- within Antitrust/Competition Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

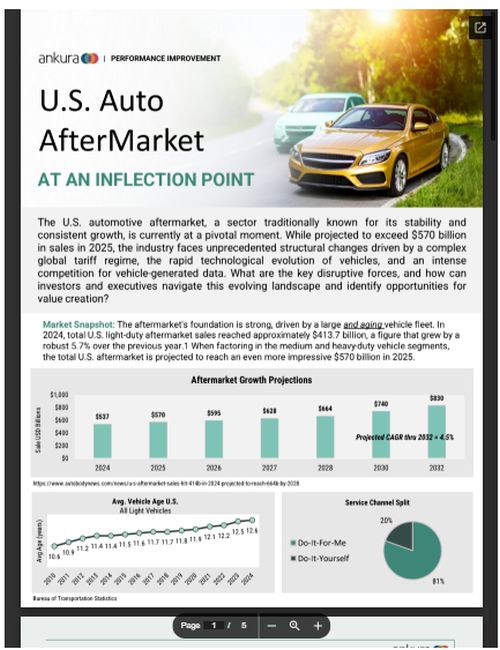

The U.S. auto aftermarket is undergoing significant changes, influenced by a complex global tariff system, rapid advancements in vehicle technology, and intense competition for vehicle data. This sector — traditionally stable — is expected to exceed $570 billion in sales in 2025. The market's foundation is strong, supported by a large and aging vehicle fleet. In 2024, total U.S. light-duty aftermarket sales reached approximately $413.7 billion, a 5.7% increase from the previous year. Including medium and heavy-duty vehicles, the total U.S. aftermarket is projected to reach $570 billion in 2025. The average age of light vehicles in the U.S. has steadily increased, reaching 12.6 years in 2024. The "Do-It-For-Me" service channel accounts for 81% of the market, while "Do-It-Yourself" makes up 20%. The market is moving beyond traditional mechanical repairs due to the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Key disruptive forces include a complex tariff regime, rapid technological transformation of vehicles, and the fight for control over vehicle data. Successfully navigating these challenges requires new strategies and capital discipline.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.