictions applied to foreign investors in terms of the types of activity they plan to carry out in the Kyrgyz Republic. For instance, banking legislation requires obtaining a permit for the acquisition of shares in microfinance organizations and commercial banks of the Kyrgyz Republic. While not exclusive to foreign investors, a foreign or local investor has to obtain consent from the merger authorities in order to proceed with the merger or accession of a legal entity. Other restrictions might be applied but in order to determine specific restrictions, each case should be reviewed separately.

4. Are there any foreign exchange restrictions or conditions applicable to companies such as restrictions to foreign currency shareholder loans?

There are presently no significant foreign exchange restrictions. If a company borrows a loan in a foreign currency and such loan agreement is governed by foreign law, no restrictions shall apply as there is no requirement to register the loan agreement and/or notify the authorities. That said, if the loan agreement is made in accordance with and governed by Kyrgyz laws, it shall be notarized in case the principal amount exceeds KGS 50,000 (fifty thousand soms) (approximately USD 580).

As a general rule, Kyrgyz laws provide that a monetary obligation must be expressed and paid in the national currency – Kyrgyz soms ("KGS"). Normally, however, parties may provide that payment is made in national currency in an amount equivalent to the amount in foreign currency. The amount of payment of a monetary obligation in KGS is determined at the official exchange rate of the relevant currency on the payment date unless a different rate or another date of its determination is established by law or by the agreement of the parties.

5. Are there any specific considerations for the employment of foreign employees in companies incorporated in your jurisdiction?

Foreign citizens have the right to carry out labor activities in the territory of the Kyrgyz Republic only on the basis of a work permit. Accordingly, employers in the Kyrgyz Republic have the right to employ foreign citizens on the basis of the received quota for attracting foreign labor. In addition, there are separate requirements for the work visa, registration at the place of residence, etc.

The Kyrgyz Republic is a full member of the Eurasian Economic Union ("EAEU") which consists of the following states: Kyrgyzstan, Kazakhstan, Russia, Belarus, and Armenia. By virtue of the Treaty on Accession to the EAEU ratified by the Kyrgyz Republic, citizens of the EAEU member states are exempted from obtaining a permit to work in the Kyrgyz Republic, while employers can employ foreign citizens of the EAEU member states without obtaining a quota for attracting foreign labor.

C. Corporate Governance

6. What are the standard management structures (e.g., general assembly, board of directors, etc.) in a corporate entity governed in your jurisdiction and the key liability issues relating to these (e.g., liability of the board members and managers)?

LLCs normally have the following governing bodies: general meeting of shareholders, and collective (management board) or sole (director) executive body. The supreme governing body of an LLC is the general meeting of shareholders.

The executive body (collective or sole) is created to carry out the current management of its activities and is accountable to the general meeting of its shareholders. Their liability is regulated by the internal by-laws or charter of a company

The establishment of the board of directors is optional in LLCs and may be established upon a decision of the general meeting of shareholders. Only an individual may be a member of the board of directors. A member of the board of directors cannot simultaneously be a member of the executive body (collective or sole).

Shareholders bear a limited liability proportional to their shares in the authorized capital and a general meeting of shareholders has exclusive competence over certain matters (e.g., reorganization or liquidation of a legal entity, increase or decrease of charter capital, etc.). While there is normally no special liability of other governing bodies (as it is often determined in line with the internal by-laws, charter, or other internal documents), the board of directors and executive body do have their own competence over certain matters and they bear liability according to the general provisions of the law and internal documents of a legal entity.

As the position of a director on the board of directors or executive body entails employment, individuals representing the governing bodies bear material and disciplinary liability in accordance with the concluded employment contract.

7. What are the audit requirements in corporate entities?

The procedure for conducting an audit of the activities and reporting of the company is determined by the charter of the company.

At the request of any shareholder, an audit of the company's annual financial statements may be carried out with the involvement of a professional auditor who is not related to the company or its participants (external audit).

The general meeting of shareholders has the right to form an audit committee in order to control the activities of the executive body of the company. Audits of the financial and economic activities of the executive body are carried out in the manner prescribed by the general meeting of shareholders.

As stated previously, there are separate requirements for audits in certain types of companies. For instance, in the banking sector, banks and microfinance organizations are required to undergo audits periodically and there are official positions within such companies that are in charge of compliance with the audit requirements of the National Bank of the Kyrgyz Republic.

D. Shareholder Rights

8. What are the privileges that can be granted to shareholders? In particular, is it possible to grant voting privileges to shareholders for appointment of board members?

The general meeting of shareholders is the supreme governing body of a LLC. The appointment of the board of directors falls under the exclusive competence of the general meeting of shareholders. In addition to the statutory rights of the general meeting of shareholders, their competence might be extended over other matters in accordance with the internal documents (charter, by-laws, foundation agreement, etc.).

9. Are there any specific statutory rights available to minority shareholders available in your jurisdiction?

While the majority of foreign states have provided special statutory rights to minority shareholders, there are currently no special statutory rights available to minorities in the Kyrgyz Republic.

10. Is it possible to impose restrictions on share transfers under the corporate documents (e.g., articles of association or its equivalent in your jurisdiction) of a company incorporated in your jurisdiction?

According to the general rule, the shareholder of the LLC has the statutory right to withdraw from the company at any time, regardless of the consent of other shareholders. The withdrawal must be declared by the participant at least one month before the actual withdrawal from the LLC unless other terms are provided by the constituent documents.

In the event of the alienation of their shares by one of the shareholders, the remaining shareholders have the pre-emptive right to purchase the share of the participant in full or in part in proportion to the size of their shares in the authorized capital of the LLC, unless the charter of the LLC or agreement of its participants provides for a different procedure for exercising this right. Other restrictions in relation to the share transfer are generally prohibited.

11. Are there any specific concerns or other considerations regarding the composition, technical bankruptcy, and other insolvency cases in your jurisdiction?

The current legal framework does not define technical bankruptcy as normally it happens in cases where either the general meeting of creditors' claims the formal bankruptcy of the debtor or the bankruptcy (insolvency) is made in the courts. Aside from that, there are no significant concerns or other considerations on the above, however, each case should be considered separately due to various factors and conditions pertaining thereto.

E. Acquisition

12. Which methods are commonly used to acquire a company, e.g., share transfer, asset transfer, etc.?

The most common method of acquiring a company in the Kyrgyz Republic is the acquisition through the share purchase agreement in the authorized capital of a company ( "SPA"). By acquiring a share in the authorized capital of an LLC, buyers (individuals or legal entities) become the new shareholders of the company

The acquisition is also possible via the reorganization of a legal entity (merger, accession, division). Under this procedure, one of the legal entities in this process ceases to exist and transfers all the rights and obligations to another (surviving) legal entity.

While not common, it is possible to foreclose on the pledged shares of a legal entity thus becoming a shareholder.

Asset transfer is not considered "acquisition" under the current Kyrgyz laws as it does not entail subsequent registration of changes to the shareholding structure of a company. Therefore, it is not a common method to acquire a company but can be a good method to obtain an acting business.

13. What are the advantages and disadvantages of a share purchase as opposed to other methods?

The main advantage of a share purchase is to gain control over the company and benefit from participation, namely from the potential for dividends, ease of share transfer, and statutory ownership rights. Other methods involve the acquisition of assets that do not grant direct contro over the company, thus limiting potential options and benefits from being a shareholder.

The disadvantage of a share purchase includes certain restrictions and/or mandatory requirements. For instance, a change in shareholding structure requires the company to undergo the so-called "reregistration" procedure that might take up to one month and requires communication with the state authorities. As mentioned before, in specific sectors, like the banking sector, a share purchase entails obtaining consent from authorized state bodies (e.g., the National Bank, State Antimonopoly Service, etc.).

14. What are the approvals and consents typically required (e.g., corporate, regulatory, sector based and third-party approvals) for private acquisitions in your jurisdiction?

Normally external approvals and/or consents are not required in typical corporate acquisitions unless the acquisition is made in relation to the specific sector. Internal corporate authorizations are often required and made (in accordance with internal documents) to proceed with the execution of share purchase.

As mentioned before, the acquisition of shares in credit and financial institutions requires consent from the National Bank. Reorganization of legal entities requires consent from the State Antimonopoly Service. Changes in the shareholding structures of mining companies might require notifications to the relevant authorized state body.

15. What are the regulatory competition law requirements applicable to private acquisitions in your jurisdiction?

on competition in relation to private acquisitions indicates that the purchase by any legal entity or citizen of a controlling stake (shares in the authorized capital) of an economic entity occupying a dominant position is carried out with the prior consent of the antimonopoly body.

The dominant position is the position of one or several legal entities in the market of a certain product, which provides them with the opportunity to exert a decisive influence on the general conditions for the circulation of goods in the relevant market and (or) eliminate other legal entities from this market, and (or) impede access to this market for other legal entities.

16. Are there any specific rules applicable for acquisition of public companies in your jurisdiction?

Public companies (if open joint stock companies that are listed) have specific rules applicable to them in terms of listing shares and their subsequent sale and/or purchase via the stock exchange. Public companies are typically listed at the Kyrgyz Stock Exchange and this stock exchange has its own rules and regulations pertaining to how it operates and how the listed companies proceed with the trading of shares.

As commercial banks can only be joint stock companies (either open or closed ones), any individual or legal entity intending to acquire shares in the authorized capital of a bank (including the acquisition of the threshold participation in the authorized capital of the bank, including significant participation and control; inheritance or restoration of ownership of them; additional acquisition of shares) must obtain written permission from the National Bank.

In general, joint stock companies are also obliged to register their emissions, be it a founding emission or a new emission of shares, with the State Financial Service.

There are separate regulations on the securities market and open joint stock companies have to comply therewith especially since most of the financial services require a relevant license.

To view the full article clickhere

Originally published by Ergun Publication Series: Global Legal Guides, 22 July 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.